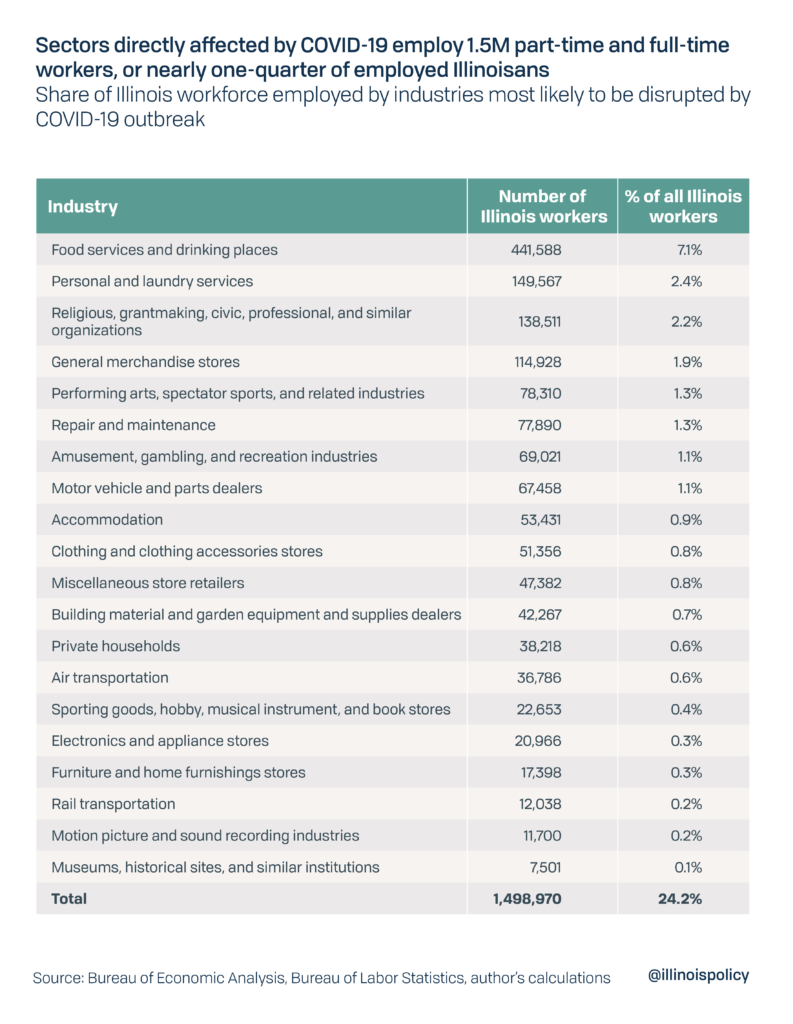

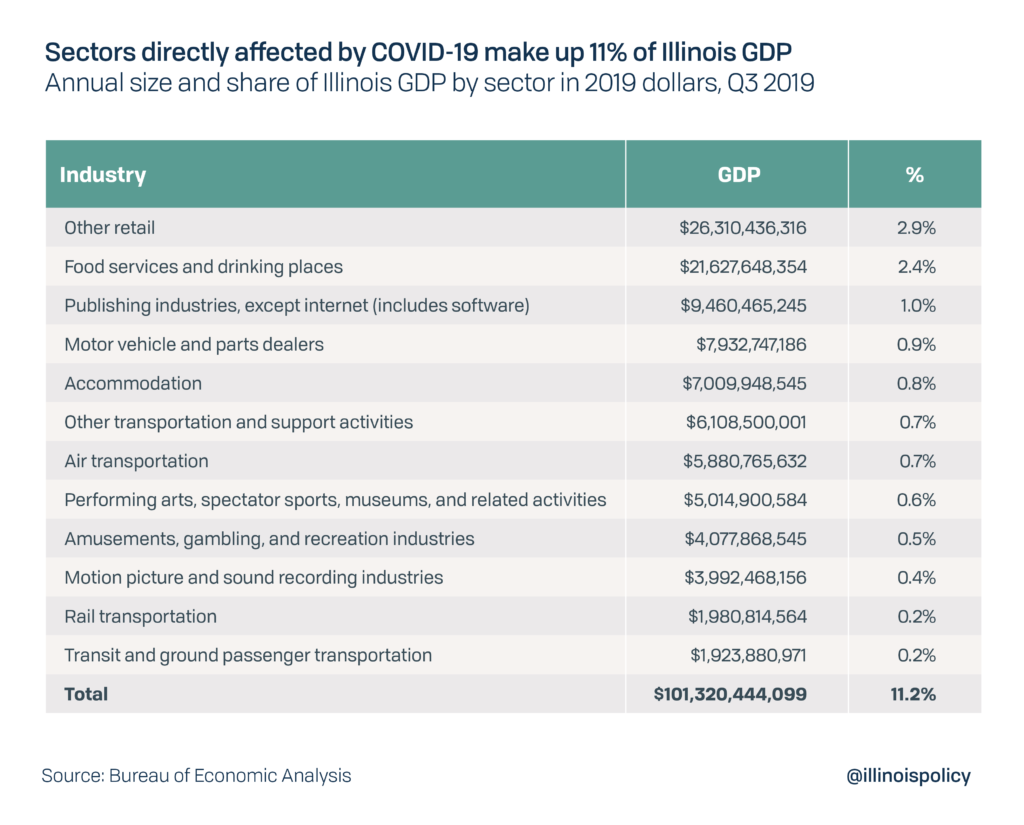

The industries most threatened by the COVID-19 outbreak, mostly service industries that are contact-intensive and those that haven’t been designated as essential, employ nearly 1.5 million Illinoisans – 24% of the workforce – and generate $100 billion in annual economic activity.

As the virus spreads and measures are taken to combat it, these Illinoisans are increasingly likely to lose their jobs and the state is more likely to lose a substantial segment of the economy.

Those who work in these industries are also the most vulnerable to the financial strains the virus is putting on families. They tend to have lower incomes, are already experiencing mass layoffs and have the most constrained budgets.

