Illinois’ housing market was one of the weakest in the nation prior to 2020. So as the state economy was brought to a sudden standstill and nearly 1.5 million Illinoisans found themselves out of a job during the COVID-19 pandemic, the number of families struggling to make their mortgage payments surged and mortgage delinquencies experienced the largest increase in recorded history.

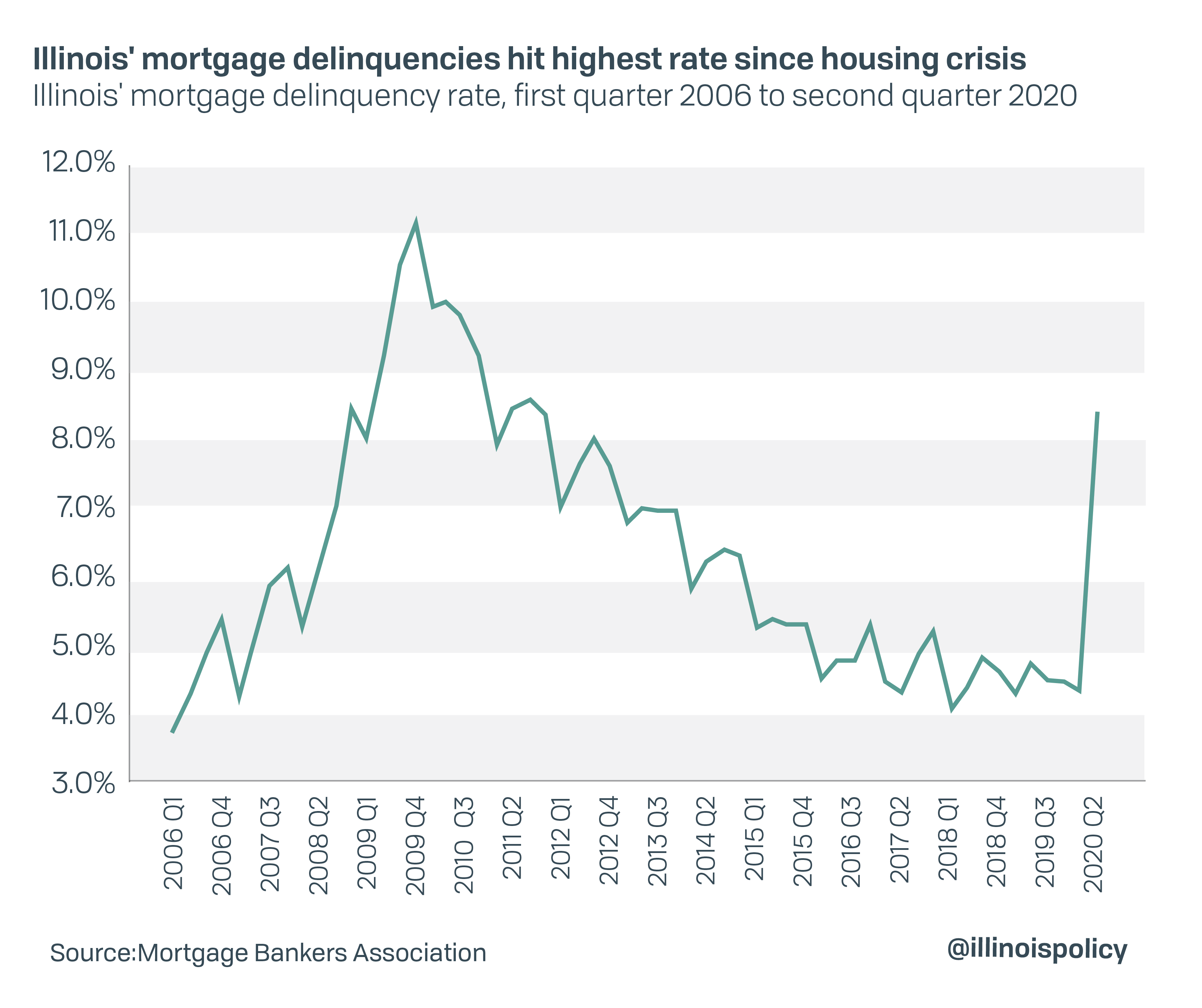

Survey data released by the Mortgage Bankers Association shows the number of Illinois delinquent mortgages increased by 79% in the second quarter of 2020 compared to Q2 2019. The increase suggests 54,940 more Illinois homeowners fell behind on their mortgage payments, bringing the total number of delinquent mortgages to approximately 124,279. Illinois Policy Institute research correctly predicted this would happen.

