Gov. J.B. Pritzker may be celebrating the lower deficits his budget office just projected for the next five years, but Illinois’ latest “improvements” owe little to what he and the General Assembly have done since the governor took office. To the contrary, most of Pritzker’s recent actions have only served to increase the burden on ordinary Illinoisans going forward. We detail those actions later in this piece.

If the budget numbers look any better, it’s overwhelmingly due to the $182 billion in federal stimulus/COVID funds that have flooded into Illinois government coffers and private sector accounts.

Those billions are helping pump up state income and sales tax revenues in 2022, providing the state with $1.7 billion in additional revenues over what was projected for the year just a few months ago. Those higher revenues also serve to elevate the base by which future tax revenues are estimated, “allowing” the state to project significantly higher revenues and correspondingly lower deficits in future years.

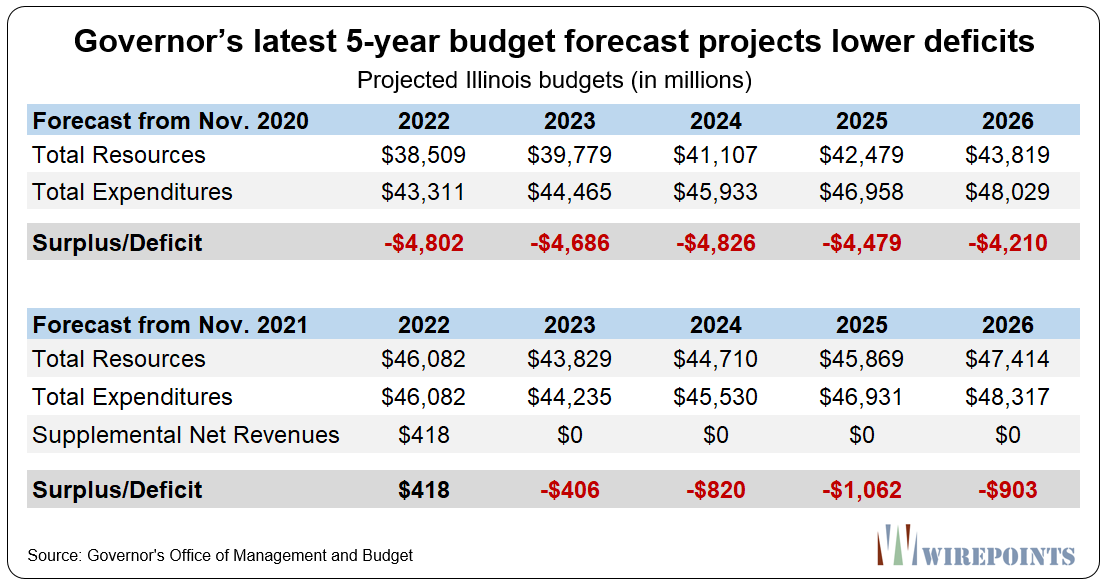

The result of all that is the Governor’s updated 5-year forecast that shows Illinois with a $480 million surplus for 2022 and yearly deficits of anywhere from $400 million to $1 billion over the next five years. Those deficits are far better than the ones projected last year, which had put the 2022 hole at $4.8 billion and the yearly shortfalls at more than $4 billion each last year.

Hence Pritzker’s celebratory comments regarding the GOMB release: “With our partners in the General Assembly we’ve made tremendous progress in putting Illinois on the right fiscal path, supporting small businesses, and creating good jobs in every part of our state.”

Hence Pritzker’s celebratory comments regarding the GOMB release: “With our partners in the General Assembly we’ve made tremendous progress in putting Illinois on the right fiscal path, supporting small businesses, and creating good jobs in every part of our state.”

The governor can say all that, but there is little evidence squaring up his rhetoric with what actually happened to the state’s finances. Below we break down the numbers that matter.

