The plight Illinoisans face under the state’s immense tax burden is hardly a secret. But a recent study offers a sobering reminder of the degree to which Illinois’ steep tax bills dwarf those of other states.

A report issued March 13 by WalletHub, a personal finance service, measures the combined state and local tax burdens of all 50 states and Washington, D.C. The Land of Lincoln ranked 51st in terms of the severity of its overall tax burden. Adjusted for cost of living, Illinois’ overall burden placed 43rd out of 51.

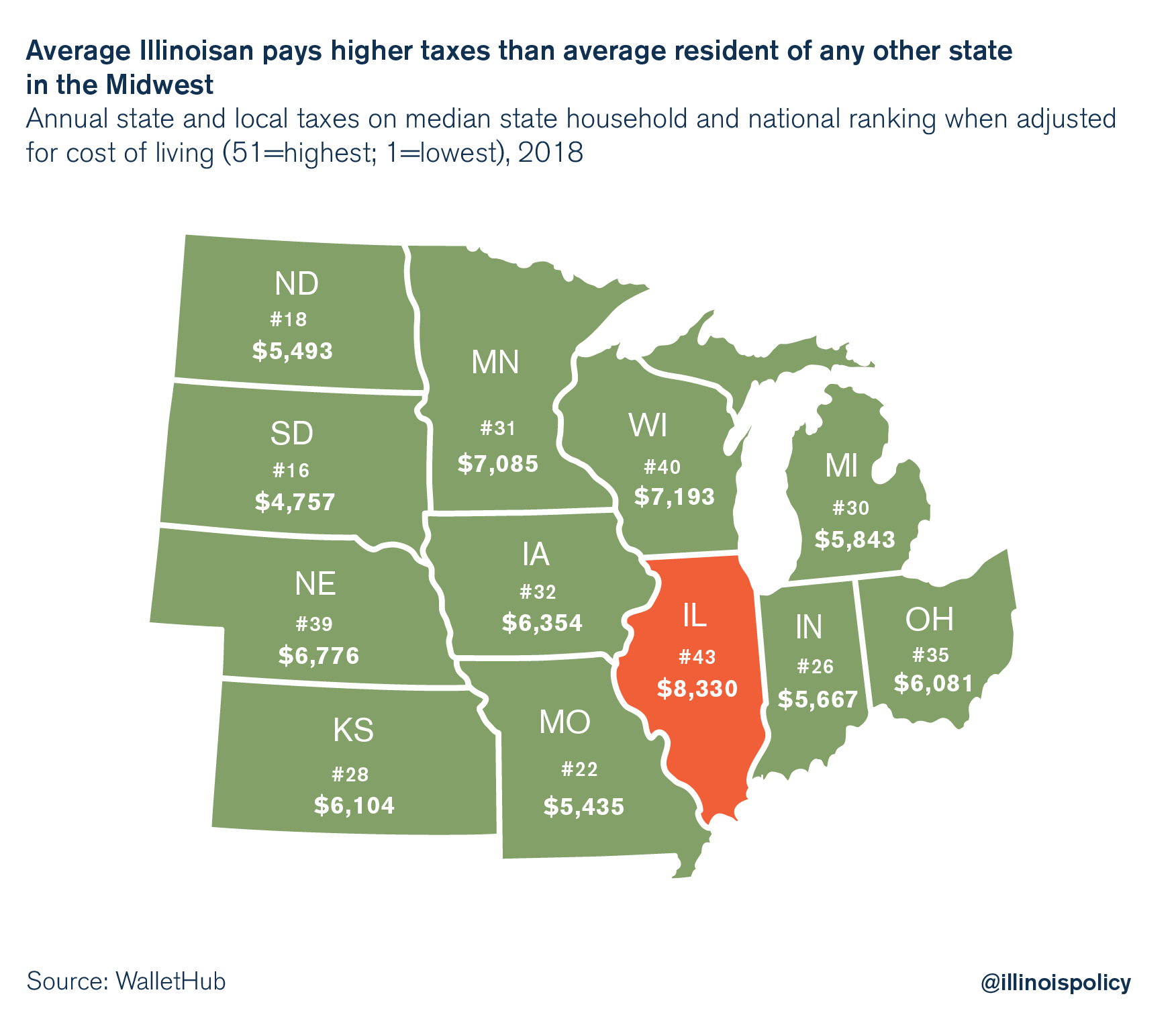

According to the study, the effective state and local tax rate on an Illinois household earning the median U.S. income is 14.89 percent, the highest in the nation. A household earning the state median income pays $8,330 in taxes annually, not including federal taxes.

The study reveals a striking disparity between Illinois and other states in the region. Illinois’ tax burden far eclipses all other Midwestern states. For example, median households in Wisconsin, the second-most burdened Midwestern state, pay an annual $7,193 in state and local taxes. But most effective tax burdens in the region are lower still. Median households in each of Illinois’ neighboring states, with the exception of Wisconsin and Iowa, pay less than $6,000 annually, meaning the tax burden on median households is at least 39 percent higher in Illinois compared to most of its neighbors.

Taxes included in the study ran the gamut, from income taxes to excise taxes. But by far the most glaring costs for the Land of Lincoln are Illinois’ punishing property taxes. Illinoisans with a home worth the U.S. median value pay $4,288 in property taxes annually, according to the study. Isolating the property tax findings, only New Jersey ranked worse than Illinois.

WalletHub’s findings mirror those illustrated by a previous tax study the service conducted in 2017. However, it is important to note that WalletHub’s analysis utilized data from a study using Illinois’ now-expired 2011 income tax rate of 5 percent, rather than Illinois’ current rate of 4.95 percent.

Some lawmakers have floated the idea of amending the Illinois Constitution to turn the state’s flat income tax into a progressive tax. But these findings should give Illinoisans pause.

Advocates proclaim a progressive tax would make room for reduced rates for lower-income taxpayers. But this claim is in conflict with at least one proposal currently floating through Springfield. The progressive tax bill authored by state Rep. Robert Martwick, D-Chicago, would hike taxes on Illinoisans making as little as $17,300 annually.

Taxpayers have made clear that Illinois’ massive tax burden has all but pushed them to the brink. This fact is reflected grimly by the state’s four-year streak of population loss, which culminated in Illinois falling from fifth- to sixth-largest state in December 2017, according to U.S. Census Bureau data.

Instead of saddling Illinoisans with higher taxes, lawmakers need to rein in the growth of government spending at the state and local levels. State Sen. Tom Cullerton, D-Villa Park, and state Rep. Allen Skillicorn, R-East Dundee, have both filed constitutional amendments tying growth in state spending to growth in the state’s economy: SJRCA 21 and HJRCA 38. And there are many commonsense reforms state lawmakers could pursue to ease residents’ property tax burdens as well.

Relieving Illinoisans’ heartache begins with relieving their wallets from the effects of government overspending.