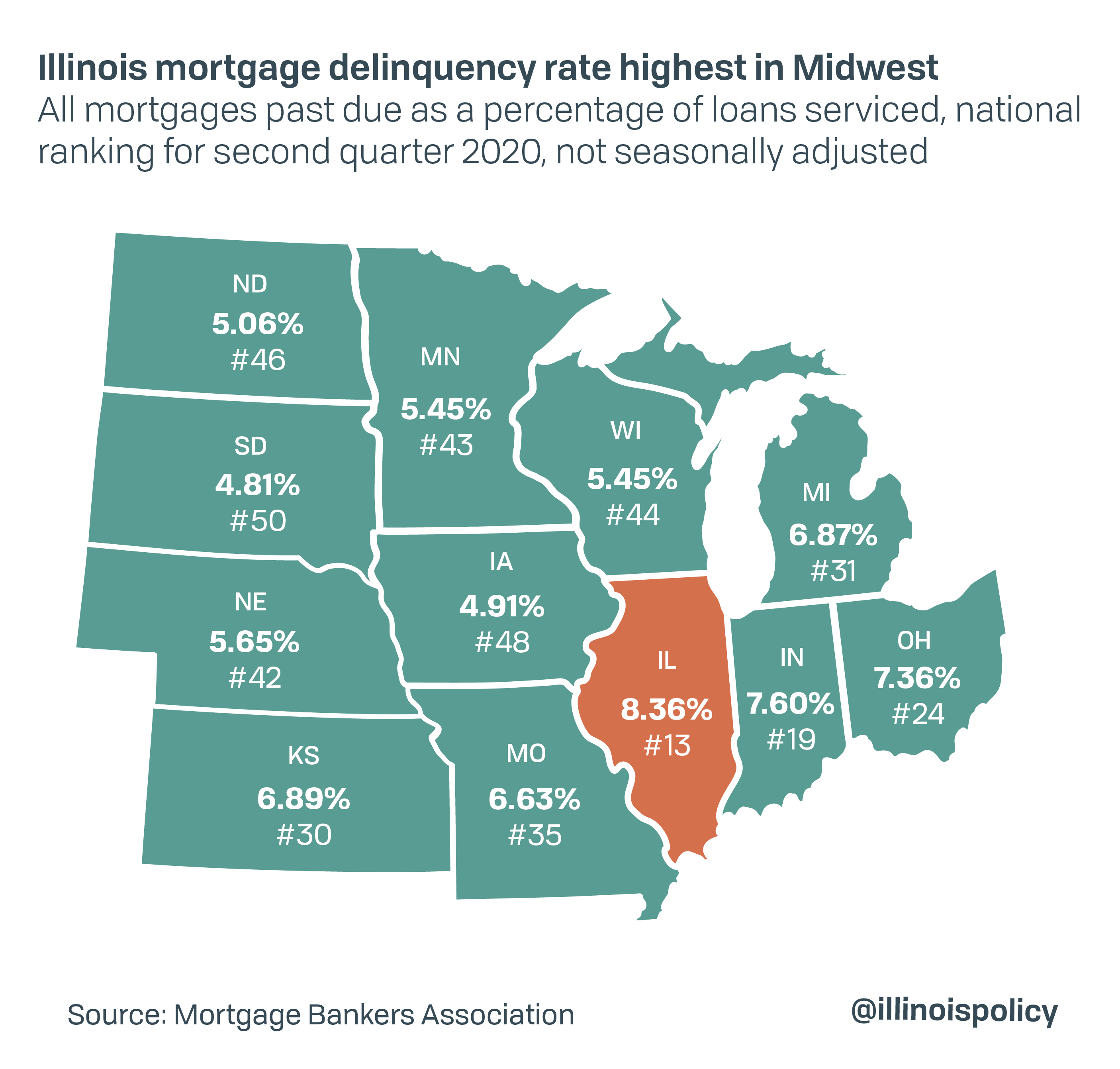

While delinquencies have risen virtually everywhere during the COVID-19 pandemic and associated state-mandated lockdowns, delinquencies in Illinois surged to the highest rate in the Midwest.

Illinois was the only state in the Midwest with housing markets among the 50 counties in the U.S. most vulnerable to the COVID-19 shock. This is because Illinois already had a large number of underwater homes as well as the second-highest foreclosure rate in the country as of February 2020.

Illinois has had the third-lowest housing price appreciation in the United States on average since the end of the Great Recession. Weak housing appreciation is largely tied to declining demand as Illinois continues to experience population decline and more Illinoisans continue to favor renting over homeownership. Despite relatively low home prices and mortgage rates, homeownership is further discouraged by added costs such as property taxes, which are second-highest in the nation.