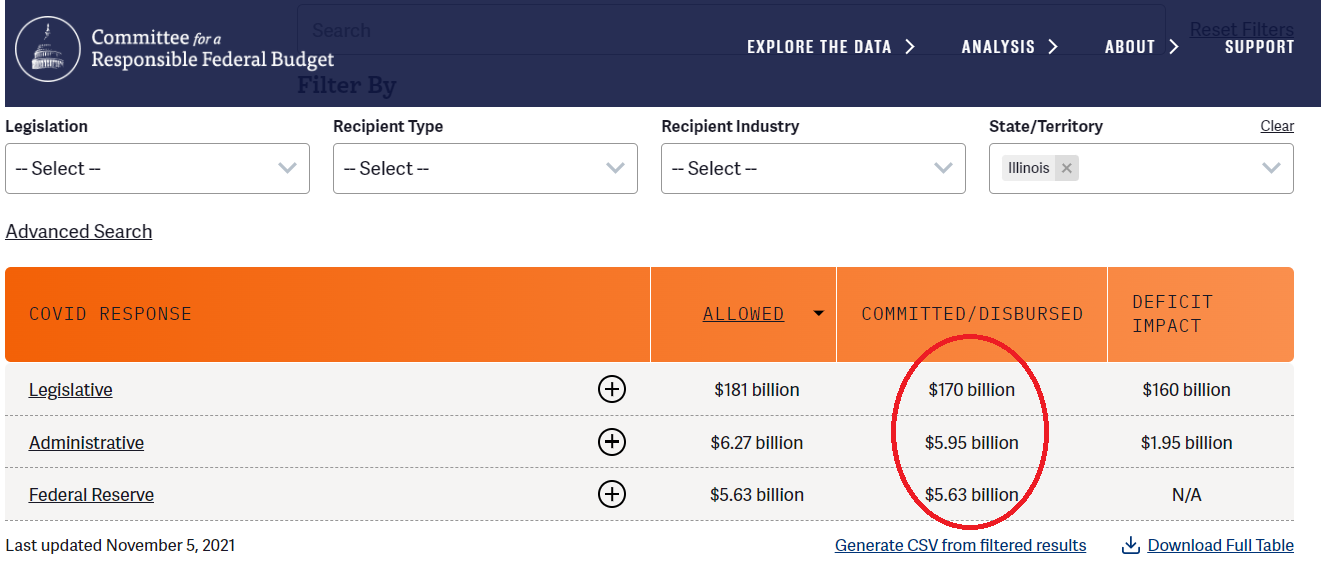

Illinois’ billions in stimulus

Spend a few minutes in the COVID Money Tracker, a website created by the bipartisan Committee for a Responsible Federal Budget, and you’ll see that $193 billion in COVID funds has been allocated from the federal government for Illinois, with $182 billion already committed/disbursed. In the site you can break that down by funds for the state, local governments, companies (e.g., paycheck protection), individuals (e.g., stimulus checks), and so on.

It’s those massive injections of federal funding that are responsible for the “improvement” in Illinois’ budget numbers. More cash in the hands of individuals and companies has helped spike income and sales tax revenues despite the massive job losses and business closures that resulted from Gov. Pritzker’s lockdowns and the general reaction to COVID.

It’s those massive injections of federal funding that are responsible for the “improvement” in Illinois’ budget numbers. More cash in the hands of individuals and companies has helped spike income and sales tax revenues despite the massive job losses and business closures that resulted from Gov. Pritzker’s lockdowns and the general reaction to COVID.

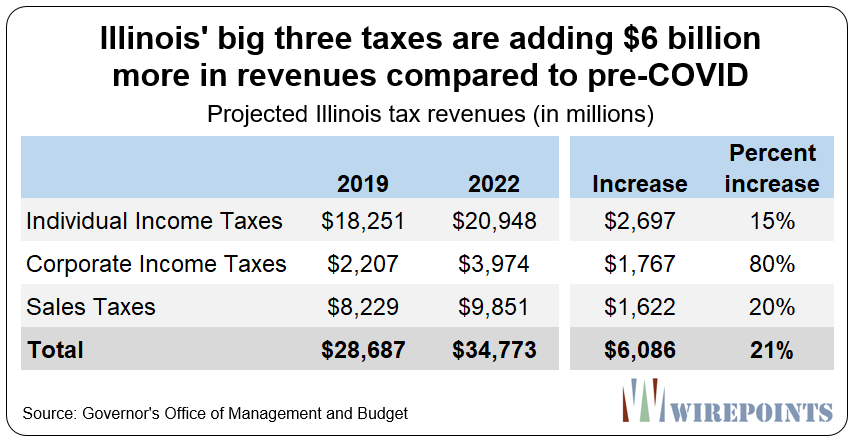

That jump in revenues can be seen by comparing Illinois’ 2022 tax collections to those of pre-COVID 2019. A collapse in the regular functioning of the economy has nevertheless resulted in a 15 percent increase in individual income taxes, an 80 percent increase in corporate taxes (50 percent increase when you back out the $650 million corporate tax hike passed in 2021) and a 20 percent increase in sales taxes. In all, the big three tax lines are adding $6 billion more in revenues compared to pre-COVID.

To reiterate, it’s the federal government’s stimulus, not the administration’s actions, that’s leading to the state’s sizable revenue improvement. And as we’ve seen with inflation, the federal government’s actions have had negative repercussions of their own.

