Illinois has the worst manufacturing jobs recovery from the Great Recession of any neighboring state, according to data released in October by the Bureau of Labor Statistics, or BLS. That means that if the Land of Lincoln had simply recovered at the average pace of its neighbors, 84,000 more people would have manufacturing jobs today. Meanwhile, manufacturing opportunities in states near Illinois are expanding. While Illinois has added only 15,000 manufacturing jobs during the recovery, smaller states have added many more, with Wisconsin adding 47,000, Indiana adding 95,000 and Michigan adding 162,000 factory jobs.

If Illinois embraced a real package of economic reforms, including changes to its workers’ compensation system and property-tax regime, tens of thousands more hardworking men and women would have a better chance at finding jobs building products and reap the rewards of their labor, instead of sitting on the sidelines waiting for opportunities.

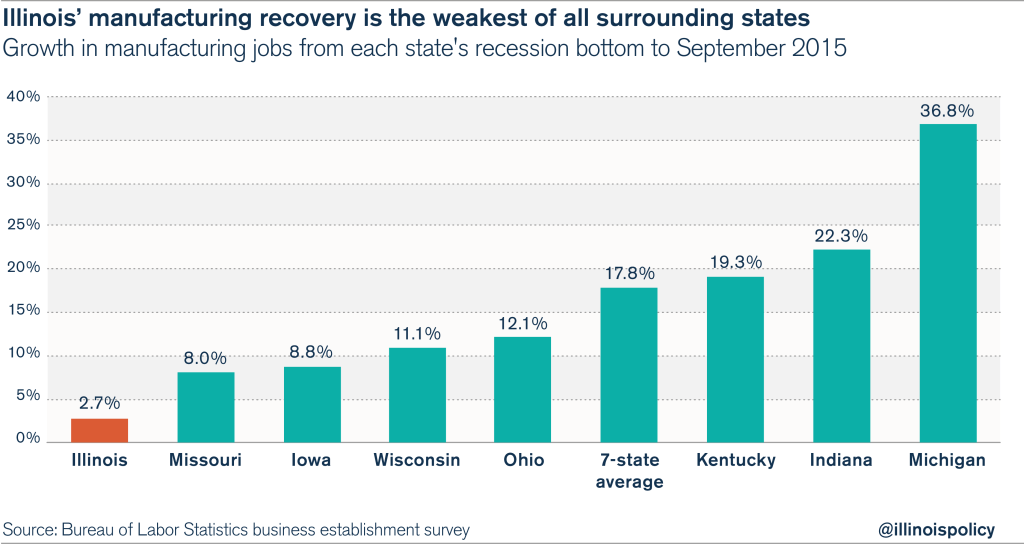

Illinois and surrounding states hit their recession bottoms in late 2009 and early 2010. Since that time, manufacturing payrolls have risen in all states, but not to the same extent. Illinois factory payrolls have grown by only 2.7 percent since the bottom of the recession, much less than those in all surrounding states. On the other end of the spectrum, Kentucky has increased its factory jobs by 19 percent, Indiana by 22 percent, and Michigan by 37 percent.

