The average American family spends $2,375 on property taxes for their home, but the average Illinois family spends nearly double that amount.

Illinois is again the second-highest state for property taxes, behind New Jersey, in a new survey by WalletHub. Illinois taxes average $4,705 on a $205,000 house, the national median. This is the third consecutive year the two states ranked No. 1 and No. 2 in the property tax survey.

Illinois’ median home value is less than the national median at $187,200, but taxes on that home still average $4,299, WalletHub reported.

Illinois realizes it has a problem, and state lawmakers in the spring created the 88-member Illinois Property Tax Relief Task Force. It was charged with finding solutions by the end of 2019. So far, no official report has been released to the public.

The group’s Republican members refused to sign off on a draft that mainly rehashed old ideas, said state Rep. Mike Murphy, R-Springfield, a member of the task force. He said substantive ideas were rejected, and the draft contained only vague suggestions.

“There’s nothing in here that says ‘tomorrow we’re going to file legislation saying this,’” Murphy told The Center Square.

He said he expects the task force would mainly be used as a way to push Gov. J.B. Pritzker’s progressive income tax hike, which Pritzker in his Feb. 19 budget address said voters must pass in November or else he would cut $1.4 billion for schools and other state services from the 2021 budget.

Proponents of the plan, which Pritzker calls the “fair tax,” claim higher income taxes can be used to reduce Illinois’ property taxes.

But despite Illinoisans shouldering two of the largest income tax hikes in state history in the last decade, the state’s property taxes remain among the highest in the nation.

What’s driving high property taxes?

Illinois’ high property taxes are driven by too many layers of local government and crippling pension costs.

With nearly 7,000 local government units, Illinois by far has the most in the nation, burying residents under six layers of local government on average.

A large part of the government problem is that Illinois has too many school districts, which take up about two-thirds of property taxes statewide. Illinois was the only state to spend over $1 billion on school district administration in 2017. Were Illinois to achieve the national average of administrative spending per student, it would save $708 million a year that could be better spent in the classrooms and on providing property tax relief.