Projecting off a bigger base

Projecting off a bigger base

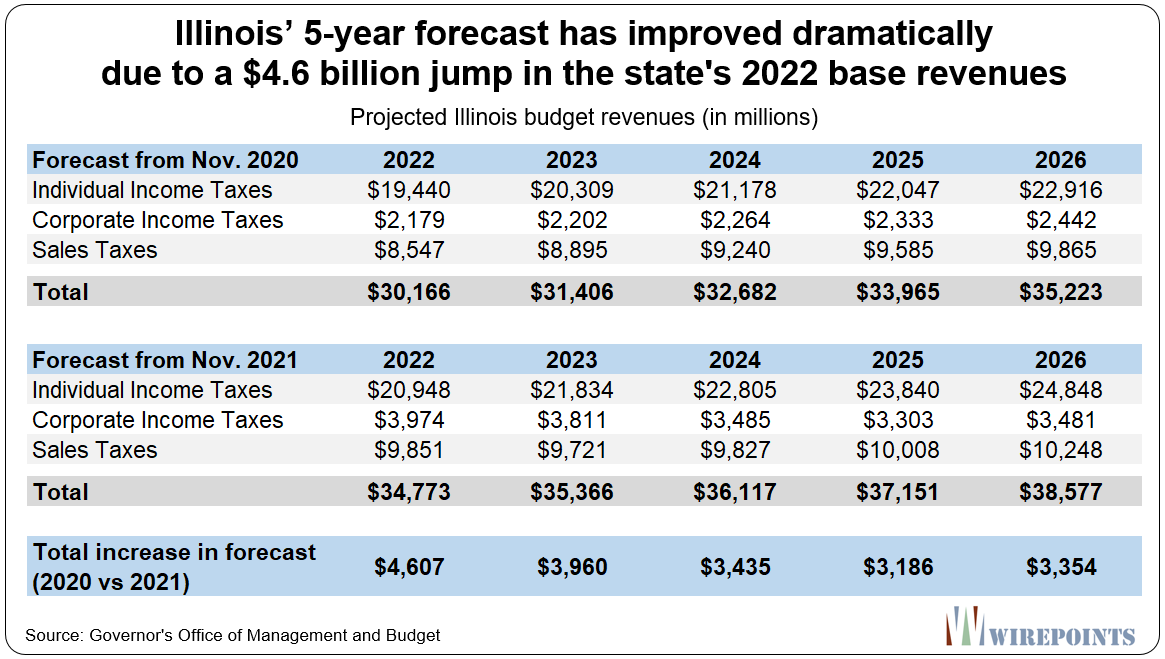

Another key reason that Illinois’ 5-year forecast has improved so dramatically is the state has increased the base on which it made its future revenue projections.

In November of 2020, the state based its 5-year projections off of a $30.2 billion revenue base (the sum of the big three income taxes: individual, corporate and sales). Now one year later, the starting revenue base has jumped to $33.8 billion, with the new projections growing from there.

The Pritzker budgeting team has simply increased the state’s starting point by $4 billion-plus, leading to quickly evaporating budget deficits.

It’s hard to predict if these increases in tax revenues will stick around or not – there’s a big risk that the massive increase in spending may cause the economy to come tumbling down. So you have to wonder, with the run-up to next year’s election, how much of this is just positive positioning to make the governor’s numbers look good?

It’s hard to predict if these increases in tax revenues will stick around or not – there’s a big risk that the massive increase in spending may cause the economy to come tumbling down. So you have to wonder, with the run-up to next year’s election, how much of this is just positive positioning to make the governor’s numbers look good?

Pritzker’s policies have made things worse

As mentioned above, Pritzker and the legislature have taken a few actions to boost state revenues. They hiked corporate taxes by $600 million, mainly by killing different tax deductions and depreciation rules. Sin taxes on cannabis and gambling have also been added or increased, along with a slew of other taxes that have been raised for capital spending – gas taxes, licensing fees, etc.

Only time will tell what impact those increases will have on the budget considering Illinois’ struggling economy, its already-uncompetitive business environment and its shrinking population.

Then there’s the additional damage that’s been done by a host of new laws passed by Pritzker and the General Assembly. Many increase government employment costs, pension costs and the general cost of doing business in Illinois. Here are just a few of those actions:

- Granting additional sick leave benefits to teachers

- Granting the Chicago Teachers Union additional bargaining powers

- Using taxpayer dollars to pick winners and losers in the EV industry

- Making Tier 2 benefits for local public safety more expensive

- Granting an expensive new contract to state AFSCME workers

- Restoring 6 percent salary spiking for Illinois teachers

- Expanding costs in healthcare by unionizing new workers

- Expanding Medicaid coverage to illegal immigrants

- Pushing a massive transformation of Illinois energy sector with incentives and subsidies

- Hiking Illinois’ minimum wage to $15 in the next few years

- And biggest of all, pushing a new ballot initiative that would cement union powers into the state constitution

The bottom line is that the state’ new projections aren’t due to effective financial management by the Pritzker administration. Any positives in the numbers are there despite the governor’s policies, not because of them.

Yes, the impacts of the federal government’s stimulus may stick around for a bit. But in the long term, nothing’s been done about pensions, property taxes or the increasing power of public sector unions. Those costs continue to rise unabated.

So expect Illinois’ fiscal cliff to get bigger and bigger once the federal money dries up.