(This article was published first by the Illinois Policy Institute).

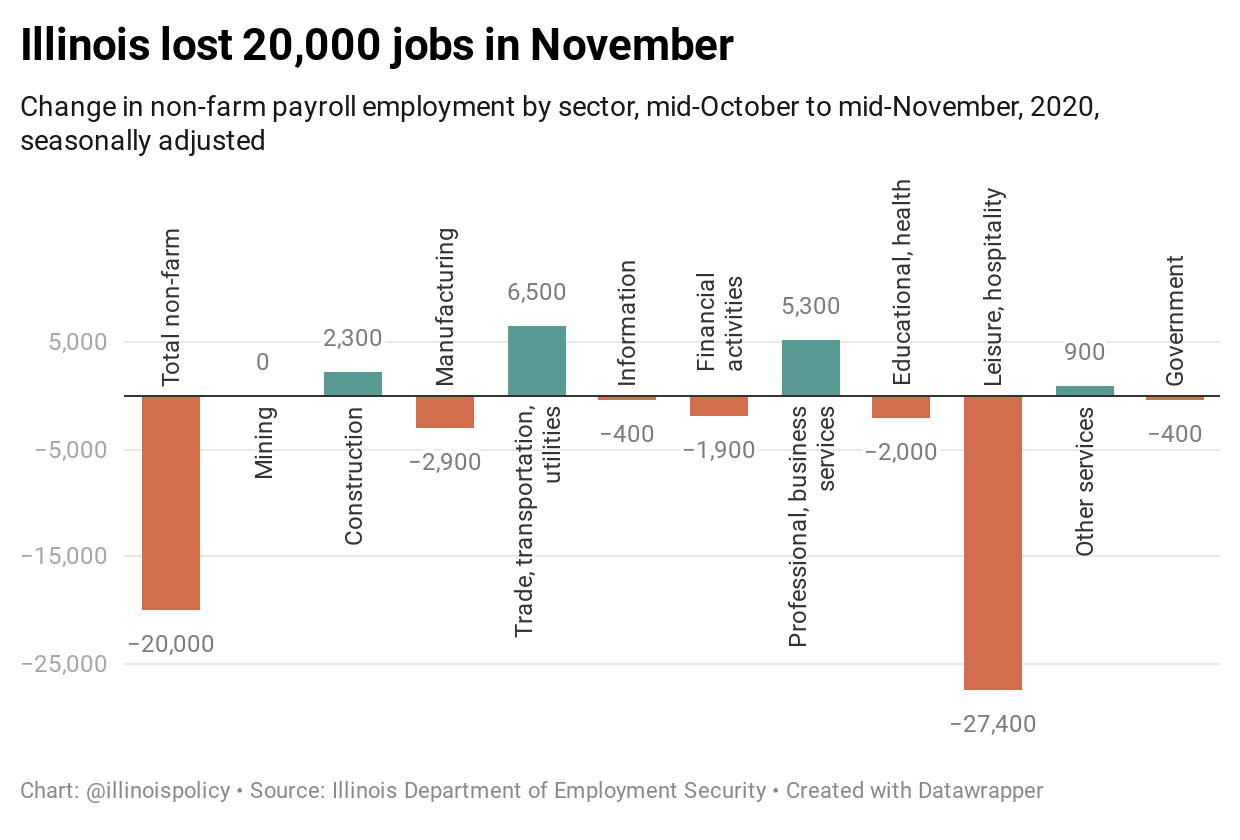

While the rest of the nation added jobs for the seventh consecutive month in November, Illinois lost 20,000 from mid-October to mid-November, according to data released Dec. 17 by the Illinois Department of Employment Security. This is the second time in the past three months Illinois shed jobs as the rest of the nation’s economy recovered.

The bulk of the losses came from the leisure and hospitality industry, which lost 27,400 jobs during the month. These losses come amid the statewide ban on indoor dining implemented by Gov. J.B. Pritzker, which took effect Nov. 4. It is likely the industry will continue to suffer jobs losses for the foreseeable future, as the ban remains in place and Illinois has since implemented further mitigation protocols that limit economic activity.

The manufacturing sector, which was also one of the most affected industries by mitigation protocols, also shed jobs, losing 2,900 jobs. Educational and health services lost 2,000 jobs; financial activities shed 1,900 jobs; while information sector jobs declined by 400, and government payrolls also shrank by 400.

Meanwhile, some job sectors continued their recovery in Illinois. Trade, transportation and utilities added 6,500 jobs; professional and business services grew payrolls by 5,300; construction jobs increased by 2,300; and other services added 900 jobs to payrolls.

While some industries have been able to extend their recovery, employment across all industries remains well below pre-pandemic levels. The Illinois recovery appears to be stalling as the state has been shedding jobs again in recent months. Illinois’ unemployment rate of 6.9% also remains above the national average of 6.7%, which is no surprise as the rest of the nation has enjoyed seven months of uninterrupted jobs growth during its recovery.

Although it looks like there may be some hope with a COVID-19 vaccine being dispersed throughout the state of Illinois, there is still a painful economic recovery ahead. Making matters worse for already-struggling businesses, Pritzker is continuing to pursue new taxes, even after voters soundly rejected his progressive income tax hike Nov. 3.

The governor has suggested he may now be in favor of raising the state’s flat income tax or closing “loopholes” to raise more revenue, although exactly which loopholes he is referring to remains unknown. As the state’s economy continues to struggle with the COVID-19 downturn – and to a much greater extent than the rest of the nation – it is imperative lawmakers work to avoid the harm to businesses and jobs that tax hikes would create.

Economists argue against raising taxes during a recession, so lawmakers now must reject Pritzker’s call for a 20% income tax hike on everyone to avoid damaging the jobs market even more.

Instead, Illinois can improve its fiscal situation and continue to provide core services mainly by implementing constitutional pension reform. There is also the additional possibility of the state receiving federal aid by reforming state finances, if congress adopts the Taxpayer Protection Act.

Rather than just throwing more money at pension debt and deficits, constitutional pension reform and the Taxpayer Protection Act would offer overburdened Illinois taxpayers a path to declining debt, lower taxes, more effective state government and a more sustainable recovery.