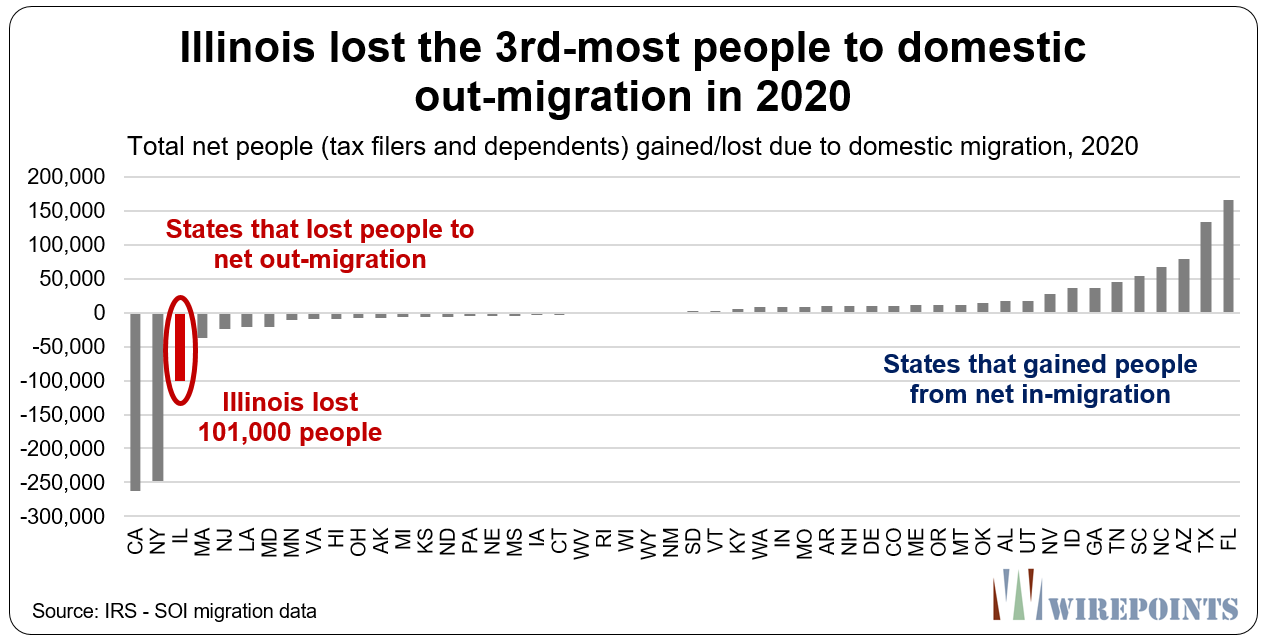

A Wirepoints analysis of the Internal Revenue Service’s just-released migration data shows Illinois lost, on net, another 101,000 residents to other states in 2020. The state ranked third-worst nationally for net resident losses, both in number of people and per capita.

