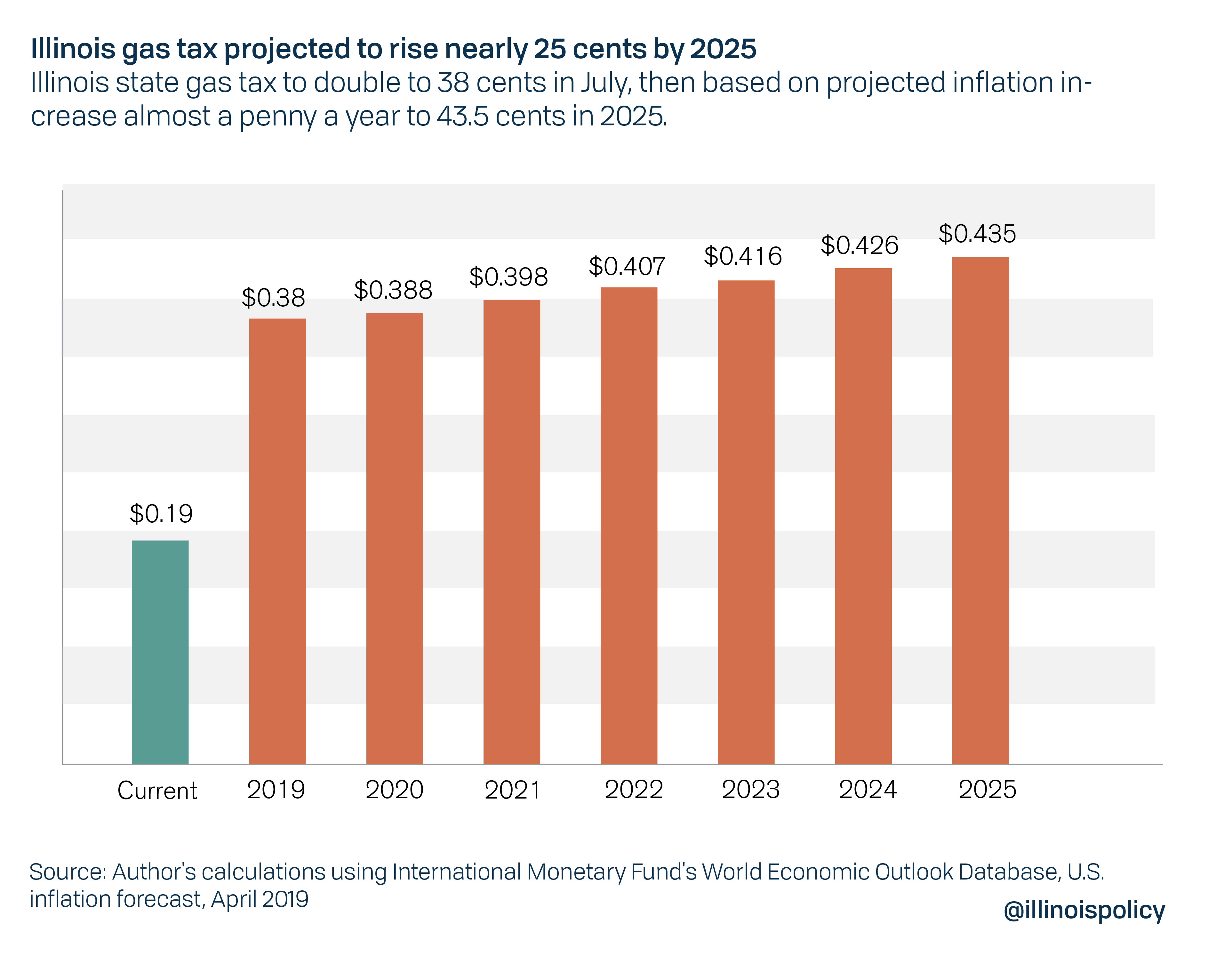

Illinoisans will see the state gas tax double starting July 1. But that’s not all: the tax will be tied to inflation, meaning it will automatically rise in future years so lawmakers are shielded from motorists’ ire.

Based on current inflation projections, the gas tax will rise almost a penny a year. Lawmakers bumped it from 19 to 38 cents starting in July. Their inflation mechanism is expected to drive the gas tax to 43.5 cents by 2025 — almost 25 cents per gallon more than now.

Senate Bill 1939 doubled the state motor fuel tax to help fund Gov. J.B. Pritzker’s $45 billion infrastructure plan, and passed by a bipartisan 83-29 vote in the Illinois House. Pritzker is expected to sign the bill soon, then in July Illinois’ gas taxes will become the second-highest in the nation.

Using the most recent inflation forecasts for the United States, the gas tax will grow by a fraction shy of a penny a year until 2025. That translates to a 130% increase.

In future years, the state will raise the gas tax every July 1 at the rate of inflation for the 12 months prior to March of that year. Each yearly increase is capped at one cent – but the pennies add up.

The average driver in Illinois drives 12,921 miles a year, and the average vehicle nationwide consumes one gallon of gasoline every 24.7 miles. Based on those numbers, Illinoisans will pay $100 more a year under the 38-cents-per-gallon state gas tax in its first year. By 2025, that burden will rise to nearly $130 more per year.

Pritzker’s gas tax hike is projected to raise $1.2 billion, with the state bringing in $560 million and local municipalities gaining $650 million.

There’s more localized pain to come from SB 1939.

The law lets Chicago raise its city gas tax by an extra 3 cents, which would put it at 8 cents. It allows Lake County and Will County to impose a gas tax of up to 8 cents per gallon. DuPage, Kane and McHenry counties would be able to double their 4-cent-per-gallon gas taxes to 8 cents.

Supporters of the bill have defended the gas tax hike by asserting the tax has not been increased since 1990. Had it kept up with inflation, they claimed it would be 38 cents today. But without adjusting for inflation, Illinois’ 19-cent state gas tax was already the 10th-highest in the nation. When doubled, Illinois jumps to second-highest in the nation. The inflation adjustments then drive it higher without lawmakers being held responsible for the increases.

If Chicago and the collar counties move to increase their motor fuel taxes – along with automatic yearly inflation-tied increases at the state level – residents will be looking at the highest average gas tax burden in the country.

Automatic gas tax increases let lawmakers duck their responsibilities, hurt taxpayers and drive consumers out of state to buy fuel. Lawmakers should stop the automatic increases.