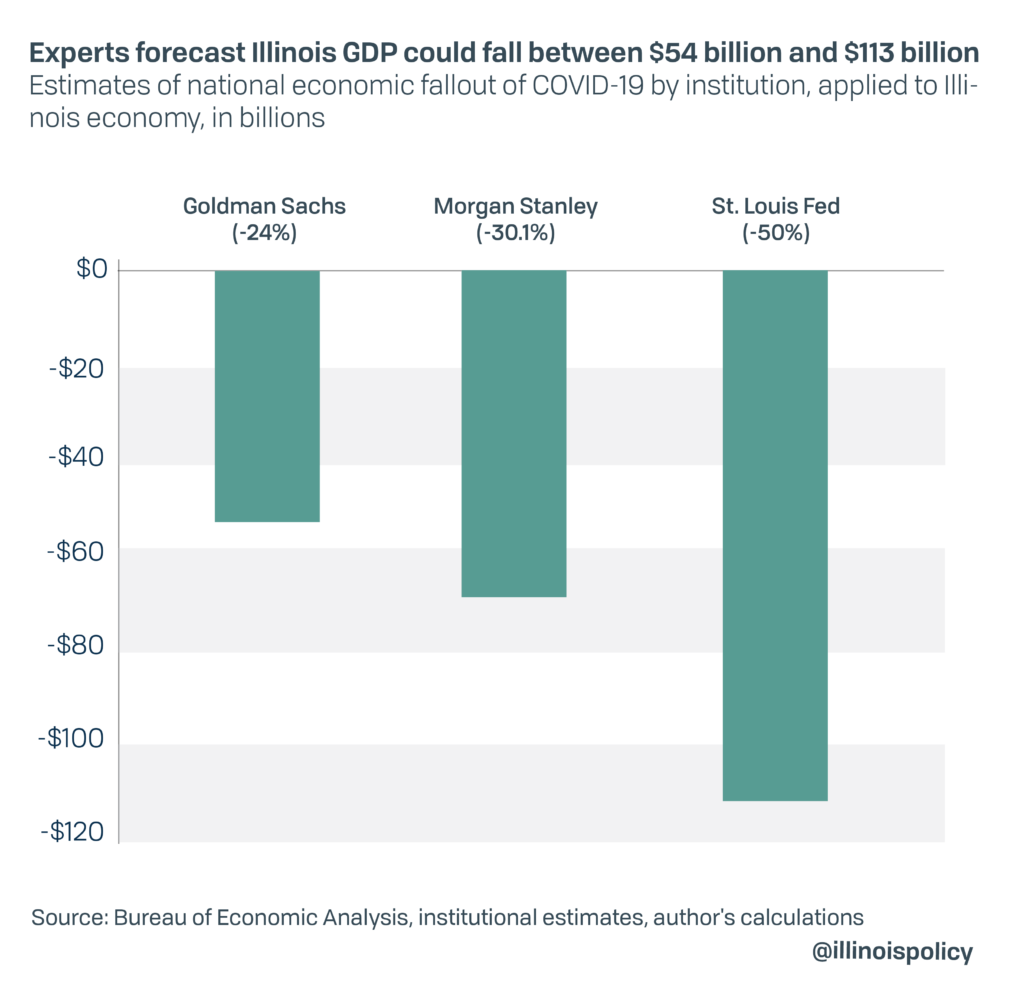

While it remains to be seen how long this downturn will last, experts are predicting at least through the current quarter. Economists are predicting a decline in gross domestic product of anywhere from 24-50% and an unemployment rate around 30%. For Illinois, these projections would mean the state’s economy would shrink by between $54 billion and $113 billion, however the contraction could be much larger if the crisis persists beyond June.

The cost of coronavirus

The economic fallout from the COVID-19 virus is anticipated to be the sharpest downturn in national history, with estimates of a contraction ranging from 24% to 50% by the end of the second quarter 2020. These forecasts are mostly based on the 40% contraction in Chinese gross domestic product during the past three months. The Wall Street consensus is that U.S. gross domestic product will shrink anywhere between 24% and 30% in Q2 2020, while the Federal Reserve Bank of St. Louis President James Bullard forecasted a 50% drop in GDP as the national unemployment rate moves to 30%.

For context, the only double-digit percentage decline in real GDP in recorded U.S. history was the Great Depression, when economic output fell by 26.3% from August 1929 to March 1933.

Meanwhile, the Illinois economy contracted 5.25% during the Great Recession during an 18-month period. A decline similar to the Great Recession in Illinois’ economy today would represent a $47.4 billion contraction in the economy.

While attempting to predict the magnitude of the current downturn is difficult, the low-end Wall Street estimates would be a $54 billion retraction in Illinois’ economy – which currently has a GDP of approximately $902 billion – and at the high end, the figure would be more than $113 billion. However, these forecasts rely on the economic recovery beginning in the third quarter of 2020.

If the downturn is prolonged, the contraction will be much more severe. Based on current forecasts, if the downturn and containment measures last a full year until March 2021, the total economic cost to Illinois could range from $216 billion to $451 billion.

As governments continue to struggle to contain the spread of the virus, economic activity will continue to be dampened, and many Illinoisans will find themselves without work.

Industries most affected by COVID-19

During the outbreak, contact-intensive services sectors will be the most negatively affected as individuals are required to stay at home to avoid spreading the virus. As the lockdown continues, the negative impact is likely to spread to the manufacturing sector, the financial sector and other non-services sectors.

The industries most susceptible to disruption by COVID-19 employ nearly 1.5 million Illinoisans – or 24% of the state’s workforce. All are at risk of losing their jobs or facing reduced hours.

These industries generate more than $100 billion in annual economic activity, or more than 11% of the state’s GDP. Note that these sectors are grouped slightly differently than the employment data because of reporting differences but reflect the same parts of the economy.

As more people lose their jobs, families are likely to struggle to cover their monthly bills, and households in deeper debt will become more likely to default on their loans. Low-income households will be most negatively affected by the outbreak and measures taken to contain it. Not only do these families face more constrained budgets, they also tend to work in the industries most susceptible to the downturn, and are already experiencing layoffs.

