(Editor's note: This article was first published by the Illinois Policy Institute).

Illinois voters soundly rejected income tax hikes as a strategy to fix the state’s financial problems on Election Day, with nearly 55% saying “no” to the so-called “fair tax” amendment.

Lawmakers should now turn their attention to reforming the state’s worst-in-the-nation pension crisis. The only realistic path to balancing Illinois’ budget while protecting programs for the state’s most vulnerable residents starts with a constitutional amendment to allow pension reform.

Instead, Gov. J.B. Pritzker now warns he will look to some combination of “painful” cuts and tax hikes on everyone. All program spending, including core government services, could face up to 15% across-the-board cuts. He’s also considering supporting a hike in the flat tax by up to 20%.

Pritzker should abandon both of these crude deficit-closing strategies and pursue better available alternatives.

‘Fair tax’ fallout

The progressive tax amendment, Pritzker’s signature policy proposal, would have scrapped the flat tax protection from the state constitution in favor of new taxing powers that allow lawmakers to divide the population into segments and charge varying rates based on income. Pritzker has touted income tax increases as a strategy for closing Illinois’ long-running budget deficit since his campaign for governor in 2018.

However, the $3 billion haul expected from an initial set of rates raising taxes on income earners making more than $250,000 would have fallen far short of what would be needed to close Illinois’ fiscal gap. Progressive income tax powers combined with Illinois’ growing deficit and debts would have opened the door to tax increases on the middle class and seniors’ retirement income.

During his daily COVID-19 briefing after voters rejected the “fair tax,” Pritzker suggested he would pursue “painful” cuts to core government services as well as income tax hikes on all taxpayers as deficit-closing strategies. Pritzker did not mention alternatives, such as pension reform or other structural spending reforms to the largest cost-drivers of the state budget.

Asking Illinoisans to pay more in taxes to receive less in services and provide less support for families in need has been the trend in state government for the past decade, driven by the ever-growing cost of Illinois’ worst-in-the-nation pension crisis. Largely as a result, Illinois lost population for six consecutive years due to outmigration and saw the nation’s worst population loss over the last decade.

Springfield should not ignore the clear message Illinois voters sent when they decisively rejected the statewide “fair tax” referendum: further tax hikes are the wrong strategy to balance the budget. Moreover, indiscriminate cuts to public safety and education would deprive vulnerable residents of services they rely on and threaten to further derail Illinois’ weak economic recovery from the COVID-19 recession.

Instead of doubling down on the same failed strategies that gave Illinois the nation’s lowest credit rating, Springfield should send Illinois voters a pension amendment to fix the root cause of the state’s overspending. The Illinois Policy Institute’s budget plan, “Illinois Forward: A 5-year plan for balanced budgets, declining debt, and tax relief,” presents a comprehensive path to fixing the state’s finances while protecting both taxpayers and residents who rely on essential government services.