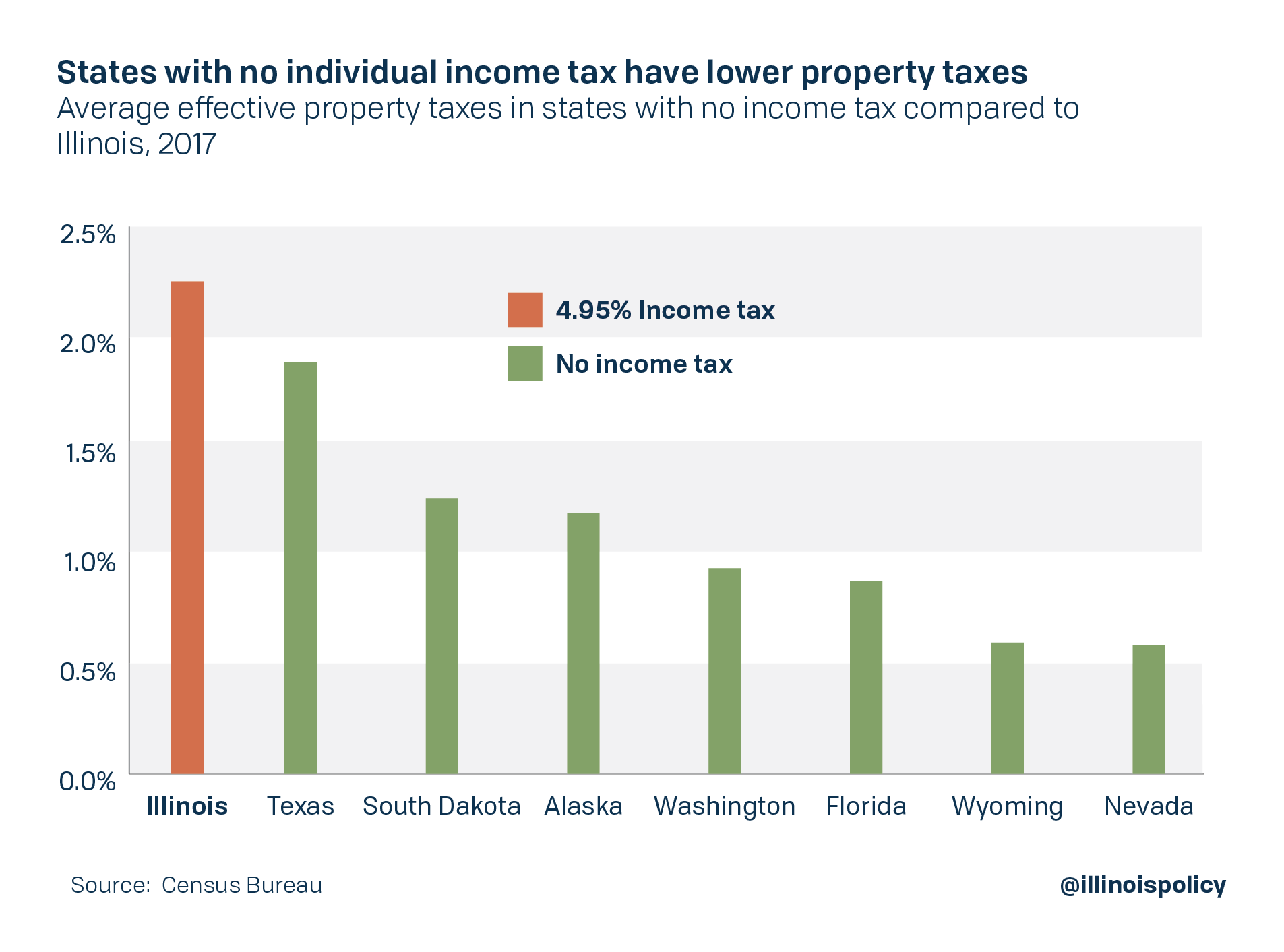

It is a myth that Illinois property taxes are high because of insufficient state aid for local government resulting from Illinois’ flat income tax. All seven states that have no income tax also have lower property taxes than Illinois, meaning they’re able to fund both state and local government services without high property taxes or a progressive income tax.

Pritzker’s progressive tax plan contains no guarantee that the $3.7 billion it is expected to take from the Illinois economy will do anything to lower property taxes. Local governments can simply take the new state revenue and continue to increase the property tax burden.

That is what happened in other states. Connecticut lawmakers promised property tax relief when they switched from a flat tax to a progressive tax in the 1990s, but property taxes as a share of personal income have actually increased since the switch, as have middle-class income taxes by 13% and poverty by half.

New Jersey also has a progressive income tax, which ranks among the fairest in the nation according to the left-leaning Institute on Taxation and Economic Policy.

But the same report that praised New Jersey’s progressive state income tax system also stated middle-income earners in the $74,800 to $132,000 bracket carry the highest effective tax rates, with state and local taxes eating up 10.7% of their income. They are also the group paying the highest chunk of their income toward property taxes, at nearly 6%.

New Jersey’s property taxes have led the nation for three years running, again belying the idea that a progressive tax yields property tax relief.

Illinois wasn’t always at the top for property tax burdens. In 1996, property taxes in Illinois hovered around the national average. As public pension debt has ballooned, so too have Illinois property tax bills. Pension costs have eaten up about 50 cents of every additional property tax dollar during the past two decades.

Rather than amending the Illinois Constitution to give state lawmakers greater power to raise taxes, Pritzker should instead lead them to amend the Illinois Constitution to allow local governments to get their pension costs under control. An ideal pension amendment would protect already-earned pension benefits, while allowing for adjustments to the growth of future benefit accruals, such as cost-of-living increases pegged to inflation.

Without commonsense pension reform, Illinoisans will continue seeing themselves on the wrong end of the property tax rankings.