As COVID-19 cases rose in March, Illinois Gov. J.B. Pritzker issued stay-at-home orders to try to mitigate the spread of the virus. As a result of the shuttering of businesses and a pandemic-induced drop in consumer demand, Illinois’ economy has cratered.

Two months after the statewide shutdown, new research shows the state’s economy has experienced unprecedented damage.

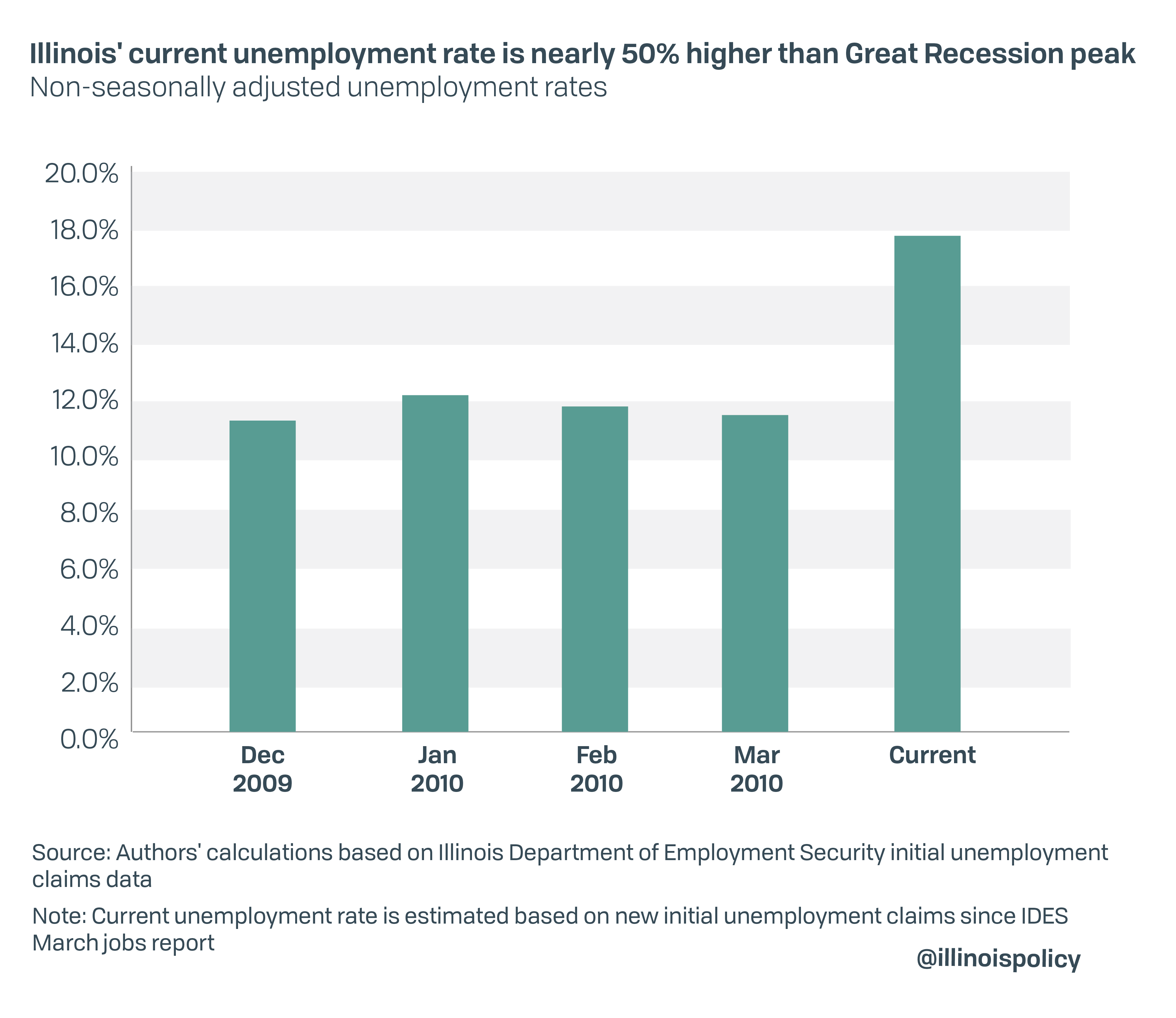

The state’s unemployment rate is nearly 18% – around 50% higher than the worst months of the Great Recession.