The health care and social assistance industry, which is a $65 billion industry in Illinois, will certainly be impacted by the virus but the extent is difficult to gauge. Former medical professionals are being asked to rejoin the workforce to combat the virus, while many specialists are not working as elective procedures are postponed. While elective procedures make up the bulk of revenues for many hospitals, the net economic impact, especially with a potential ramp-up of government spending, is hard to predict with any accuracy.

Industries directly affected by the emergency response

While combatting the public health crisis posed by COVID-19 has rightfully been the top priority of public officials, it is important to note the ramifications of these measures on the state’s economy.

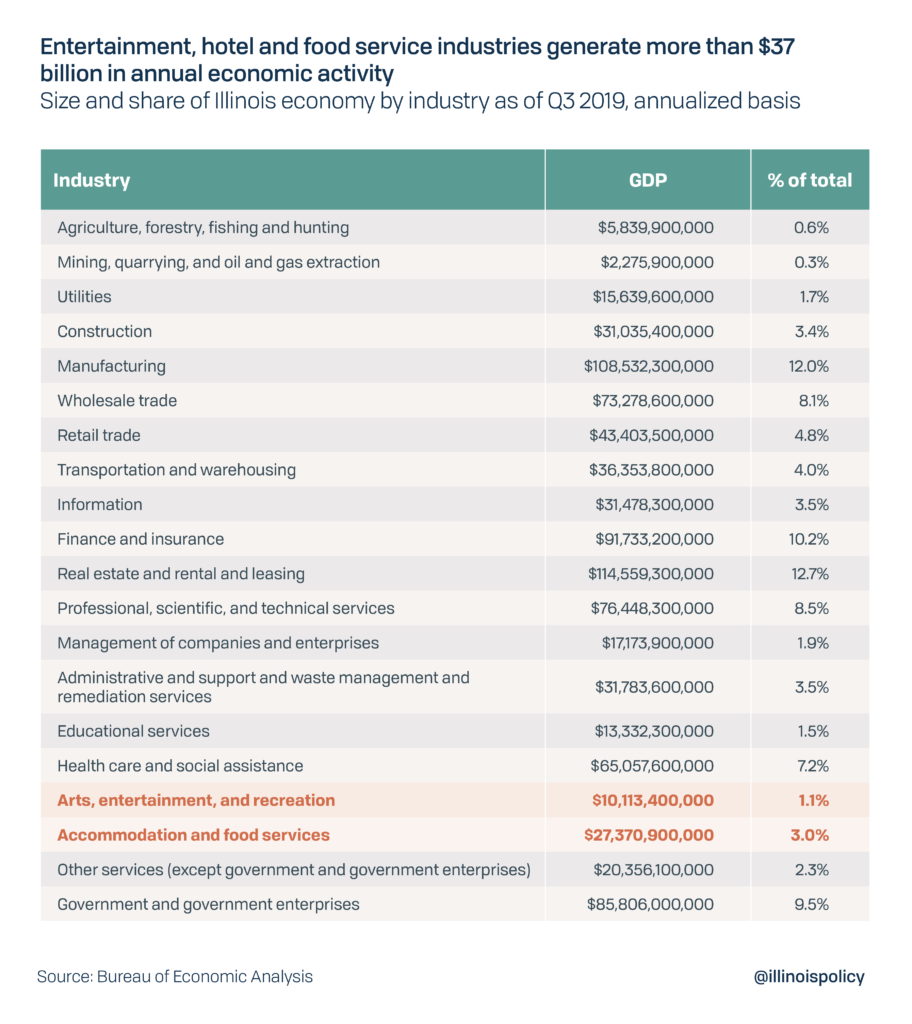

Among the first emergency responses to mitigate spreading the virus were orders for all bars and restaurants to suspend dine-in service and for many leisure services to completely suspend operations. On March 16, Gov. J.B. Pritzker announced all restaurants and bars in Illinois would be closed to dine-in service. By March 20, the governor had announced a statewide “stay at home” order, asking 12 million Illinoisans to leave the house only when absolutely necessary.

Given the size of the arts, entertainment and recreation industry alone – which has come to a near complete halt – these orders mean the state is losing out on up to $28 million per day as these activities have been put on hold. Meanwhile, the accommodation and food services industry, which is still operating albeit in a very limited capacity, generates approximately $75 million per day for the state’s economy.