Fixing the pension crisis is key to avoiding painful cuts to core services

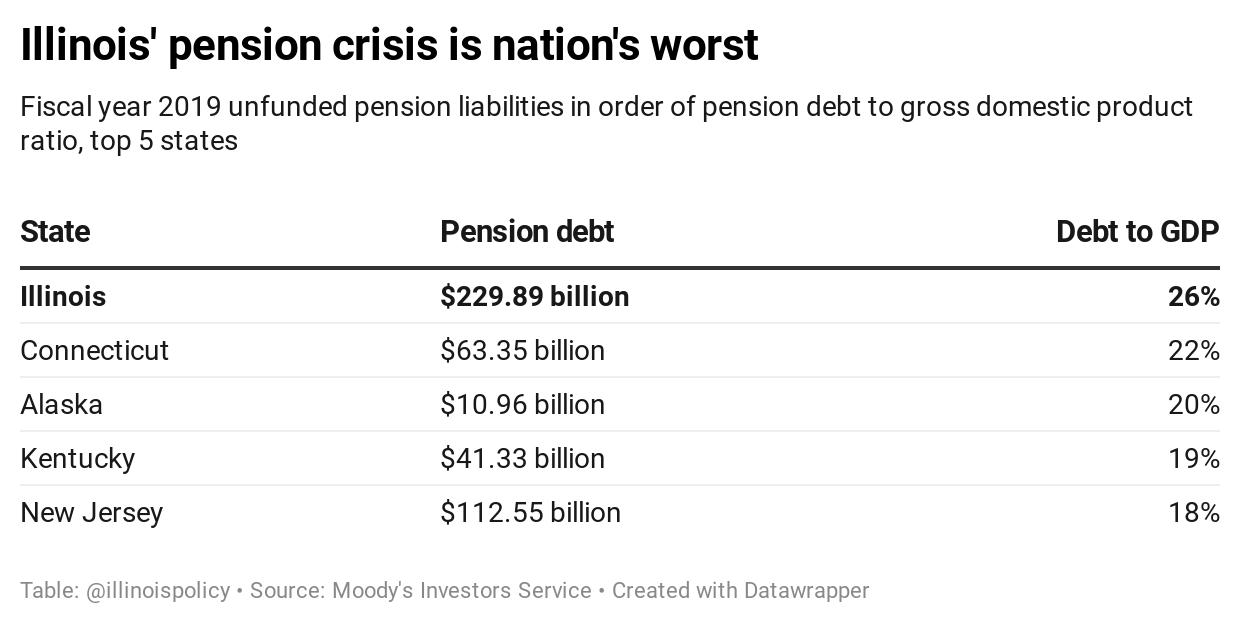

Illinois’ pension crisis is the worst in the nation when compared to the size of its economy.

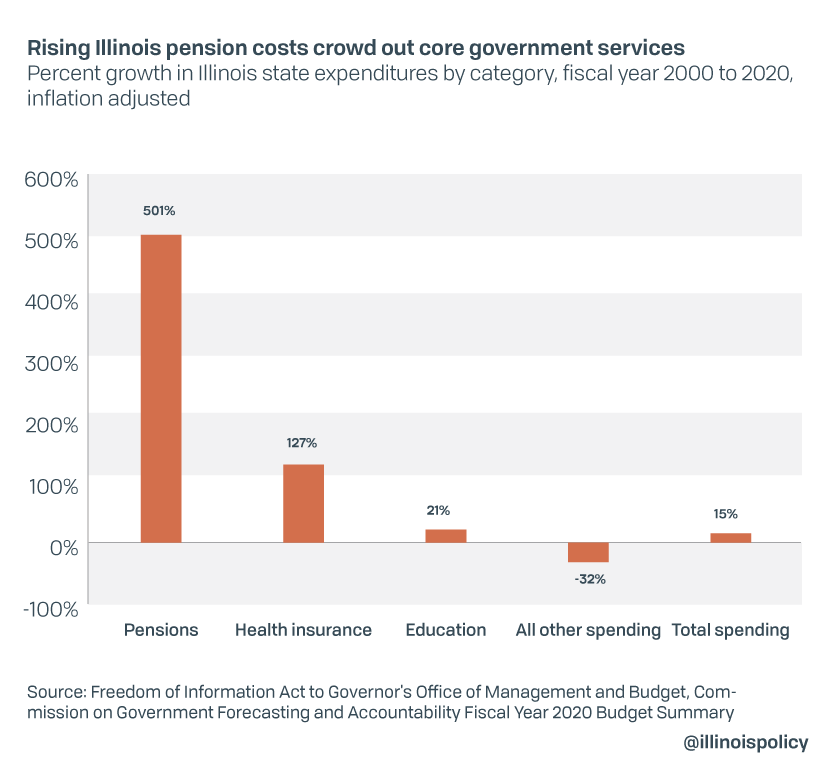

Attempts to keep up with this unsustainable debt burden without reform have already caused disinvestment in higher education, public safety, public health programs, and vital services for the poor and vulnerable. Since fiscal year 2000, a 501% increase in inflation-adjusted pension spending was accompanied by a nearly one-third decline in spending on a range of core services.

