(Editor's note: This article was originally published at Illinois Policy Institute).

Lt. Gov. Julianna Stratton, the second-ranking member of Gov. J.B. Pritzker’s administration, said Sept. 24 that to adequately address the state’s budget crisis, “lawmakers will be forced to consider raising income taxes on all Illinois residents by at least 20%, regardless of their level of income.”

The warning came during an online “fair tax virtual rally” hosted by the Vote Yes For Fairness Committee, the political organization backing the progressive income tax amendment which Pritzker has funded to the tune of $56.5 million.

Stratton apparently intended for the comment to pressure voters into passing the progressive tax on the Nov. 3 ballot. Then on Sept. 25 Pritzker expanded on the threat, saying there either would be a 20% income tax hike or a 15% cut in state spending, “which would significantly reduce education funding at the state level.”

But Illinois has better options than massive tax hikes or holding schoolchildren hostage. Structural spending reforms to public pensions and to other drivers of overspending would actually fix state finances, rather than Pritzker trying to tax his way out of a spending hole that keeps getting bigger. Pritzker has ignored or blocked those reforms and relied on the same false choice narrative since his first-year budget address.

More money won’t fix things: S&P Global Ratings on Sept. 21 made it clear that Illinois faces a 5% budget gap even if the progressive tax were to pass. That is despite a 1.8% growth in tax revenue between fiscal year 2019 and 2020, ranking Illinois No. 5 in the nation and beating the average of a 5.5% decline.

The Chicago Tribune’s editorial board hit Pritzker and Stratton for the threats and doubted they could muster enough state lawmaker votes for a tax hike.

“But the threat alone suggests that voters are pushing back against his proposed constitutional amendment, understanding it for what it is: Not just a tax increase on the super-rich but a scheme of graduated rates that politicians likely will exploit – just as soon as they can – to soak middle-class taxpayers, too.”

The progressive tax, also called the “fair tax” by its supporters, would eliminate the 1970 Illinois Constitution’s flat tax protection that ensures no one’s taxes are hiked unless everyone’s taxes are hiked. The protection is intended to make state lawmakers cautious because raising taxes creates voter backlash.

The change would grant permanent new taxing authority to Illinois politicians, making it easier for them to raise taxes on everyone, one group at a time – including opening the door to a retirement tax. Research from the non-partisan Illinois Policy Institute has found the progressive tax would hike taxes on more than 100,000 small businesses and kill at least 56,000 jobs under the initial rates passed by the Illinois General Assembly.

But as the Tribune stated, no one expects state lawmakers to stop at the initial rates. The last state to pass a progressive tax, Connecticut in 1996, hiked taxes on the middle class 13% despite initial promises lawmakers only wanted to tax the rich.

Stratton admitted the harms of hiking taxes in an already high-tax state, saying, “We all know that our middle- and lower-income families cannot withstand a 20% tax increase and it will only serve to deepen the dramatic inequities that we already see across the state. It will drive out our residents and it will drive out investment in Illinois.” While this is true, the lieutenant governor seemed to be saying the administration’s revenue demands would be more important than these harms.

This admission is a break with past rhetoric from the administration, which has sought to sell its progressive income tax hike plan as a way to lower taxes for the working poor and middle class. However, these claims were always lacking important context and often based on inaccurate information.

The amendment does nothing to lower Illinois’ second-highest in the nation property taxes. It would leave the poorest Illinoisans paying the third-highest overall tax burden in the nation, $1,800, while gaining barely enough of a break for a fast food meal.

Working-class families were already disproportionately harmed by doubled gas taxes and hiked vehicle registration fees when Pritzker signed off on 20 new or higher taxes and fees in his first year. A typical suburban family could end up paying $1,700 more in vehicle-related taxes after those hikes.

The Pritzker’s administration’s budget crisis is largely of its own making.

The governor in June signed a budget that increased spending by $2.4 billion over last year despite significantly lower expected revenues resulting from the pandemic. He refused to even discuss canceling or postponing pay raises for state workers that cost taxpayers $261 million. That budget has a $6 billion deficit. It relies on $5 billion from a non-existent federal bailout or additional borrowing, as well as more than $1 billion from the progressive tax hike voters have not approved.

Pritzker previously warned of 5% cuts to state government during the current budget year if he does not receive a federal bailout, calling those cuts a “nightmare scenario.” He did not offer a new superlative for his new threat of a 15% cut if he doesn’t get his “fair tax.”

Progressive tax powers would give state leaders a “divide and conquer” ability without the threat of voters punishing them at the next election. Lawmakers fear that ability: about 30% were forced to retire or were voted out of office after the 2017 tax hike passed.