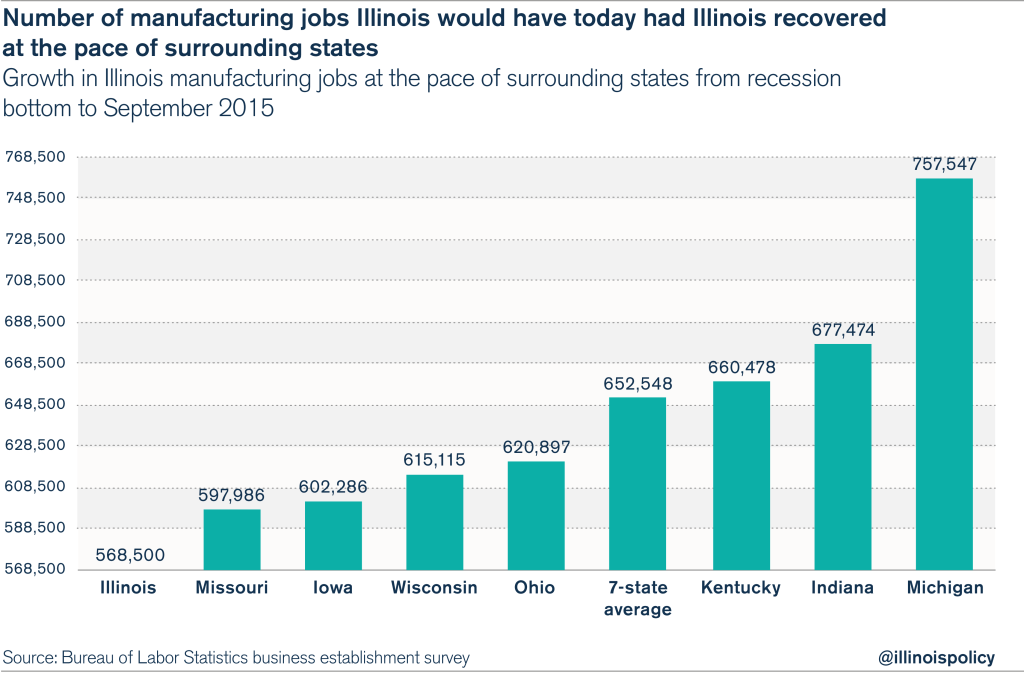

A comparison of Illinois to nearby states reveals how many more manufacturing jobs Illinois would have if the Land of Lincoln’s recovery were on par with the recoveries experienced by its neighbors:

- 30,000 more factory jobs if Illinois had kept pace with Missouri

- 34,000 more factory jobs if Illinois had kept pace with Iowa

- 47,000 more factory jobs if Illinois had kept pace with Wisconsin

- 52,000 more factory jobs if Illinois had kept pace with Ohio

- 92,000 more factory jobs if Illinois had kept pace with Kentucky

- 109,000 more factory jobs if Illinois had kept pace with Indiana

- 189,000 more factory jobs if Illinois had kept pace with Michigan

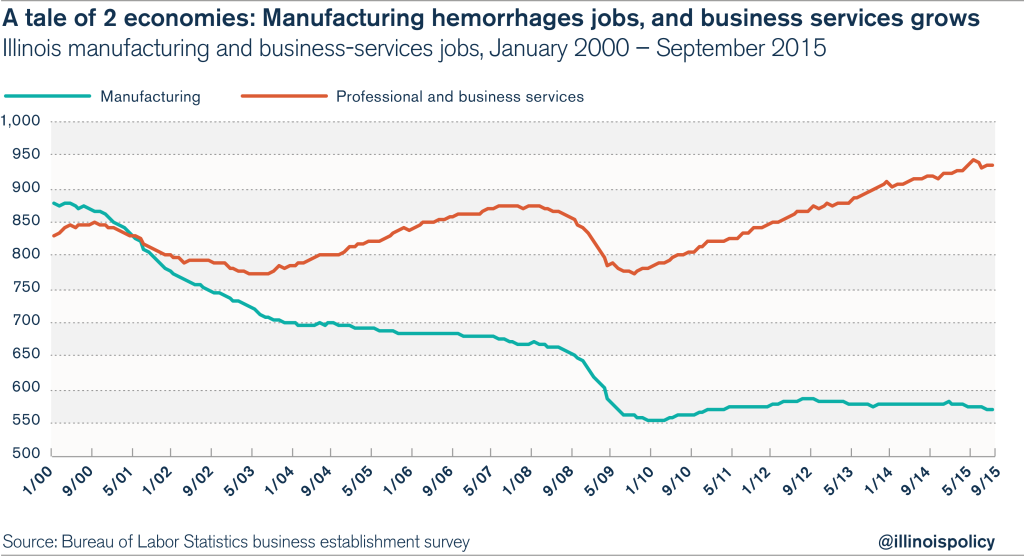

Illinois’ lackluster performance compared to other states reveals a long-term trend. Illinois’ political leaders ignore the hardships they impose on the state’s manufacturing industries, and instead spotlight white-collar, city-center sectors such as technology and business services that are less severely affected by Illinois’ harmful policies, such as its broken workers’ compensation system and sky-rocketing property taxes.

