We recently wrote about how Illinoisans are burdened by the nation’s highest effective property taxes. New research by ATTOM ranked Illinois residential property tax rates as number one in 2021, just ahead of New Jersey.

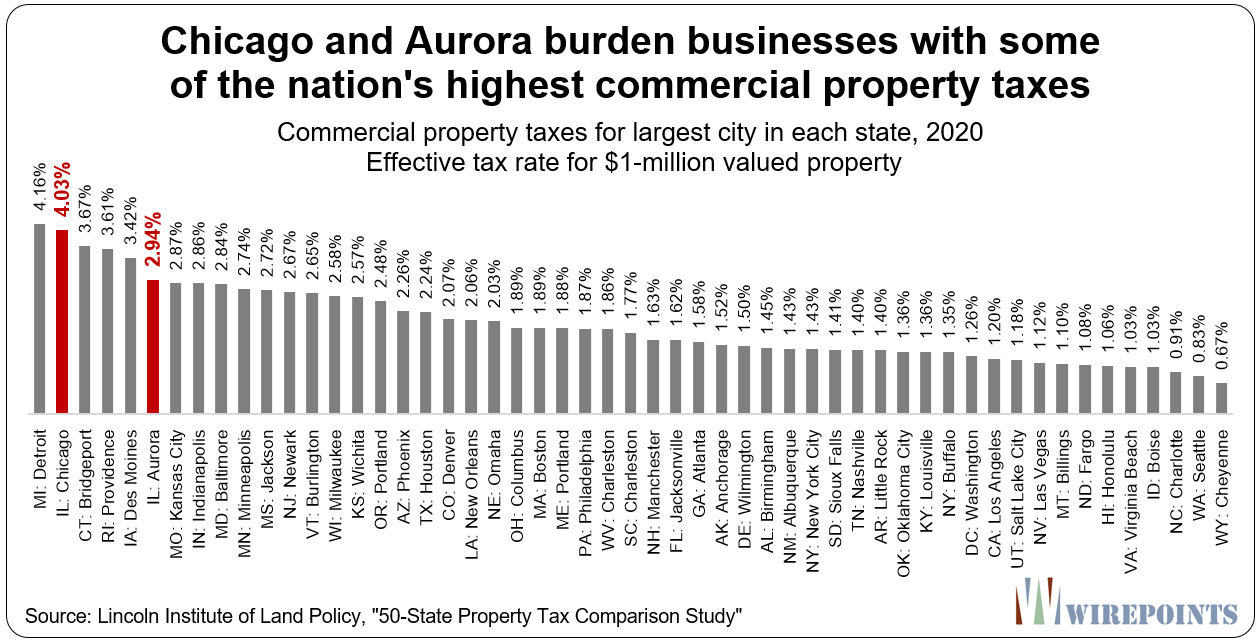

Residents aren’t alone. Illinois businesses are subject to the same level of overbearing taxes. A 2021 Lincoln Institute of Land Policy study measuring effective property taxes in the largest city in each state found that Chicago imposes the 2nd-highest commercial property taxes in the nation.

The study also calculated that Aurora, Illinois, the state’s second largest city, imposes the nation’s 6th-highest tax rate. (Illinois and New York had two cities in the study because the tax systems in Chicago and New York City are significantly different from what exists in their respective states.)

Combined, the two cities serve as a proxy for Illinois’ overall property tax burden on businesses.

Chicago’s effective tax rate in 2020 on commercial properties valued at $1 million was 4.03 percent, while Aurora’s was 2.94 percent. The average tax rate of the cities analyzed by the study was 1.95 percent.

Chicago and Aurora’s high national rankings remained almost constant regardless of whether the commercial properties analyzed were worth $100,000 (2nd and 5th), $1 million (2nd and 6th) or $25 million (2nd and 6th).

Chicago and Aurora’s high national rankings remained almost constant regardless of whether the commercial properties analyzed were worth $100,000 (2nd and 5th), $1 million (2nd and 6th) or $25 million (2nd and 6th).

Illinois can’t hope to attract many businesses here, or even keep the ones it has, as long as the property taxes remain a national outlier.

Not only do the sky-high taxes hurt companies’ bottom lines, but they also drive away residents – the customers businesses need to thrive. What company wants to be in a high tax state that’s losing people?

