(Editor's note: This article was published first at Illinois Policy Institute).

Growing pension costs for retired educators and administrators are quickly crowding the classroom out of Illinois budgets.

Pension costs are crowding out direct education spending throughout Illinois school districts.

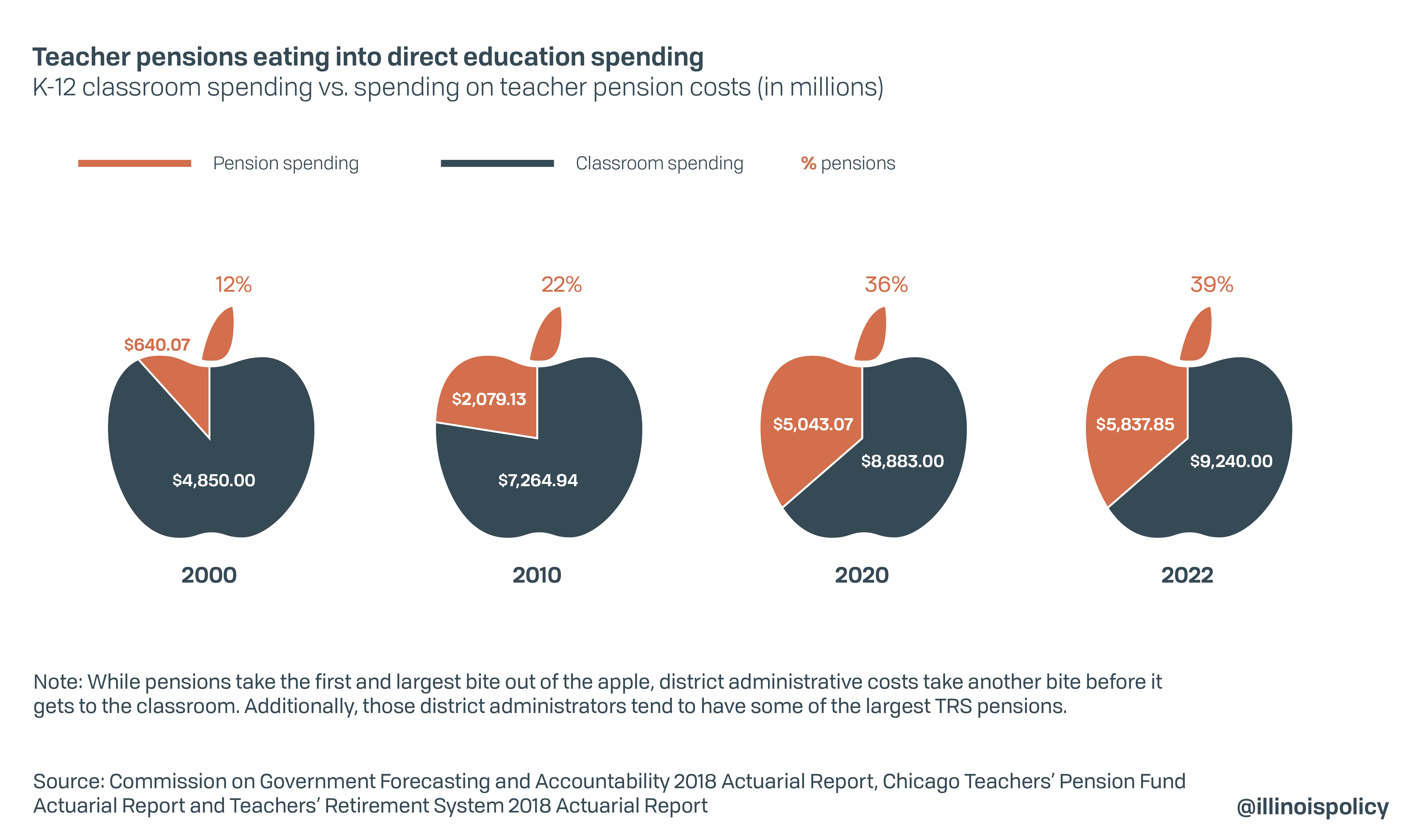

In the coming school year, 39% of the money the state allocates to education will be diverted away from teachers and students to meet required pension payments.

This represents a 458% increase in spending on teacher and administrator pensions since 2000, compared with a mere 17% increase in general education spending during that period, adjusted for inflation.

This massive growth in pension spending is especially concerning for younger teachers new to the workforce and parents with children enrolled in public schools whose needs will be delayed to make room for rising retirement costs.

Pensions aren’t the only thing crowding out student needs. Pensions take the first and largest bite out of the budget, then excessive administrative costs caused by Illinois’ overabundance of districts take another bite before any money actually gets to the classroom. Furthermore, district administrators tend to have some of the largest pensions with some collecting millions in retirement.

Since 2010 alone, spending on educators’ pensions more than doubled in nominal terms, jumping to nearly $6 billion in the 2022 budget from less than $2.1 billion. Education spending, including administrative costs, grew modestly to $9.2 billion from $7.3 billion.

Simply put, pension costs commanded just around 20% of the state’s total education spending only a decade ago, before doubling to nearly 40% of education spending today.

These growing costs take away dollars needed to operate local schools – especially poorer districts that rely heavily on state funding. This crowding-out effect is one reason pensions are a core driver of Illinoisans’ high property tax burden.

Without real pension reform, hundreds of schools across the state will continue to be forced to cut programs, increase class sizes, lay off teachers or hike property taxes as more and more new state dollars are directed away from classrooms and toward generous retirement benefits.