Divide between manufacturing and white-collar jobs continues to grow

The divergence between manufacturing and white-collar business services has expanded dramatically. As recently as 2001, there were the same number of jobs in manufacturing and business services. But today, the BLS data show Illinois has 65 percent more jobs in business services than in manufacturing.

While white-collar workers can still make their way in Illinois, blue-collar workers find themselves shut out by policymakers. This policy favoritism for white-collar jobs over blue-collar jobs is unacceptable.

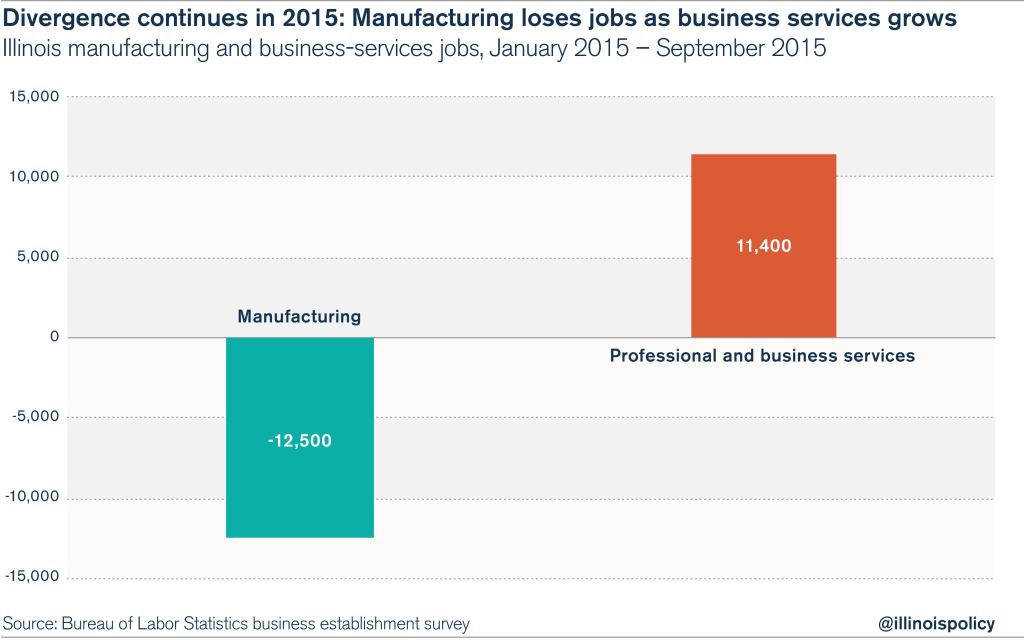

Illinois’ industrial divergence has continued in 2015. Since the beginning of 2015, 11,400 new business-services jobs have been created in Illinois, but the state lost 12,500 manufacturing jobs during the same time.

Instead of fairness and a level playing field, Illinois’ makers labor under policies that benefit special interests to the disadvantage of blue-collar workers.

The Illinois Policy Institute supports a legislative agenda to counter these anti-worker policies and reinvigorate Illinois’ manufacturing sector. Structural economic reforms will allow Illinoisans to take advantage of the state’s location, talent and resources to create more jobs, better incomes and high-quality products. The package of reforms should include:

- Regulatory reform to fix Illinois’ broken workers’ compensation system, which drives manufacturing jobs out of the state

- Regulatory reform to improve the state’s anti-business lawsuit climate

- Tax and spending reform to freeze the nation’s second-highest property taxes and allow local governments to control budget costs

- Tax reform to exempt businesses from sales tax on the purchase of business inputs. This would broaden the concept behind the manufacturers’-purchase credit and the manufacturing- and machinery-equipment credits so that Illinoisans only pay sales tax on final products, not on the products used to make them.

- Statewide or local Right-to-Work laws to protect worker paychecks

- Education reform to bring shop class back to high schools. A broader vision of education should include in manufacturing areas schools that specialize in training students for careers as makers, so that interested students can graduate ready to succeed in good manufacturing jobs.

Michael Lucci is the Vice President of Policy with the Illinois Policy Institute.