EDWARDSVILLE – A Wood River taxpayer is suing the city to prohibit it from using certain tax funds to build a recreation center.

Plaintiff William Dettmers filed the lawsuit on March 18 in the Madison County Circuit Court against the City of Wood River.

In its motion to dismiss, Wood River responded May 5, arguing that Dettmers' claims are moot because the city repealed ordinance 2646 on April 19, the basis for declarations made in his complaint.

However, Dettmers alleges the city violated the state's municipal code by illegally misappropriating certain city sales taxes to build the recreation center.

The lawsuit states that the city passed ordinances to impose a 1 percent non-home rule municipal retailers occupation tax. Dettmers alleges that under the state's municipal code, these taxes can only be used to fund public infrastructure, property tax relief and municipal operations.

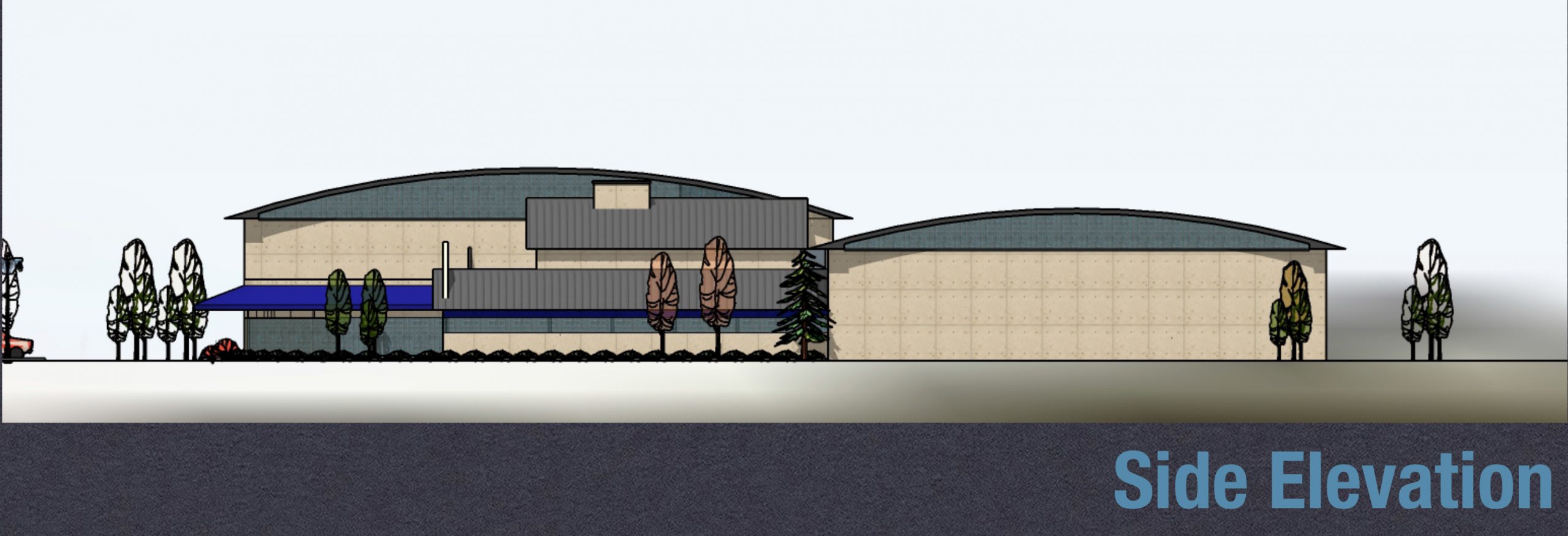

The city later announced that it would use the money to fund "capitol improvement projects," including a recreation center.

Dettmers claims that "capitol improvement projects" are not mentioned in the state's municipal code, and that the proposed recreation center does not qualify for funding from the 1 percent non-home rule municipal retailers occupation tax.

Dettmers is asking the court to issue an order prohibiting the spending of sales taxes on the recreation center. He is represented in this case by attorney Eugene J. Hanses, Jr. of Guin Mundorf, LLC in Collinsville.

A case management conference is set for July 1 at 9 a.m.

Madison County Circuit Court case number 2022MR000056