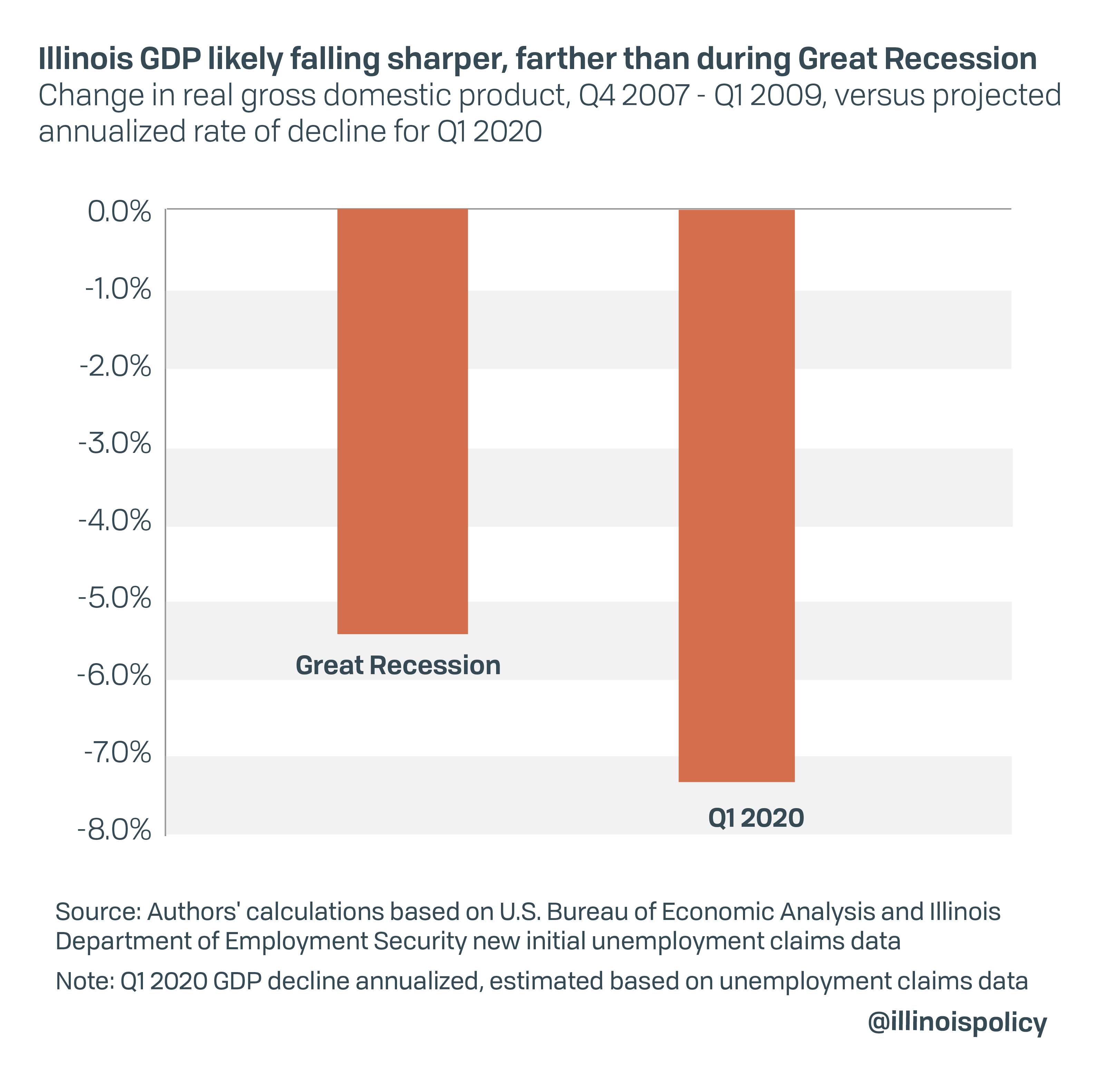

Meanwhile, the Illinois Policy Institute estimates that Illinois’ gross domestic product shrank by 7.4% on an annualized basis, bringing the current economic cost to more than $183 million each day.

