Gov. J.B. Pritzker is raising pressure on state lawmakers to hike state income tax revenue by replacing Illinois’ constitutionally protected flat income tax with a graduated, or “progressive,” income tax.

The governor on Feb. 21 revived one of his campaign themes with heightened urgency, according to the Chicago Sun-Times, asking state lawmakers to pass the measure before they adjourn at the end of May. Pritzker added that House Speaker Mike Madigan and Senate President John Cullerton have also pledged to push for a progressive income tax this spring.

Enacting a progressive income tax would require amending the Illinois Constitution by scrapping its flat tax protection. To make that change, lawmakers must pass the amendment in the House and Senate by a three-fifths majority, and then voters must approve it via referendum. The earliest opportunity for such a referendum is in 2020, the next general election year.

The governor also made a pitch for a progressive tax during his first budget address on Feb. 20. “Workers deserve an income tax cut and a property tax break,” Pritzker said. “A fair tax system will allow us to eliminate the structural deficit that has plagued our state for nearly two decades.”

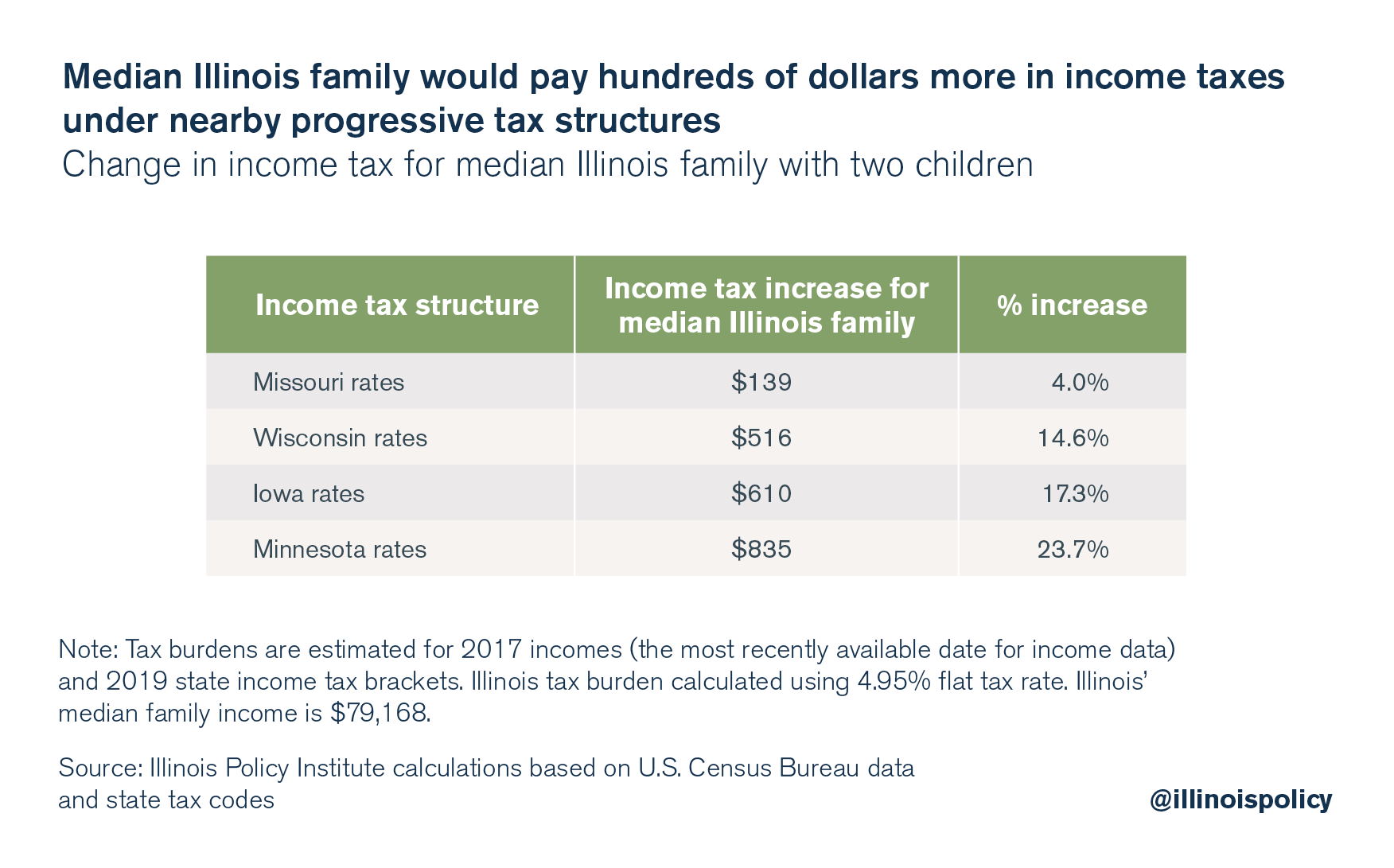

But while Pritzker speaks admiringly of other Midwestern states’ progressive tax systems, the typical Illinois family’s taxes would increase by up to $835 a year under those models. And promises of filling a budget gap ring hollow when continuous tax hikes have not been able to keep up with state spending, which has grown nearly 50 percent faster than Illinoisans’ incomes over the past decade.