Crowd out of spending on services will worsen without reform. Pensions were previously projected to consume just under $11 billion of next year’s budget. Those costs will be even larger in the wake of investment losses owing to COVID-19 related market volatility. One of Illinois’ five state pension systems, the Teacher’s Retirement System, recently announced a $310 million increase in costs over prior projections.

“If you set aside federally protected programs, court- ordered obligations and our bond and pension debt, we would have to reduce discretionary spending in our state by approximately 15% [to balance the budget],” Pritzker said according to CBS 2 Chicago. He did not provide a reason why pension reform should be “set aside” as a deficit-closing strategy.

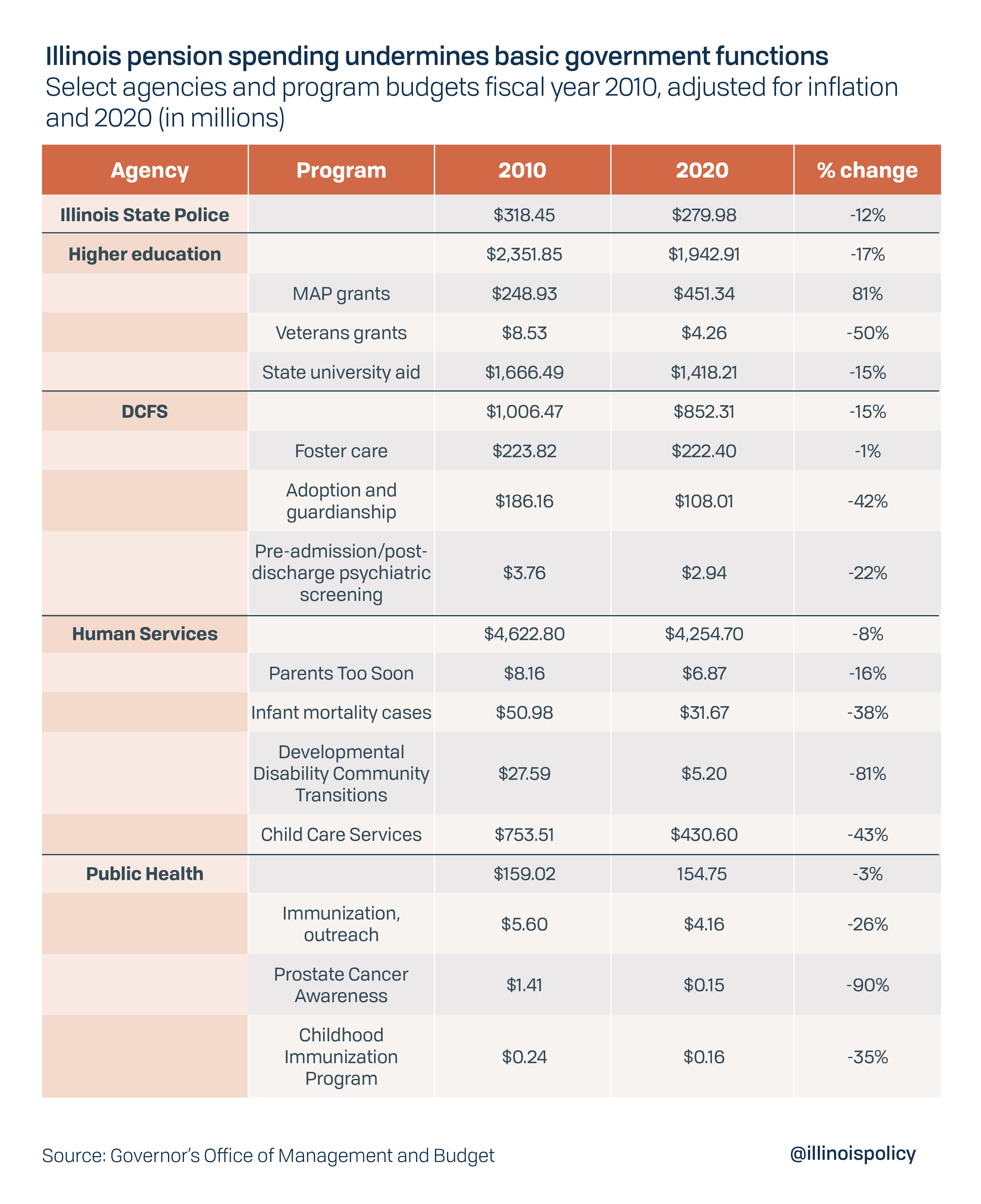

“That’s 15% fewer state troopers. That’s 15% fewer students going to college. Fifteen percent fewer working parents, receiving Child Care Assistance and 15% less money for your local public schools, which likely means that your property taxes will increase,” Pritzker continued.

Many of the programs hardest hit by pension crowd-out over the past decade overlap with areas Pritzker is now warning may be targeted for further cuts, including public safety and various family and parenting services.

Ultimately, balancing Illinois’ budget in the wake of the COVID-19 recession is likely to require some cuts in the operating budget. The Governor’s Office of Management and Budget estimated the budget deficit for the current fiscal year 2021 at $7.4 billion without the $1.2 billion in first-year revenue from the progressive tax. The governor must propose a balanced budget for the coming fiscal year 2022 in February and will face a deficit of similarly historic magnitude.

But any budget cuts should be made with a scalpel, not a hatchet, approach, prioritizing spending on the most efficient and vital programs.