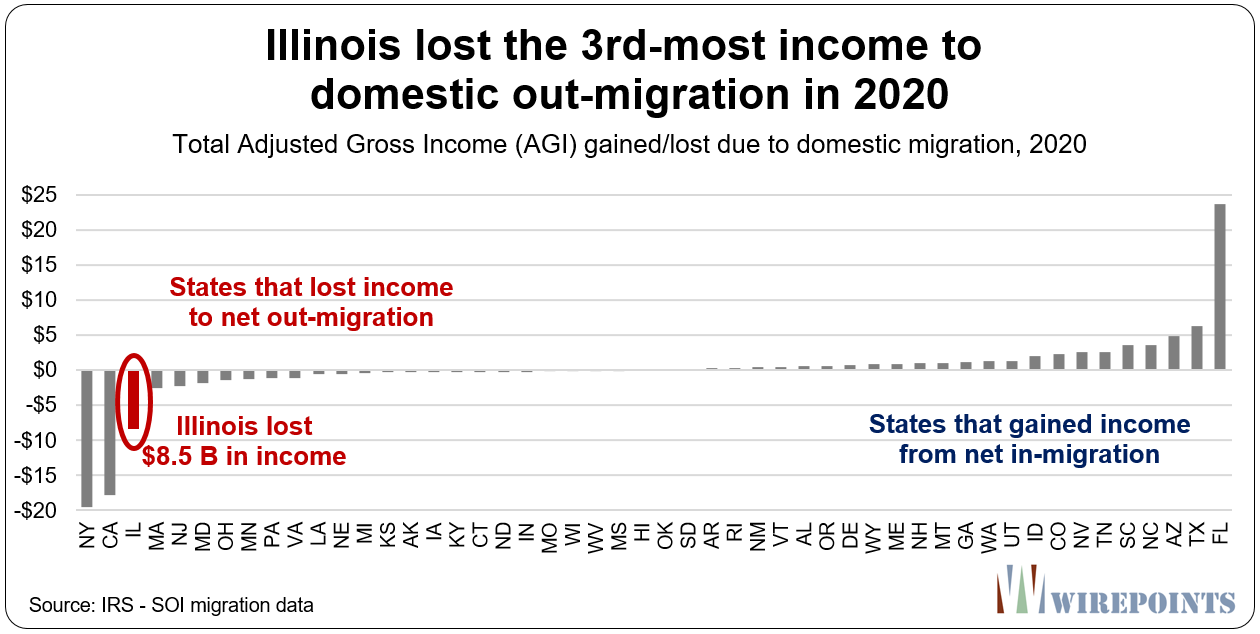

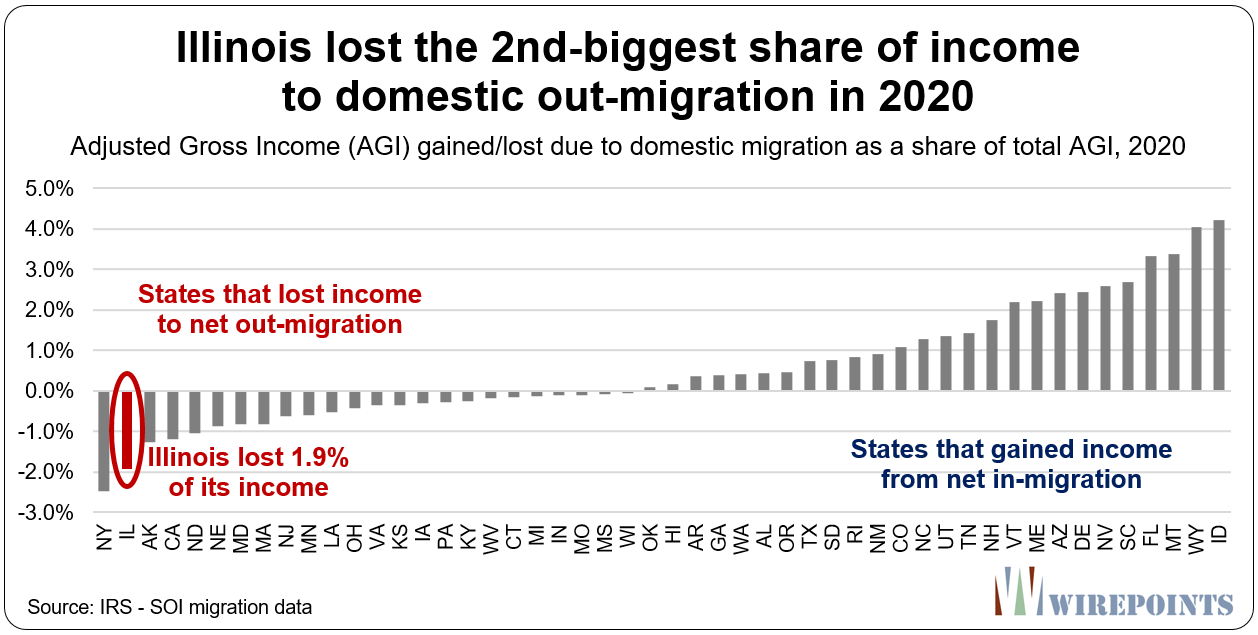

Illinois’ tax base also took a hit as a result of that flight, losing a net $8.5 billion in taxable income (AGI) to other states in 2020 – a new record. That, too, was the third-worst performance in the country. But when measured as a share of total income, Illinois’ losses were the nation’s 2nd-worst.

In all, Illinois lost people, on net, to 44 other states.

To be clear, the data shown in this piece are migration numbers from the IRS. They are unrelated to the U.S. Census Bureau’s 2020 Decennial Census or its 2021 population estimates.

However, this new IRS data does help confirm what the recent 2021 U.S. Census Bureau population estimates for Illinois showed: the state is a severe loser in the competition of people and their wealth. The Census reported Illinois’ population declined by 114,000 in 2021 – more than any other state other than New York and California.

However, this new IRS data does help confirm what the recent 2021 U.S. Census Bureau population estimates for Illinois showed: the state is a severe loser in the competition of people and their wealth. The Census reported Illinois’ population declined by 114,000 in 2021 – more than any other state other than New York and California.

The exodus continues

Wirepoints’ latest analysis comes from state-by-state migration data compiled by the Internal Revenue Service. The IRS reviews tax returns annually to track when and where people move. It also aggregates the ages, income brackets and adjusted gross incomes of filers.

That data shows Illinois continued to be a national outlier in 2020 when it comes to losing people and the money they earn.

Illinois lost 101,000 net tax filers and their dependents in 2020. Illinois’ losses were the third worst in the country, with only California and New York losing more residents – 263,000 and 248,000, respectively.

On a per capita basis, Illinois also ranked 3rd-worst for out-migration, with net losses of 0.79 percent of its population. Only New York and Alaska fared worse, with losses of 1.23 percent and 0.97 percent of their populations, respectively.

On a per capita basis, Illinois also ranked 3rd-worst for out-migration, with net losses of 0.79 percent of its population. Only New York and Alaska fared worse, with losses of 1.23 percent and 0.97 percent of their populations, respectively.

Illinois lost $8.5 billion in Adjusted Gross Income (AGI) to net out-migration in 2020. Illinois’ losses were the third worst in the country, with only New York and California losing more AGI, $19.5 billion and $17.8 billion, respectively.