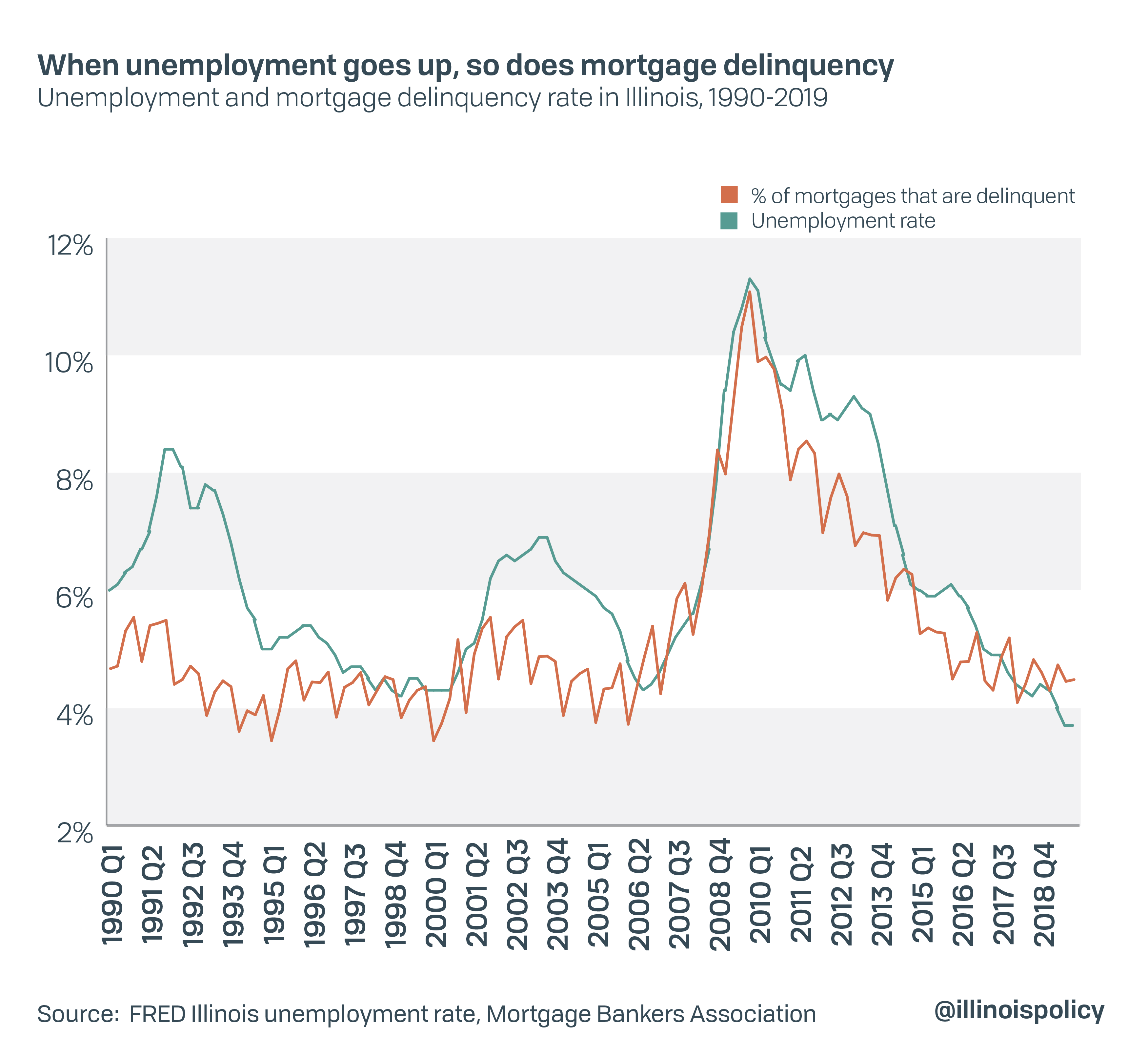

The state’ labor market also appears to be one of the most affected in the region as well, as the state’s unemployment rate remains the highest in the Midwest. Aggregate unemployment and aggregate mortgage delinquency tend to move in the same direction, as seen in the chart below. Meanwhile, aggregate income – which increases when more people are employed – and aggregate mortgage delinquency move in the opposite direction, meaning delinquency rates can be expected to increase as incomes fall.

Growth in home equity is negatively associated with mortgage delinquency. If the value of your home goes up, then you are probably not going to experience delinquency. On the other hand, if you become unemployed and are already “upside down” on your loan – owing more on your mortgage than your home is currently worth – then you are more likely to enter delinquency.