The Budgeting for Results initiative was created in 2010 and intended to create a “results-based” budgeting process, where measurements of program performance and outcomes are used to make spending decisions. Unfortunately, Illinois lawmakers have largely ignored program results data and continued to make spending decisions using a “line item” approach, which uses the prior year’s spending as a baseline for yearly increases without a systematic way of measuring effectiveness.

The nonpartisan Pew Charitable Trusts has recommended results-based budgeting as a strategy for prioritizing scarce resources during the pandemic and making strategic budget cuts to balance public budgets amid declining revenues.

A constitutional amendment to allow pension reform that preserves workers’ earned benefits and allows for changes in unaccrued benefits such as 3% compounding automatic annual benefit increases would make the system more sustainable and make pensions more secure. A “hold harmless” pension reform plan developed by the Illinois Policy Institute would save the state roughly $2.4 billion the first year and more than $50 billion through 2045, while fully eliminating the debt over that time.

Pension reform would ensure Illinois’ scarce resources are invested in programs Illinoisans need most during the pandemic and in spending that delivers the best return on investment for taxpayers. Any program cuts should be targeted at inefficient or less immediately vital programs, rather than using a 15% across-the-board approach.

Hiking flat tax 20% means doubling down on an already failed strategy to fix state finances

Asked if he would now push for lawmakers to hike the the flat income tax on everyone, Pritzker responded that “everything’s on the table.”

Income tax hikes are the wrong way to attempt to balance Illinois’ budget. Voters clearly rejected income tax hikes when they said “no” to the governor’s “fair tax” proposal. Moreover, recent income tax hikes failed to improve state finances while harming Illinois’ economy.

