(Editor's note: This article was published first at the Illinois Policy Institute).

Fiscal watchdog Truth in Accounting crunched the numbers for Illinois and gave the state an F grade in its latest Financial State of the States report. The report showed Illinois had just over $36 billion in assets available to pay bills totaling more than $272 billion, leaving the state needing $236 billion in additional assets to pay its bills.

Each Illinois taxpayer now owes a $57,000 share of that mounting debt, nearly double what it was just a dozen years ago in 2009. That means every Illinois taxpayer would have to send that much money to Springfield to eliminate the state’s debt burden on top of what he or she already pays just so the state could pay its bills. That amount represents a $5,000 increase from the fiscal year 2019 report despite Illinois receiving billions in federal relief money due to the coronavirus pandemic.

Truth in Accounting’s Research Director Bill Bergman noted the burden doubling over the past dozen years is concerning. “The beginning of that period was in the middle of the worst economic and financial crisis since the Great Depression and Illinois has only deteriorated since then despite the massive recovery in financial markets since 2009. That’s scary.”

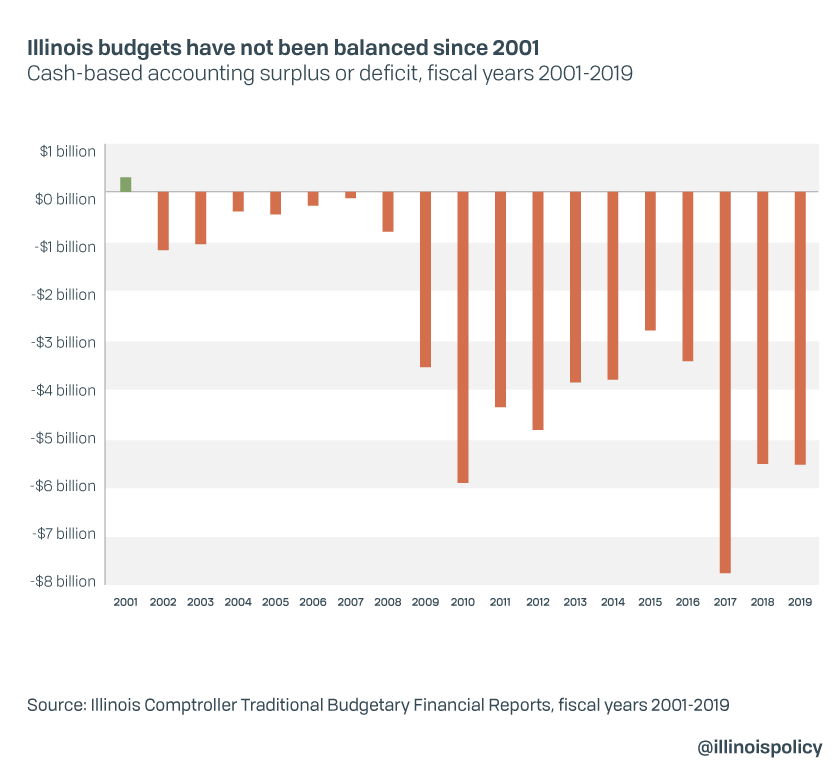

The state received more than $8 billion in flexible budgetary relief from the federal government along with billions of dollars more to cover pandemic-related expenses, but its financial condition continued to worsen over the past year. Total debt ballooned another $10 billion, mostly a result of increasing pension costs, which remain the key driver of the state’s failing fiscal health. Not even this unprecedented level of federal spending could help stabilize the state’s finances. Despite the billions in aid money, Illinois lawmakers passed another out-of-balance budget for fiscal year 2022, the 21st time they have done so since 2001.

Illinois isn’t the only state struggling with huge debts and high taxpayer burdens. The report noted just 11 states have a taxpayer surplus rather than burden. However, only taxpayers in struggling New Jersey and Connecticut faced higher taxpayer debt burdens than Illinois. Of the states that had deficits, Illinois’ debt per taxpayer burden is more than 3.5 times higher than the average of roughly $15,500.

Unfortunately, Illinois’ pension debt continues to rise. According to Moody’s Investors Service, it reached a record high of $317 billion in June 2020. Such massive debt is having great effects on the rest of the state. Illinois has one of the highest state and local tax burdens in the nation, crushing residents under increasing taxes that are going toward paying pension debts rather than paying for badly needed programs and services. Illinois also has the second-highest property taxes in the nation, leaving homeowners struggling to pay tax bills that are constantly increasing, yet still seeing cuts to core government services.

Kiplinger (a financial magazine) recently named Illinois the least tax-friendly state for middle-class families. The report names the state’s income, sales and property taxes as drivers of its status as a hostile state for middle-class families. Perhaps the only silver lining for Illinois is that neighboring Iowa, Wisconsin and Michigan all made the top 10 list as well. Unsurprisingly, seven of the states on Kiplinger’s list are also in the bottom half of the Financial State of the States report.

The high taxpayer debt burden in Illinois shows how serious the state’s debt problem has become and that the solution requires more than any bailout could provide. The only viable solution to turn the state’s fiscal future around is a comprehensive pension reform plan. The hold harmless plan proposed by the Illinois Policy Institute would preserve earned benefits but slow future growth in benefits for existing workers and retirees. This plan protects earned benefits, ensures future benefits will be stable, and saves the state $50 billion through 2045.

Lawmakers should allow Illinoisans to vote on a constitutional amendment for pension reform. Illinois has a problem with rising and unsustainable pension costs that are crushing the state and threatening the economic security of current and future generations. Pension reform is the only way for the state to secure a better, more prosperous future for all Illinoisans.