There’s no arguing that Illinois is a wreck. But read Gov. J.B. Pritzker's recent pre-budget report and you'll get the impression former Gov. Bruce Rauner alone caused that wreck.

Wirepoints wants to set the record straight.

Yes, Rauner's four years were a failure, full of blunders, lost opportunities and about-faces. And the Rauner/Madigan impasse certainly made things worse.

But Illinois was a fiscal and economic basket case long before Rauner stepped into the governor’s office. No amount of anti-Rauner rhetoric should let Illinoisans ignore that reality. Ignoring history – or reframing it as the Pritzker administration wants – makes it impossible to properly diagnose what’s really wrong with Illinois. And more importantly, it gives Pritzker cover to pursue the same policies that preceded Rauner.

Don't forget how dysfunctional, corrupt and broke Illinois was in the years before 2015.

Two former governors were jailed for corruption. Unpaid bills in 2013 had already reached a then-unprecedented $9 billion, wreaking havoc on social service agencies. Multi-billion-dollar budget shortfalls were the norm and Illinois’ $100 billion pension crisis became the nation’s worst. The state was hit with 13 credit downgrades under Gov. Pat Quinn and by 2010, Illinois was already the nation’s lowest-rated state. Worst of all, Illinois lost a net one million people to out-migration from 2000 to 2014.

All of which make former Govs. Edgar, Ryan, Blagojevich and Quinn failures, too. And don’t forget House Speaker Mike Madigan. He’s presided over the entire downward slide.

But Pritzker wants Illinois’ crisis to be all about Rauner. We get that – it’s politics as usual to blame the predecessor. But there’s more to it than that. If Pritzker can pin all of the state’s failures on Rauner by leveraging Illinoisans’ strong distaste for the former governor, then Pritzker's “solutions” – a collection of tax hikes, pension bonds and new spending – become easier to swallow.

History, however, shows those same policies under previous governors got Illinois into crisis.

Wirepoints put together a list of 20 facts to make our case. Here are just three of them:

Nation's highest paid state workers

State AFSCME worker salaries, thanks to their guaranteed contracts, grew more than 40 percent over the 2005-2015 period. In contrast, private sector worker earnings only grew 11 percent, half the rate of inflation. That growth helped push Illinois state government worker pay to the highest in the nation in 2014.

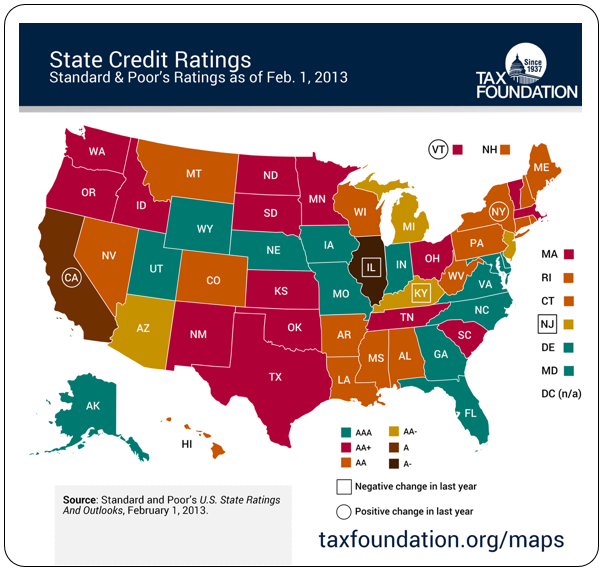

Nation’s worst credit rating

By 2010, Illinois’ credit rating was already the worst in the nation according to Moody’s. And in 2013, S&P declared Illinois was on a “credit precipice” due to lack of pension reform. Illinois’ S&P rating – also the nation’s worst – was lower than California’s, New Jersey’s and Connecticut’s – all famous for their fiscal problems. In contrast, Indiana, Missouri and Iowa were all AAA-rated. Illinois was on its path toward junk way before 2015.

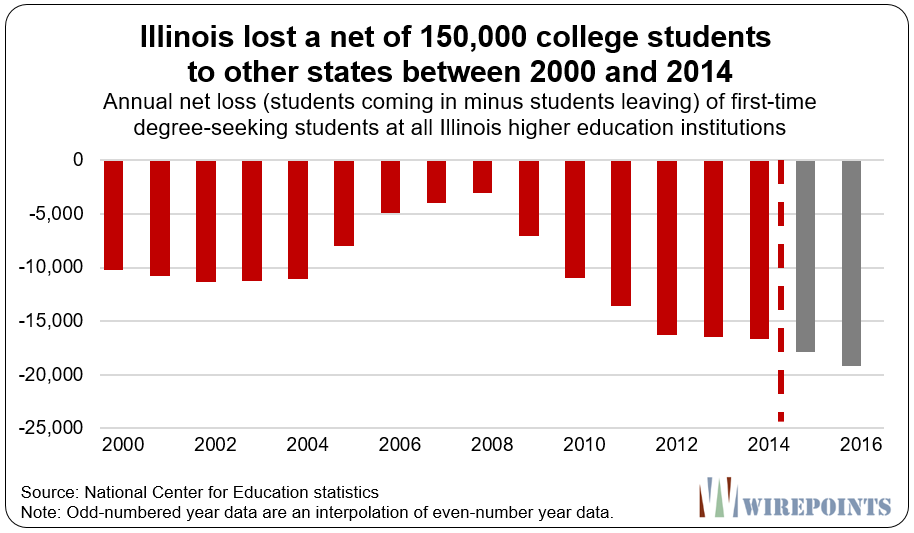

Student flight

Illinois lost a net of 16,500 university students in 2014 alone, the second-most in the country, according to the New York Times and the Department of Education. In fact, between 2000 and 2014, over 150,000 net college students left Illinois to go to college elsewhere.