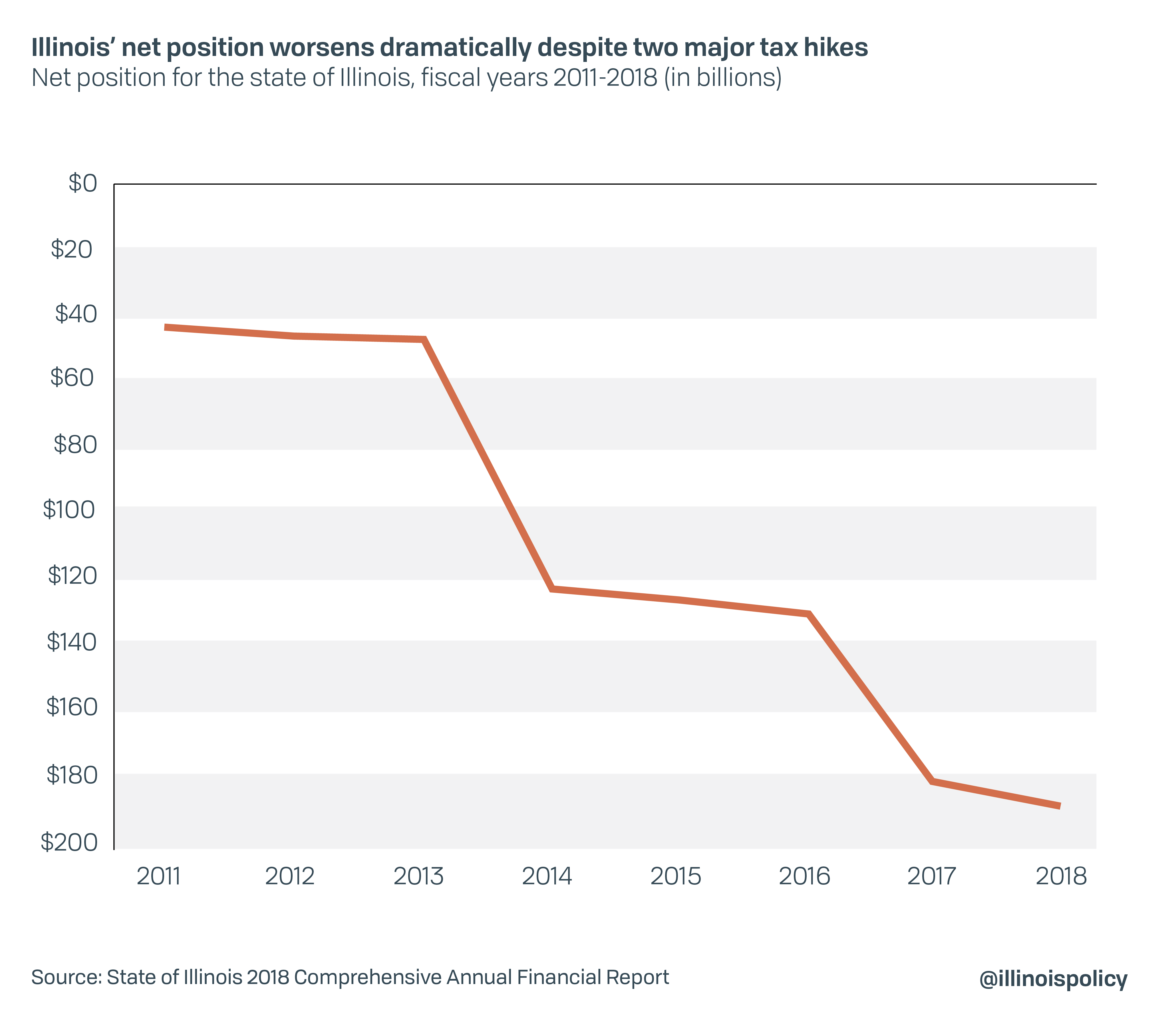

From 2011 to 2018, Illinois’ net debt quadrupled to nearly $190 billion despite a major income tax hike that brought in $37.4 billion in additional revenue from fiscal year 2011 to 2017 and was made permanent thereafter.