Because of a failure by the state to support local governments in providing adequate fiscal support to struggling homeowners, the mortgage delinquency rate has nearly doubled to 8.36%, only outpaced by the rate during the Great Recession. Illinois’ mortgage delinquency rate peaked at 11% during the Great Recession, the worst housing crisis in decades.

Delinquency often leads to foreclosures, and foreclosures make economic downturns even worse.

Property tax relief could have let some struggling families better manage their mortgages as they worked to stave off delinquency, but that required action from state lawmakers. There was none. While some Illinois counties offered property tax delays, most of them did not.

State government could have acted sooner to provide property tax relief

Other than the cost of their loans, property taxes are often Illinois homeowners’ largest annual housing expense. Recent homeowners likely make the equivalent of nearly seven additional mortgage payments each year because of property taxes.

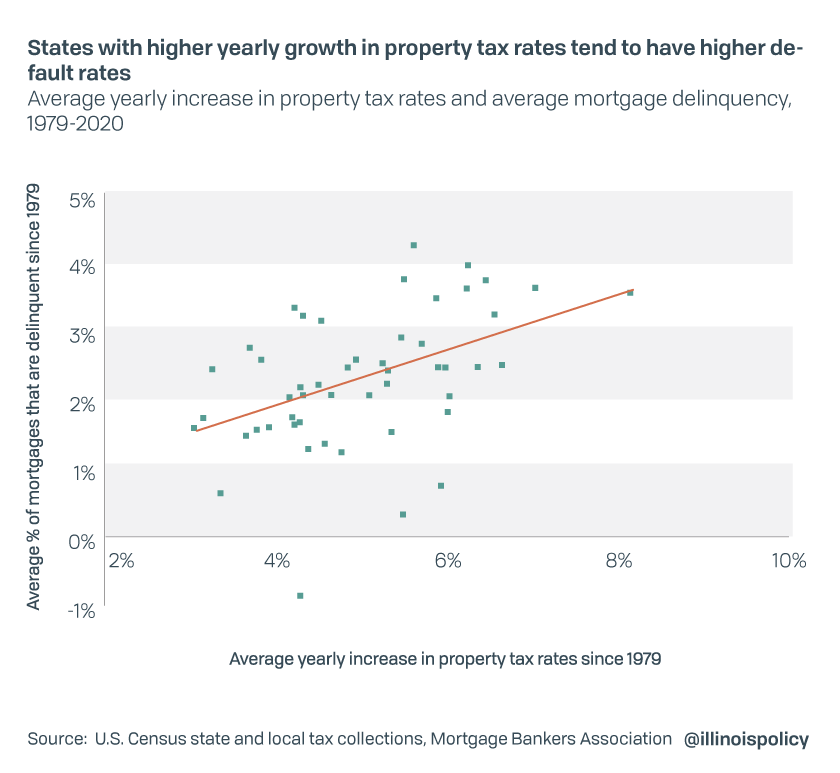

Increases in property tax rates reduce the “profit” from homeownership. When property tax payments are included in your mortgage agreement, a failed property tax payment means you are legally in default of your mortgage contract. These facts help explain the strong positive correlation between delinquency rates and property tax hikes.

Two Illinois lawmakers had introduced bills in May to delay property tax payments statewide. However, lawmakers ended this spring’s General Assembly session taking no action on those bills.

Multiple Illinois counties voted on their own to delay payments to give residents relief. Kane, McHenry, DuPage, Sangamon and St. Clair counties have all provided extensions without penalties on property tax due dates. Illinois law allows those delays during a disaster such as the COVID-19 pandemic.

Illinois homeowners again paid the nation’s second-highest property taxes, behind New Jersey, in the annual survey by WalletHub. The median Illinoisan with a mortgage pays $4,900 in property taxes on their $203,400 home, a property tax rate of 2.4% (the WalletHub survey includes those without a mortgage and shows Illinois’ property tax rate at 2.3%, both are second highest in the nation). This is the third consecutive year Illinois ranked No. 2 in the property tax survey.

With many Illinois homeowners still uncertain about how they will be able to pay the bills, property tax and income tax relief should be a priority for lawmakers.

Instead, Illinois Gov. J.B. Pritzker has so far spent more than $56.5 million of his own money to mislead voters that another tax increase is truly a “fair tax”.

Pritzker’s “fair tax” would raise the cost of homeownership, as well as depress a jobs recovery by increasing taxes up to 47% on more than 100,000 small businesses just as they are trying to recover from the COVID-19 economic damage.

By hurting Illinois’ small business job creators, Pritzker’s progressive income tax will further damage the jobs market, ultimately harming Illinoisans’ abilities to afford a house.