For context, during the worst period of the Great Recession, economic activity was 5.5% lower than at the previous peak in December 2007. Unfortunately, fiscal mismanagement resulted in an anemic Illinois recovery with real gross domestic product growing at an average annual rate of only 1.29% since the trough of the Great Recession in June 2009.

Illinois lawmakers must avoid repeating the mistakes they made following the last recession if there is to be a strong recovery. That begins with removing another economically harmful income tax hike – the third in the past decade – from the November ballot.

Illinois unemployment soars, real GDP plummets due to COVID-19 fallout

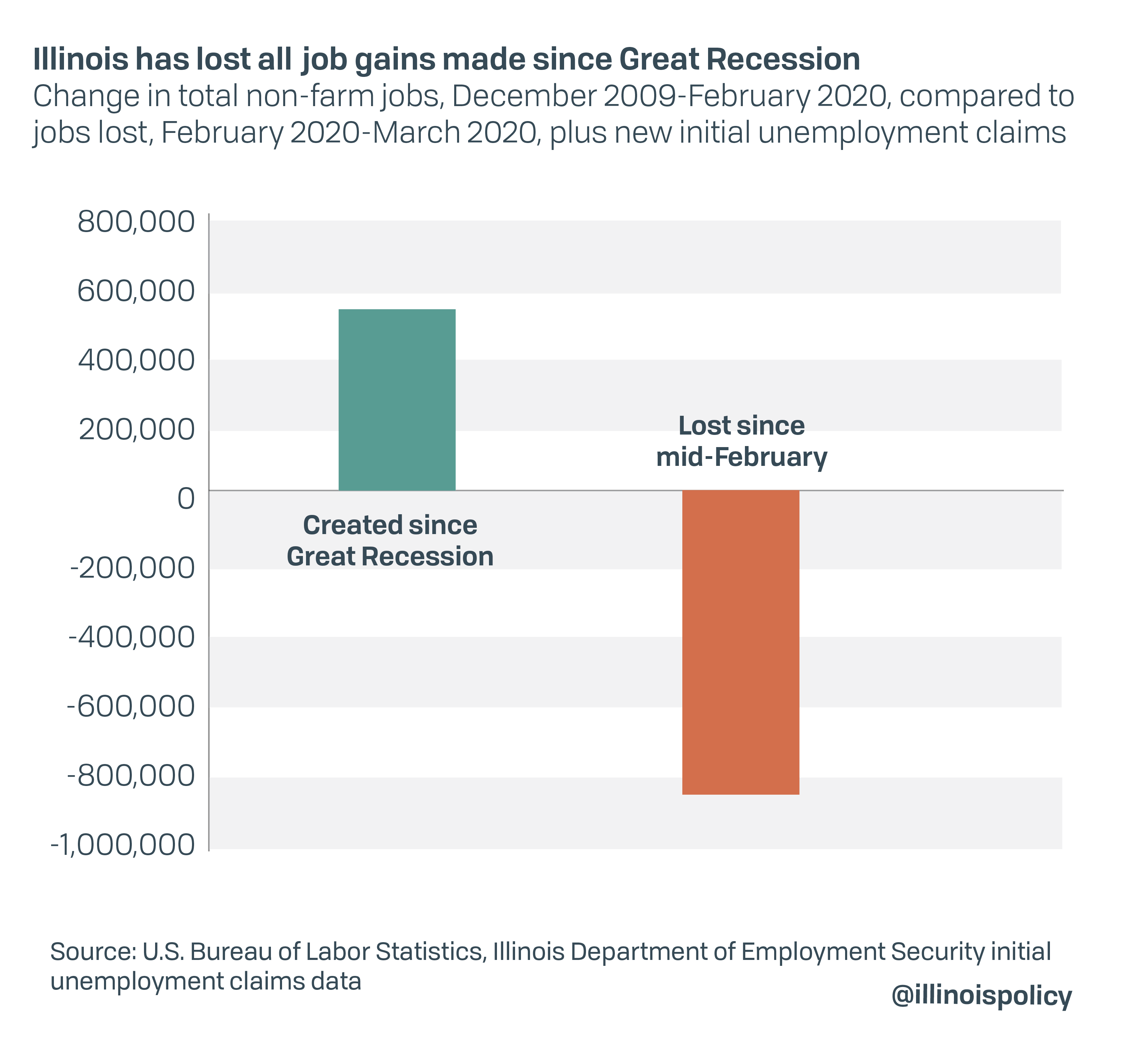

Since the Illinois Department of Employment Security’s last monthly update, more than 819,000 Illinoisans have filed initial unemployment claims. This is likely an underestimate, as gig economy workers, independent contractors and freelancers are not allowed to file for unemployment in Illinois until May 11, seven weeks after Pritzker first issued a stay-at-home order.

Economists have long argued that initial unemployment claims are good predictors of changes in employment levels, and changes in employment can help predict the extent of the economic damage.

Based on these empirical observations, the Illinois Policy Institute estimates Illinois’ real gross economic output declined in the first quarter by 7.4% on an annualized basis.

During the Great Recession, Illinois’ real GDP fell 5.5% over a five-quarter period, meaning the current decline is likely far more severe.

The current decline in economic output represents more than $183 million per day.

GDP represents the total dollar value of all goods and services produced over a specific time period. In short, it’s everything produced by people and businesses, including salaries of workers. Changes in real GDP are closely related to changes in living standards. A decline in real GDP means many Illinoisans will find it increasingly difficult to make ends meet. Many families will struggle to keep up on their rent, mortgage and credit card payments. It also means the risk of default has increased for many families and businesses.

The decline in economic activity has wiped out all of the jobs created in Illinois since the end the Great Recession.