Meanwhile, these tax increases have driven Illinois’ total state and local tax burden to one of the highest in the nation. Illinois Policy Institute analysis found the 2011 state income tax hike cost the state economy $55.8 billion in gross domestic product, along with 9,300 jobs over four years.

Residents are voting with their feet, heading to states with lower taxes and better managed finances.

Illinois has lost population for six years running, driven primarily by adults in their prime working years leaving for other states. The most common reason residents give for wanting to leave is the high tax burden, according to public opinion polling conducted for NPR and the University of Illinois-Springfield. Analysis from the Illinois Policy Institute has uncovered a weak housing market and poor job opportunities as other core causes of the exodus, which are linked to the tax burden.

Lt. Gov. Julianna Stratton, the second ranking member of Pritzker’s administration, previously warned the administration would “consider raising income taxes on all Illinois residents by at least 20%, regardless of their level of income” if the “fair tax” failed at the ballot box.

However, Stratton also admitted the harms of hiking taxes in an already high-tax state, saying, “We all know that our middle- and lower-income families cannot withstand a 20% tax increase and it will only serve to deepen the dramatic inequities that we already see across the state. It will drive out our residents and it will drive out investment in Illinois.”

Those harms are real and should be enough reason for Pritzker to take income tax hikes off the table.

Pritzker must fix Illinois finances without tax hikes or borrowing

Pritzker was right when he said, “Illinois’ fiscal problems haven’t gone away. We now sit at a crossroads. Our state finances still require fundamental structural change.” He articulated worthy goals for himself as governor, “I promised to be a governor who balances the budget and pays the bills that my predecessor left behind. I promised to make sure that our kids get a good education that we invest in job creation and that we build a better future for Illinois.”

But the only path to fixing Illinois’ finances through structural change and achieving Pritzker’s other stated goals begins with constitutional pension reform, which Pritzker has opposed to date.

Credit ratings agencies have been clear that reliance on budget gimmicks and one-time measures will be looked at unfavorably and could cause a formal downgrade to non-investment grade, or “junk” status. That means Pritzker and the General Assembly cannot build a budget strategy entirely around additional short term borrowing from the Federal Reserve or a potential federal bailout, as they did for the fiscal year 2021 budget.

In June, Illinois became the first and only state to borrow from the Fed’s new Municipal Liquidity Facility, issuing $1.2 billion in debt to cover operating expenses in the fiscal year 2020 budget. The fiscal year 2021 budget Pritzker signed in May authorized up to $5 billion in additional lending authority from the Fed. But a reliance on further borrowing will not stop Illinois from becoming the nation’s first junk-rated state. Investors are already treating Illinois’ bonds like junk, according to Barron’s.

“We are looking to see to what extent Illinois addresses its budget gap through recurring measures rather than just relying on borrowing or other one time sources,” S&P Global Ratings lead Illinois analyst, Carol Spain, said in an interview with Bond Buyer.

S&P warned in 2019 that a “practical reduction” in pension liabilities might be the only way for Illinois to avoid a junk credit rating. That can only be accomplished through a constitutional amendment.

The state may also need near-term assistance from the federal government to help cover revenues lost to COVID-19 economic fallout. But blank check bailouts will inevitably flow to debt and pensions, not services, and harm Illinois’ finances by giving cover for further delay of needed reforms. U.S. Rep. Darin LaHood’s Taxpayer Protection Act offers an alternative, providing state and local governments with forgivable loans contingent on pension reform and sound budget practices.

Under the Taxpayer Protection Act, Illinois would initially be eligible for an estimated maximum of nearly $3.1 billion in aid. That aid should be combined with pension reform, targeted budget cuts using outcome metrics, and other structural spending measures such as reducing administrative bloat in education.

For decades, Illinois has asked its taxpayers to pay more in income and property taxes to receive less in services. That was the status quo rejected by voters in the “fair tax” referendum. Rather than promising more of the same, Pritzker should commit to pension reform and structural changes that can balance Illinois’ budget while respecting taxpayers.