While very little data is available at this time to confirm the magnitude of the economic fallout of this containment measure, in normal times these industries produce roughly 4.2% of Illinois’ economic output – which amounted to $103 million per day on average in 2019, according to data from the Bureau of Economic Analysis.

Why this downturn is so severe

The novel coronavirus, COVID-19, has created one of the most sudden economic shocks in recorded history, in large part because it simultaneously causes a demand shock and a supply shock.

On the demand side, other than the initial surge of consumers stocking up on essential goods, the threat of contracting and spreading a deadly virus causes people to reduce their interactions, leading to large declines in economic activity. Individuals are also likely to continue to reduce their spending as many lose jobs and income due to business closures and others begin to increase savings for fear that they could be affected by future economic hardship.

On the supply side, as sick workers take time off and healthy workers are asked to stay home to prevent the spread of the virus, businesses are likely to face shortages of important production inputs. Not only is labor scarce, but materials and inputs from other businesses and industries also grow thin as many employees in sectors not directly affected are asked to remain home. Because of fear of spreading the virus, supply chains have also been strained as many businesses have been forced to shut down temporarily to contain the spread, while others are likely running below usual productivity levels as companies and employees face new challenges while working from home.

That is not to say that a partial and temporary economic shutdown is not an appropriate action to mitigate public health risks, which should be the top priority. The economic cost of letting a virus spread in the population would likely exceed the cost of a temporary lockdown.

New economic research shows an economy-wide, stay-at-home order or quarantine isn’t necessarily the best response to mitigate the economic harm. Because quarantines have both economic and social costs, containment policy should balance the public health risks with these costs. The economic and social costs can be mitigated by engaging in more widespread testing in conjunction with targeted quarantine policies instead of a population-wide stricter quarantine. Testing at higher rates coupled with targeted quarantines can result in smaller economic losses and social costs without an increase in the human cost.

The ultimate long-run economic effects will depend on: 1) how effective public policy has been at limiting the spread of the virus to minimize the human cost; and 2) how quickly business activity can resume.

What Illinois must do to prevent economic harm

In the second week of March 2020, Illinois’ new initial unemployment claims stood at nearly 11,000, according to the Illinois Department of Employment Security. For the week ending March 28, there were over 178,000 new unemployment claims – over 1800% higher than the same week a year earlier.

The duration of the current downturn and how long preventative stay-at-home measures will remain in place remains to be seen. On March 27, Congress passed a $2 trillion stimulus bill to provide aid to Americans during the crisis. The package included a one-time tax rebate of $1,200 per individual taxpayer and $500 per child, expanded unemployment benefits, and the funding of small business loans, to name a few.

At the state level, Illinois has pushed back its income tax filing deadline to be in line with the federal government’s July 15 deadline and has made $90 million worth of assistance available to small businesses through the Illinois Department of Commerce and Economic Opportunity.

But Illinois must take further action to ensure businesses are able to survive and recover as quickly as possible following this unprecedented downturn.

First, the state should pass legislation to postpone at least the next installment of property taxes, which otherwise will come due within the next four months, so that businesses do not incur additional expenses as they remain closed and can hopefully keep employees on payrolls with these additional resources. The cost to local governments could be financed by the state through short-term emergency borrowing.

Lawmakers should also remove the progressive income tax constitutional amendment from November’s ballot. Illinois’ labor market was already struggling before this crisis, and actually shed private sector jobs for the first time in a decade in 2019. The introduction of a tax hike, particularly at the onset of an economic recovery, would likely cost the state thousands of foregone jobs and hamstring the economy as it attempts to rebound.

The approval of a $3.7 billion progressive income tax hike on the Nov. 3 ballot would lead to tax hikes on nearly 112,000 of the state’s largest jobs creators – small businesses known as “pass-through” entities – who would see a tax increase under the plan. These businesses are some of the most vulnerable to the current downturn.

While these measures will likely ease the financial strains on some households and could mitigate job losses, Illinois government should also take additional steps such as pension reform to ensure the state’s economy can recover as quickly as possible once the public health threat subsides.