Gov. J.B. Pritzker says Illinois’ budget is balanced "for the first time in decades." That’s the claim he made upon signing Illinois’ $40 billion budget for 2020.

Pritzker’s claim is simply not true. According to the state’s own actuarial calculations, his budget is billions in the red.

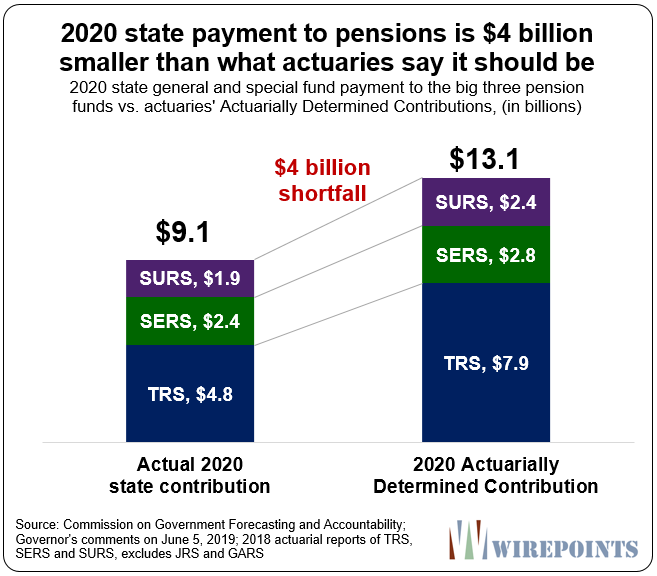

A big reason for the unbalanced budget comes from how politicians account for the state’s retirement debts versus how actuaries do. There’s often a gap of several billion dollars between the two. Today, politicians say the state should contribute $9 billion to the state's pension funds. They set the law and are happy to keep payments low now in exchange for far higher payments in the future.

On the other hand, Illinois' actuaries say the payment should be $13 billion now. That's a $4 billion hole in the budget all by itself.

And it’s not just pension payments that are being shorted. It’s also payments for state-worker retiree health insurance that are grossly underpaid.

State actuaries calculate the required payments for those benefits at about $4 billion a year, yet the state has only paid around $1 billion annually in recent years. That’s billions more in shortfalls that Pritzker’s budget ignores.

The same fiscal game – saying the budget is balanced when it's not – has been played in this state for decades. That's why Illinoisans are stuck with over $400 billion in government worker retirement debts. That's made up of $234 billion in state pension debt, $73 billion in health insurance debt for retired state workers, another $70 billion in various Chicago retirement debts, and $40 billion in other pension debts across the state.

Break that down by household and Illinoisans outside of Chicago are on the hook for almost $75,000 in debt. Chicago households are even worse off. They're each on the hook for nearly $145,000 in debt. Those are impossible numbers that residents can't afford.

No other state is in as dire straits as Illinois. Politicians on both sides of the aisle can pat themselves on the back all they want for passing a budget. But the truth is they’ve just made the debt crisis even worse.

Illinois' fiscal reality won’t change until the state is more honest about its debts and it reduces those debts through structural reforms. And that will only come when Illinois amends the pension clause of the state constitution.