Illinois lost the border wars with every neighboring state over tax years 2010-2015, according to new data from the IRS. On net, more people and money “walked out” of Illinois to neighboring states than walked in.

Between tax years 2010 (2010-2011) and 2015 (2015-2016), the most recent years of available data, Illinois hemorrhaged 101,000 more people to surrounding states than it took in. This loss amounts to more than 43,000 households, measured in individual tax returns.

The IRS data calculate migration trends using reported address changes contained in yearly tax returns filed. The migration flow of households is based on the number of tax returns filed with the IRS, while the migration of individuals is determined by the number of claimed exemptions.

In tax year 2015 alone, outmigration from the Prairie State reached record-breaking levels when the IRS recorded a net loss of nearly 42,000 tax returns, or estimated households, to other states. At the individual level, this exodus amounted to more than 86,100 people.

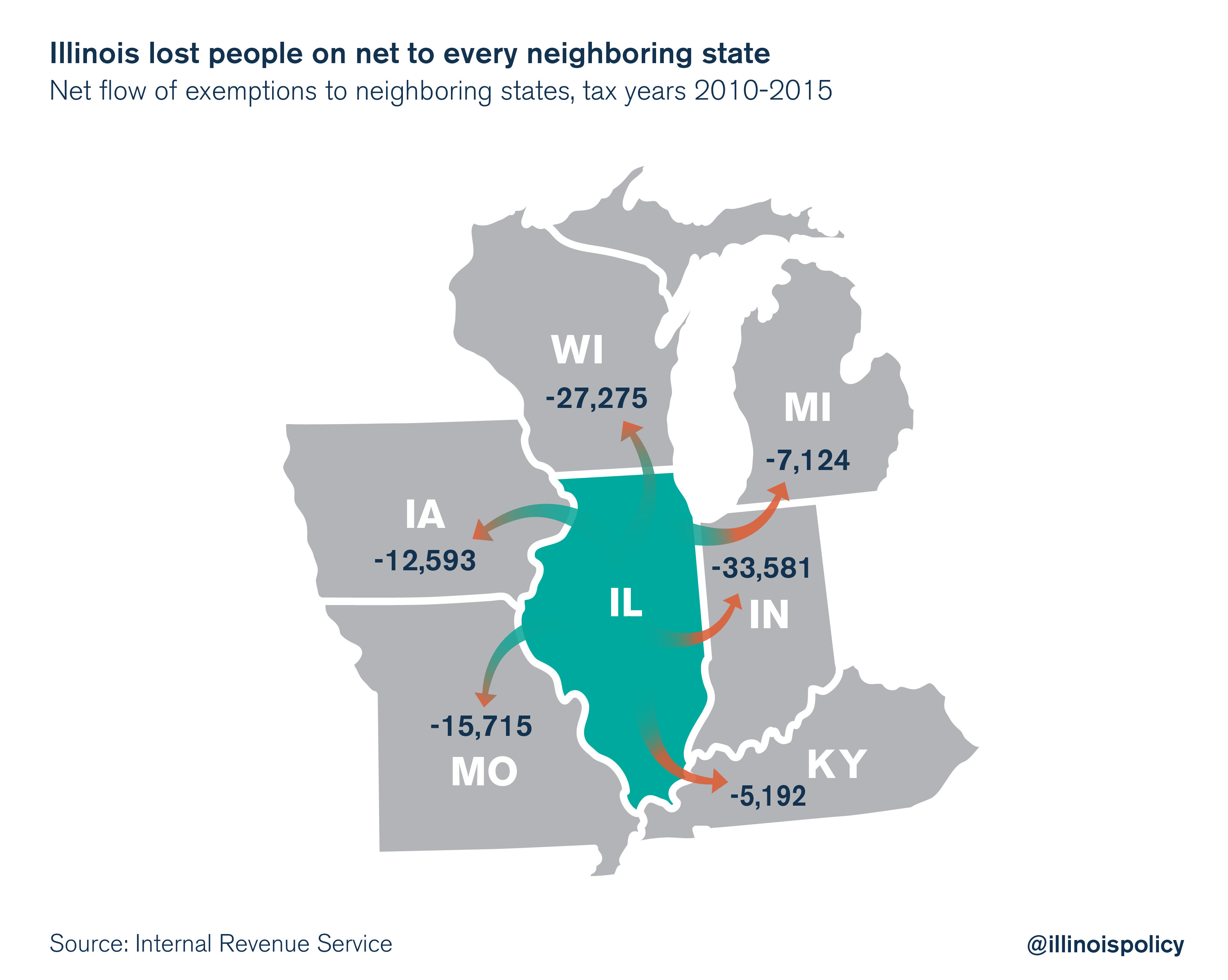

But what’s especially revealing is the degree to which Illinois residents have been lost to surrounding states. The IRS data show that in tax year 2015, Illinois lost nearly 22,000 people on net to states just across the border. But a longer view of the data reveals a more dismal picture of this trend: Since tax year 2010, neighboring states have welcomed in more than 101,000 onetime Illinoisans, on net. Indiana and Wisconsin ranked among the top five biggest recipients of Prairie State exemptions nationwide, netting roughly 33,500 and 27,000, respectively, since 2010.

Indiana’s net intake of Illinoisans more than doubled between tax years 2014 and 2015 alone, jumping to more than 8,000 in the IRS’s most recently provided year of data, from roughly 4,000 the year prior.

In tax year 2010, nearly 1,000 Michiganders moved to Illinois, on net. By the following year, the ball changed courts, with Illinois shuffling off roughly 1,000 people on net to its Great Lakes neighbor. By 2015, Illinois was running a migration deficit with the Wolverine State in excess of 2,500.

Illinois’ other neighbors – Iowa, Missouri and Kentucky – have each won the border wars against Illinois since 2010, as well.

In part, the hardship inflicted by one of the highest property tax burdens in the country has been sending Illinoisans fleeing across state lines. A 2016 Paul Simon Public Policy Institute poll found taxes were the most frequently cited reason Illinois respondents gave for wanting to leave the state.

IRS data have also shown that, in large part, millennials are leading the march out of state. The Paul Simon Public Policy Institute study is consistent with this, noting that more than half of Illinois millennials expressed a desire to leave the state.

That so many of Illinois’ young people are choosing other states offers a bleak forecast for the Land of Lincoln.

But the brunt of the blame for disenchantment with Illinois falls on lawmakers in Springfield, not the youth demographic they’ve managed to repel.

For lawmakers to preserve a reliable tax base, taxpayers need a sense of security. Illinois’ property taxes are among the country’s most punishing – in many cases, homeowners’ towering property tax bills are akin to a second mortgage they can never pay off. This has pushed many property owners to head for the hills, and repels new homeowners the state desperately needs.

Illinoisans are in need of a real property tax freeze – one that caps their actual bills, not just local governments’ levies – as well as other bold reforms at the state level to lower the burden of property taxes.

If Illinois lawmakers wish to reverse the trend of taxing Illinoisans out of the state, they would be wise to pursue policies that broaden the base – by establishing a tax environment attractive to more prospective taxpayers.