Illinois lost $8.5 billion in Adjusted Gross Income (AGI) to net out-migration in 2020. Illinois’ losses were the third worst in the country, with only New York and California losing more AGI, $19.5 billion and $17.8 billion, respectively.

But based on a percentage of total income, Illinois ranked 2nd-worst nationally for losses. Illinois lost 1.9 percent of its total AGI in 2020. New York and Alaska ranked 1st and 3rd, with losses of 2.5 percent and 1.3 percent of their 2019 total incomes, respectively.

But based on a percentage of total income, Illinois ranked 2nd-worst nationally for losses. Illinois lost 1.9 percent of its total AGI in 2020. New York and Alaska ranked 1st and 3rd, with losses of 2.5 percent and 1.3 percent of their 2019 total incomes, respectively.

The three biggest gainers nationally of people and their incomes in 2020 were Florida, Texas and Arizona. Florida was the biggest winner by far, gaining a net 167,000 people and $23.7 billion in AGI. Texas gained 133,000 people and $6.4 billion in AGI. Arizona gained 80,000 people and $4.8 billion in AGI.

The three biggest gainers nationally of people and their incomes in 2020 were Florida, Texas and Arizona. Florida was the biggest winner by far, gaining a net 167,000 people and $23.7 billion in AGI. Texas gained 133,000 people and $6.4 billion in AGI. Arizona gained 80,000 people and $4.8 billion in AGI.

Illinois’ deeper losses

The Illinoisans who fled in 2020 earned, on average, $30,600 more than the residents Illinois gained from other states. Outgoing residents earned $106,000, while incoming residents made just $75,000. That’s the biggest gap since at least 2000, based on Wirepoints’ analysis of the IRS data.

So not only is Illinois losing people outright, but the people moving into Illinois make far less than those who are leaving.

So not only is Illinois losing people outright, but the people moving into Illinois make far less than those who are leaving.

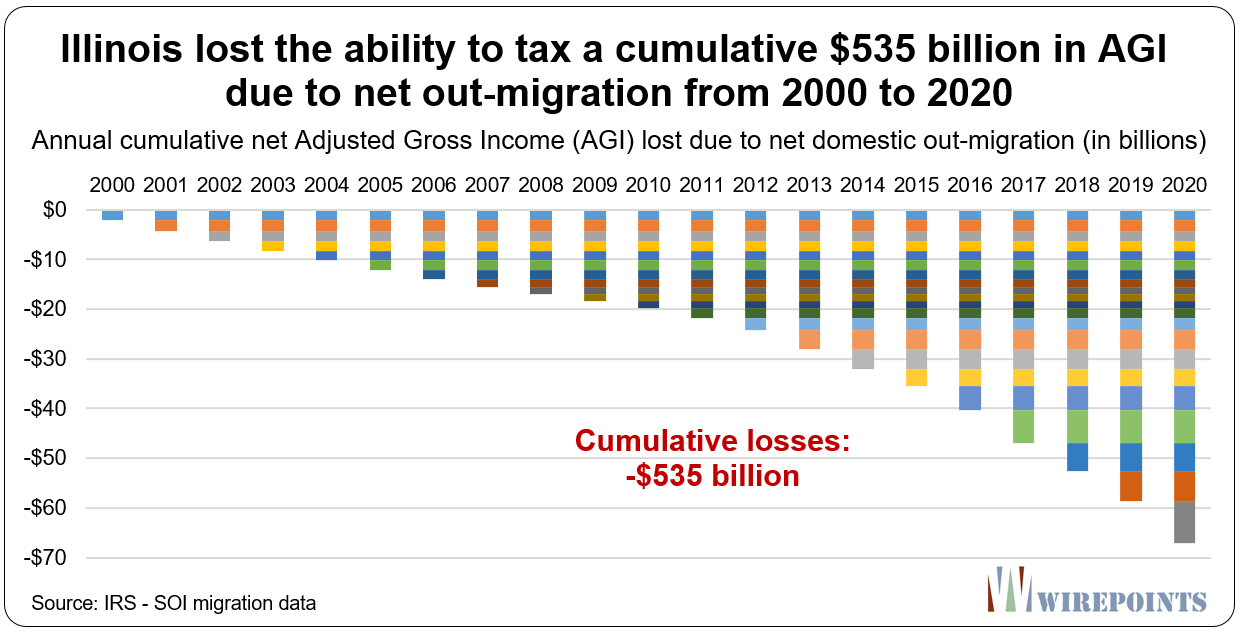

The problem with Illinois’ chronic outflows is that one year’s losses don’t only affect the tax base the year they leave, but they also hurt all subsequent years. The losses pile up on top of each other, year after year. And when you lose income to other states for 20 straight years, the numbers add up.

In 2020 alone, Illinois would have had $67 billion more in AGI to tax had it not been for the state’s string of yearly losses in income.

When Wirepoints adds up Illinois’ losses since 2000, it turns out Illinois has lost a cumulative $535 billion in AGI that it could have taxed over the 2000-2020 period.