Fortunately, most business closures have been temporary, but many business owners fear that if the lockdowns continue, they will have to close permanently. If economic activity does not return to levels observed before many states implemented stay-at-home orders, nearly 85% of U.S. restaurant owners expect to be closed permanently. That number falls slightly to 78% for personal service firms, 73% for firms in tourism and lodging and 65% for firms in the arts and entertainment. This is because most small businesses have less than two months of cash on hand while the median small enterprise has more than $10,000 in monthly bills and less than one month of cash on hand.

Nearly 1.5 million Illinoisans are at risk of losing their jobs because of COVID-19 and the associated lockdown. Illinois shed 34,100 jobs from mid-February to mid-March, and since then 819,268 Illinoisans have filed new unemployment claims, bringing the state’s estimated real-time unemployment rate to nearly 18%.

For context, Illinois’ unemployment rate – not seasonally adjusted – peaked at 12.2% during the Great Recession.

Despite the mounting costs of Illinois’ plunging economic activity, Gov. J.B. Pritzker has extended the statewide lockdown until May 30. The outline for reopening released May 5 provided some framework for what to expect, but for many workers and small businesses it’s just another extension of Pritzker’s stay-at-home order with no clear dates.

Household decisions and business investments depend on expectations about the duration of the lockdown. Those remain frozen by uncertainty.

Promoting a safe and robust economic recovery

The Illinois economic recovery will depend on many factors. Most importantly, workers must feel confident it will be safe to return to work. Consumer confidence must also return to pre-COVID-19 levels.

In addition, it will rely on alleviating state policy uncertainty by eliminating the prospect of tax hikes – especially a progressive income tax that would raise taxes by up to 47% on small businesses that survive the lockdown.

Research shows a sequential lift of the stay-at-home orders is the best way to mitigate both the human cost and the economic damage caused by COVID-19.

Illinois families cannot afford to be out of work for an extended period of time. Many are still waiting to have their unemployment claims processed and have little to no savings to feed their families or cover other expenses. Other countries and other U.S. states are beginning to phase in the re-opening of their economies.

Business and consumer confidence are a cheap form of stimulus. Pritzker now has an outline of a plan, but Illinoisans need it to be more detailed for it to provide the certainty needed to make economic decisions.