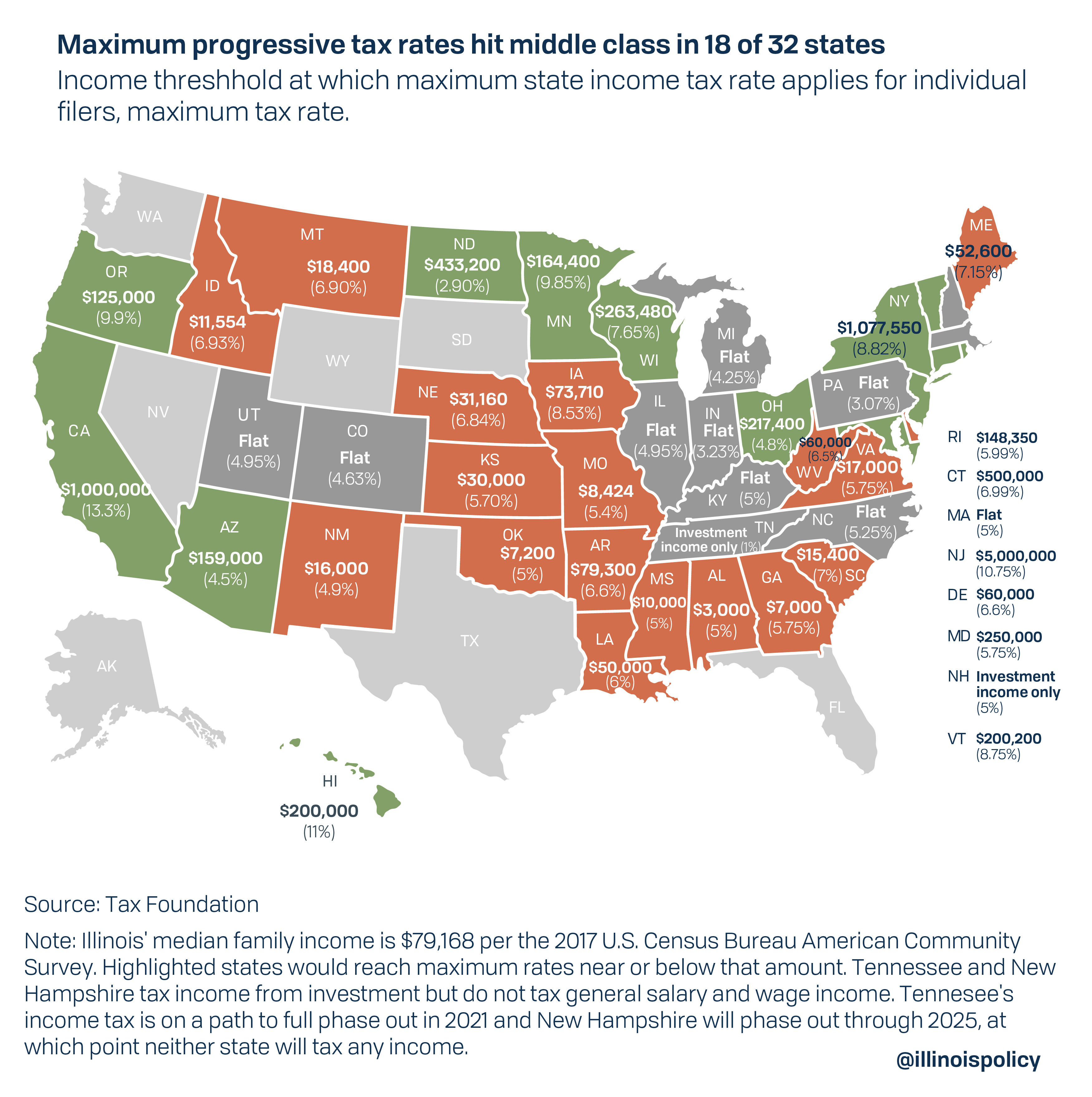

Progressive tax states make it easier for politicians to target the middle class to raise revenue. In fact, 18 of 32 states with a progressive income tax hit the middle class with the same maximum tax rate paid by millionaires.

Every state with a progressive tax also taxes retirement income.

Rather than threatening further tax hikes or essential service cuts if they don’t get their way, Illinois lawmakers should look to reforms that fix spending, not that fix taxing.

A recent report from the Illinois Policy Institute, “Illinois Forward,” details the history of the state’s self-made financial crisis as well as commonsense reforms to fully fund public pensions, balance budgets, reduce debt and lower everyone’s taxes over time.

Pritzker and other “fair tax” backers should stop standing in the way of needed reforms and stop trying to scare taxpayers into granting them permanent new taxing power.

Adam Schuster is the senior director of budget and tax research at the Illinois Policy Institute.