Taxes take a larger chunk out of Illinoisans’ incomes than residents of all bordering states, according to data from the U.S. Census Bureau.

Microdata from the Current Population Survey show Illinoisans paid the largest share of their income in property taxes, state taxes and the federal income tax, even after including all tax credits.

From March 2015 to March 2016, Illinoisans saw 31.1 percent of their income flow toward income and property taxes each year, compared with 28.7 percent for Wisconsinites, 25.1 percent for Michiganders, 24.6 percent for Iowans. 23.3 percent for Indianans, 23.1 percent for Missourians and 21.1 percent for Kentuckians.

Said another way, Illinoisans kept only 68.9 percent of their income after taxes, compared with 71.3 percent for Wisconsinites, 76.7 percent for Indianans, 76.9 percent for Missourians, 78.9 percent for Kentuckians, 74.9 percent for Michiganders and 75.4 percent for Iowans.

Keep in mind that this data on Illinoisans’ tax burden does not take into account the largest permanent income tax hike in state history, which state lawmakers passed this summer. Illinoisans can look forward to having an even smaller share of their incomes available after taxes.

Who’s paying?

The same data show Illinoisans who earn more see a larger share of their income go toward taxes.

Despite a flat income tax, the higher-earning half of Illinoisans – those with an average personal income above the median state income – kept 74.2 percent of their income, compared with 75.5 percent for those with a personal income below the median income in the state.

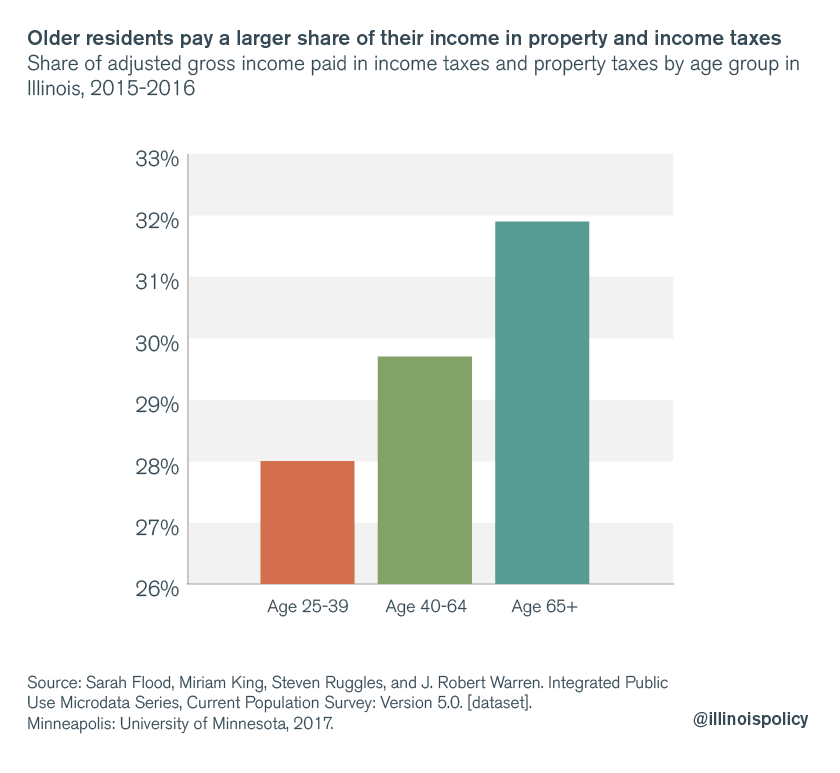

In terms of age, Illinoisans older than 65 bear the largest burden of state and federal tax policies – keeping less of their income after property and income taxes than Illinoisans age 25 to 39 and Illinoisans between the ages of 40 and 64.

An ever-growing burden

Despite Illinoisans seeing the worst personal income growth in the nation over the recession era – and Illinoisans seeing a larger share of their incomes flow to income and property taxes than residents of any surrounding state – lawmakers were bold enough to pass a 32 percent income tax increase in July 2017.

Meanwhile, Illinoisans cite high taxes as the No. 1 reason for wanting to leave the state.

Rather than seeking to take even more money from taxpayers, officeholders should be working to prevent further tax increases from swallowing up more of Illinoisans’ weak income growth. Doing so requires comprehensive spending reforms as well as pro-growth economic reforms to grow the state’s tax base, rather than hitting up tapped out taxpayers again and again.