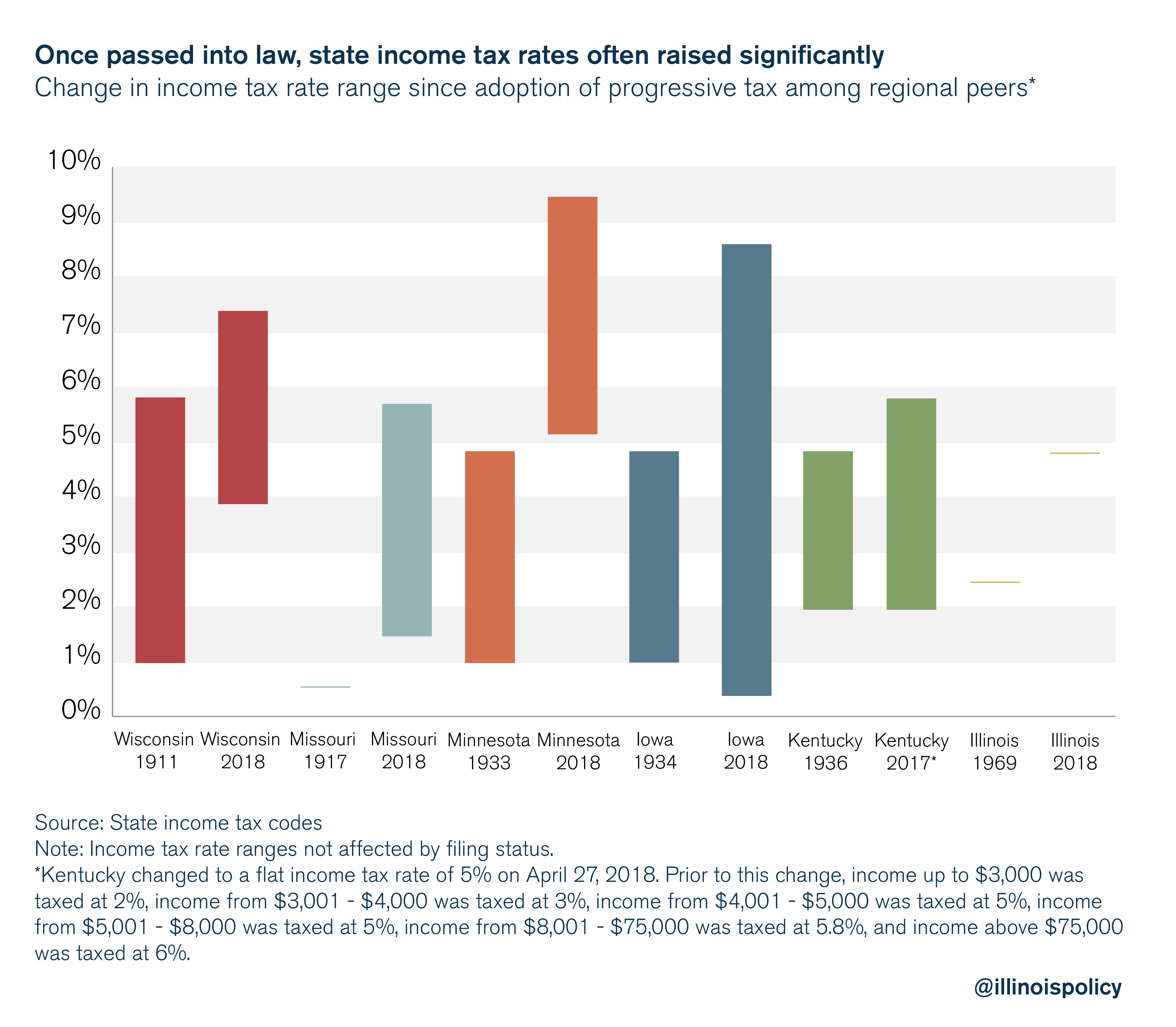

Those states have all seen an upward trend in their income tax rates since first passing a progressive income tax. Take Minnesota, for example. When the progressive income tax was implemented there, the richest citizens paid top marginal tax rates of 5 percent. Today, the lowest marginal tax rate in the state is 5.35 percent. Low-income Minnesotans are paying more today than wealthy residents were when the tax was first introduced.

“[Illinois] can accomplish [a progressive income tax] with a more competitive rate structure than Wisconsin or Iowa,” Pritzker said in his budget address. But what he means by this is entirely unclear.

In fact, a recent Tax Foundation study on Wisconsin’s tax code recommended exchanging its progressive income tax for a flat income tax as one way to make the state more competitive. Both North Carolina and Kentucky have swapped their states’ progressive income tax for a flat income tax in recent years.

The governor’s preferred framing of the progressive tax as a “tax on the rich” is questionable at best. Without structural reform, the state’s enormous fiscal problems and Pritzker’s new spending promises of $13 billion to $18 billion require middle class tax hikes.

His plan also flies in the face of Illinois’ five consecutive years of population loss, driven by residents fleeing to other states. Progressive income tax states are hemorrhaging residents to more competitive tax environments, losing nearly 300,000 residents from July 2017 to July 2018 as a group. Meanwhile, states with no income tax gained more than 300,000 residents. And taken together, flat income tax states excluding Illinois also gained residents from other states.

If Pritzker wishes to eliminate the structural deficit and reverse property tax hikes, he must address their primary cause: rising pension costs. Constitutional pension reform is the only path toward fiscal stability in the long term.

Stripping Illinois of one of its few competitive advantages would be far from a bold step forward – it would be a painful leap into a new era of fiscal problems and tax increases.