“First and foremost, respect the taxpayer. Start losing taxpayers and it’s a downward spiral from there.” That’s the advice a wise man from Detroit had for Chicago when I visited the Motor City right after it filed for bankruptcy in 2013. It was just one of five lessons I was told Illinois should learn from Detroit’s collapse.

Illinois politicians aren’t heeding that advice. Punishing taxes, failed criminal justice policies, worsening corruption and an anti-business climate continue to chase out tens of thousands of taxpayers every year. That includes a net loss in the last decade of 40,000 taxpayers earning more than $200K. We’ve documented the state’s outmigration losses in detail here and here.

Those losses matter. Illinoisans earning $200K-plus make up only 6 percent of all tax filers in Illinois, but they pay about 40 percent of the state’s personal income taxes.* Lose them and the state’s tax base takes a real hit.

Now Illinois’ failures are pushing out the state’s wealthiest resident. Ken Griffin is moving to Florida and he’s taking his company, Citadel, with him. Griffin alone has paid more than $200 million in yearly state taxes in recent years, so his move will have a direct impact on the state’s budget.

Illinois’ revenue losses will be even bigger considering Griffin’s firm employs more than 1,000 people, many of them wealthy, though it’s not yet clear how many of those employees will be moved. The Washington Free Beacon reports Citadel employees have funneled over $1 billion to the state’s coffers over the past decade.

On top of that, Citadel is known to have spawned 80 different companies, many of them successful. It’s not clear how Citadel’s departure may affect those companies.

Citadel’s exit follows the departure of Boeing and Caterpillar’s headquarters, both of which are stacked with high-paid executives. Caterpillar CEO D. James Umpleby’s total compensation, for example, exceeded $24 million in 2021. And Boeing’s CEO, David Calhoun, was paid over $21 million.

These recent high-profile losses are only the latest in the long history of high-income residents deciding to leave Illinois.

IRS migration data shows between 2012 and 2020, 80,900 tax filers with $200K-plus incomes left Illinois for other states, but only 40,900 similarly-wealthy people moved in. (The IRS only began breaking out its data by income brackets in 2012.)

That means a net 40,000 wealthy tax filers have exited Illinois in the last nine years.

In the most recent year of data alone, a record net 8,000 wealthy residents left and took $5.6 billion in income with them.

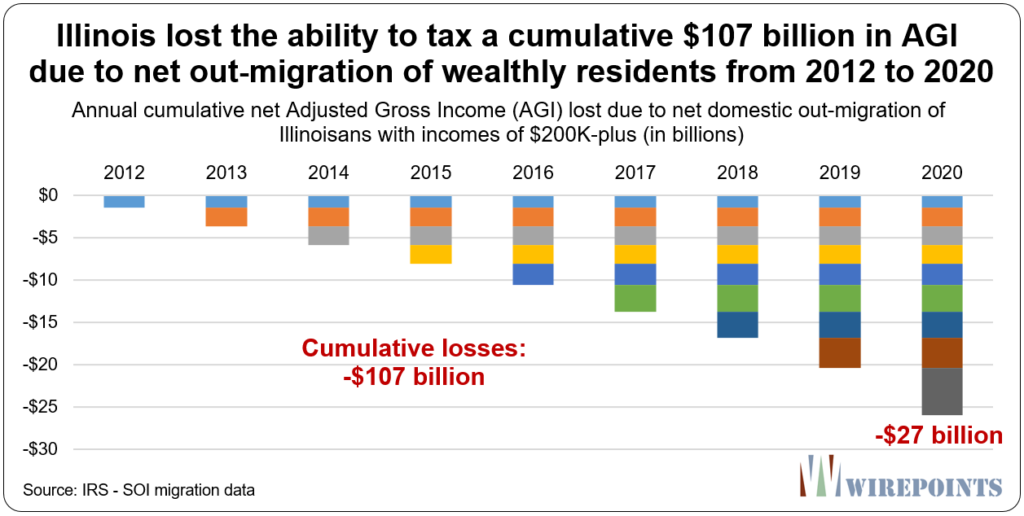

But that’s just the losses for one year. The problem with losing people and their wealth is that one year’s loss doesn’t just affect the tax base the year the income is lost, it also impacts all subsequent years. The losses pile up on top of each other, year after year.

Cumulatively, Illinois has lost out on $107 billion in taxable income since 2012 from wealthy Illinoisans leaving. That’s equivalent to about $5 billion in lost state personal income tax revenues for the state over the period. The number is even larger when other lost taxes (sales, etc.) are taken into account.

Cumulatively, Illinois has lost out on $107 billion in taxable income since 2012 from wealthy Illinoisans leaving. That’s equivalent to about $5 billion in lost state personal income tax revenues for the state over the period. The number is even larger when other lost taxes (sales, etc.) are taken into account.

In 2020 alone, Illinois lost out on taxing $27 billion in AGI. That’s equivalent to $1.2 billion in lost personal income tax revenues for the state.

Illinois is playing a dangerous game with its tax base. There’s only so much disrespect taxpayers can take.

*Based on Illinois Department of Revenue Annual Income Tax Reports for 2015 and 2016. Detailed income tax brackets, including incomes $200K-plus, were FOIA’d by Wirepoints. More recent public reports have far more limited brackets.