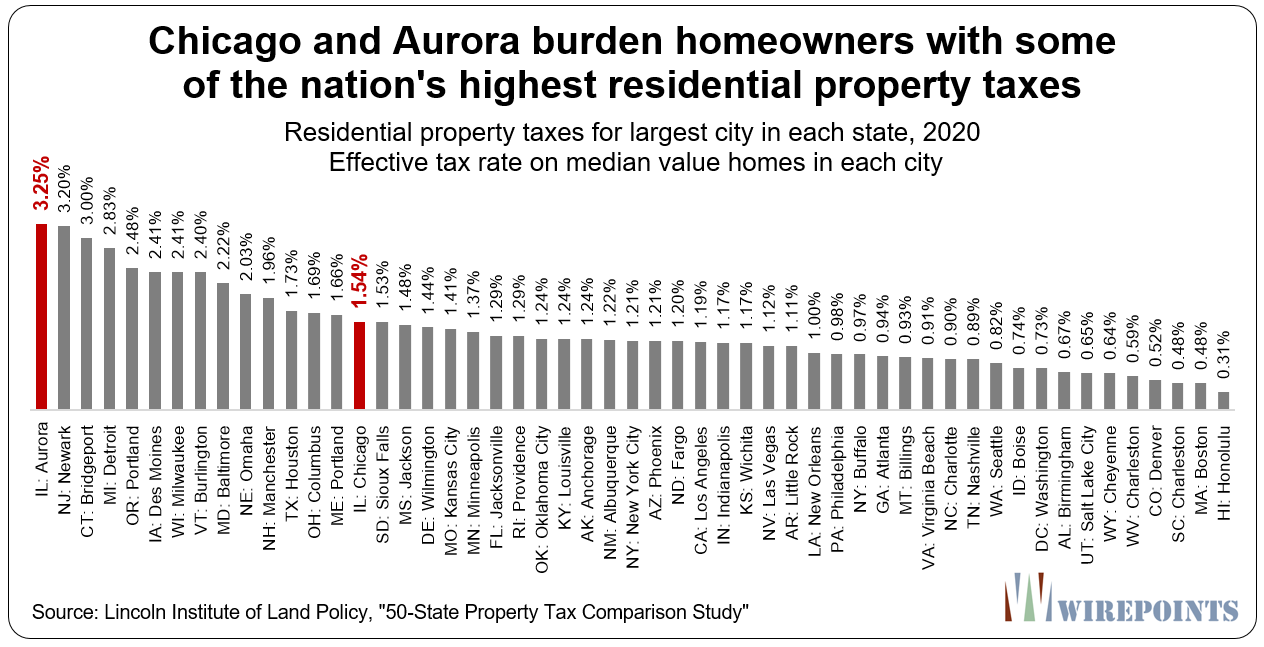

The Lincoln Institute study also found that Chicago and Aurora’s residential property taxes are, unsurprisingly, also high. Aurora hits its residents with an effective tax rate of 3.25 percent – the highest of the 53 big cities measured.

Chicago taxes are lower, but still high compared to most states. The Windy City hits its homeowners with a 1.54 percent rate, the 15th-highest of the cities measured. The average tax rate among all the cities was 1.34 percent.

Of course, there are many things that help determine the overall effective tax rate for a given city or state: a government’s overall reliance on property taxes versus other taxes; the overall value of home and commercial properties; whether a government spends a lot or a little relative to its peers; and how much of the property tax burden falls on commercial properties compared to homes.

Of course, there are many things that help determine the overall effective tax rate for a given city or state: a government’s overall reliance on property taxes versus other taxes; the overall value of home and commercial properties; whether a government spends a lot or a little relative to its peers; and how much of the property tax burden falls on commercial properties compared to homes.

Illinois politicians often claim property taxes are high because Illinois relies more heavily on property tax revenues compared to other states, but that defense doesn’t hold up. Illinois is a high-tax state, period.

Illinoisans now pay the nation’s 7th-highest combined state and local taxes, according to the latest state-by-state data released by the nonpartisan Tax Foundation. Other groups say the burden is even higher. Kiplinger says Illinois is the nation’s least tax friendly state for the middle class, and Wallethub calculates that Illinoisans pay the highest overall state and local tax burden in the country.

Taxes are high because Illinois is a high-spending state. A few of those higher costs include:

Taxes are high because Illinois is a high-spending state. A few of those higher costs include:

- Paying state workers the 2nd-highest average government salaries in the nation.

- Providing government pensioners, especially teachers, with some of the nation’s most generous retirement benefits.

- Paying for nearly 7,000 units of local government, the nation’s most, and the bureaucracies that go with them.

- Offering free retiree health insurance to state workers.

- Spending the 8th-most per student – and the most in the Midwest – on K-12 education.

- Granting government retirees 3 percent compounded COLAs, one of the nation’s most generous post-retirement benefits.

- Increased operating costs for local governments driven by some of the nation’s most union-friendly collective bargaining laws.

Some Illinois politicians say they want to bring property taxes down by capping property taxes or implementing spending freezes. But those ideas don’t actually address the cost drivers behind Illinois’ rising property taxes: skyrocketing pension costs, generous public sector benefits and too many units of local government.

There won’t be any significant drop in property taxes until pensions are reformed and public sector unions are stripped of their extreme bargaining powers.

If candidates on both sides of the aisle aren’t openly pushing for an amendment to the pension protection clause and subsequent pension reforms; if they’re not pushing for a roll back in the public sector union’s collective bargaining laws; and, if they’re not pushing to get rid of overlapping, duplicative local governments and the bloat that comes with them, then they’re not serious about bringing down your property taxes.