While recently released data from the U.S. Census Bureau revealed Illinois was home to the nation’s worst loss of residents to other states over the decade, new IRS data shows those leaving the state are taking billions of dollars with them.

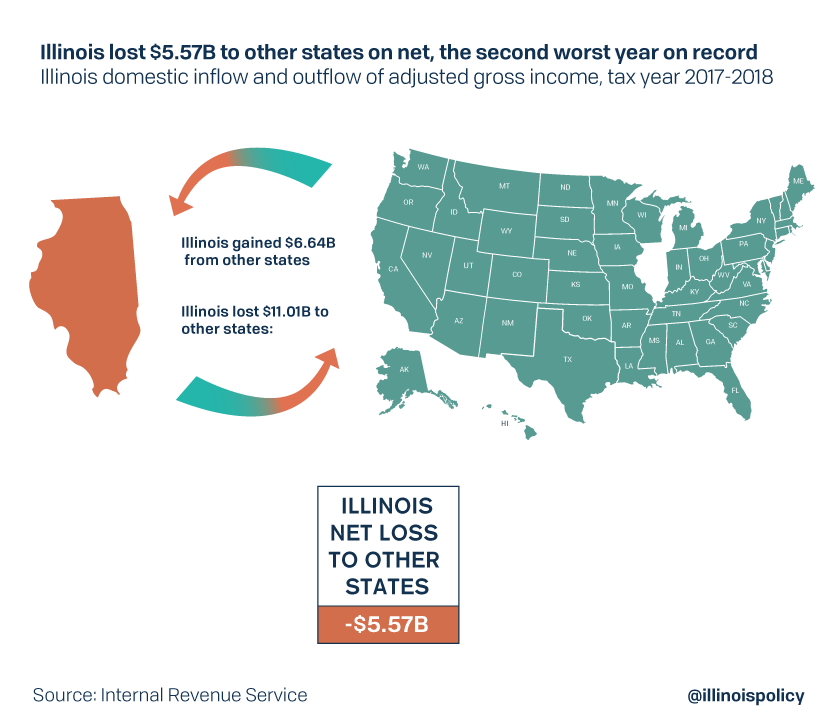

For tax year 2018, that amounted to a net loss of up to $5.6 billion in adjusted gross income to other states, with each person leaving earning on average $18,000 more per tax return than those who moved to Illinois.

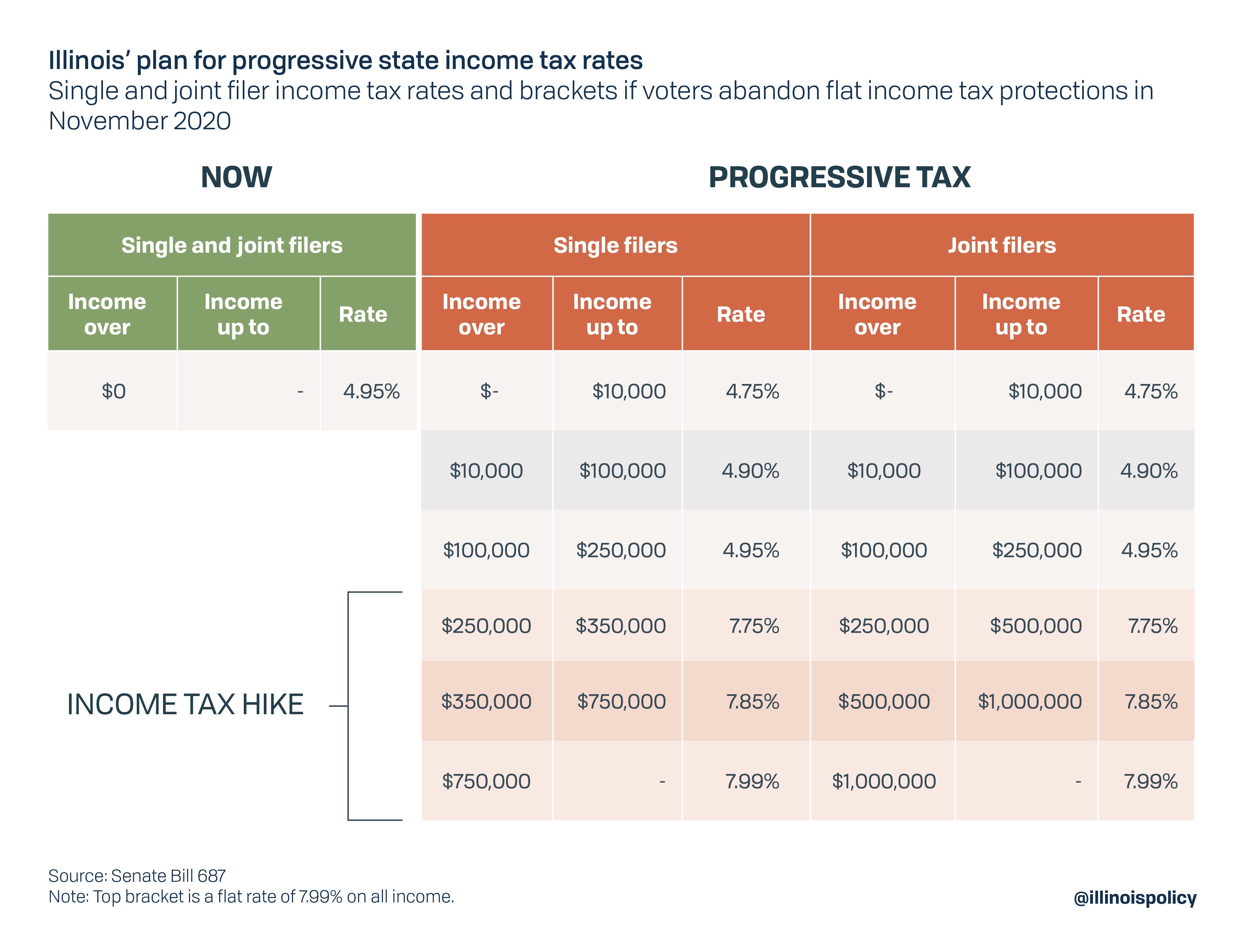

The new data also shows Gov. J.B. Pritzker’s biggest policy priority of 2020 – a $3.4 billion progressive income tax hike that voters will approve or deny in November – would increase taxes on the Illinoisans already most likely to exit the state, leaving middle-class residents to pick up the tab.

High-income earners leaving Illinois the fastest

The IRS data reveals who is making up the bulk of the exodus from Illinois. Of the 2018 income tax returns that Illinois lost on net, 24,834 (58%) of them were prime working-age Illinoisans between 26-54, as has been the case for the entire decade.

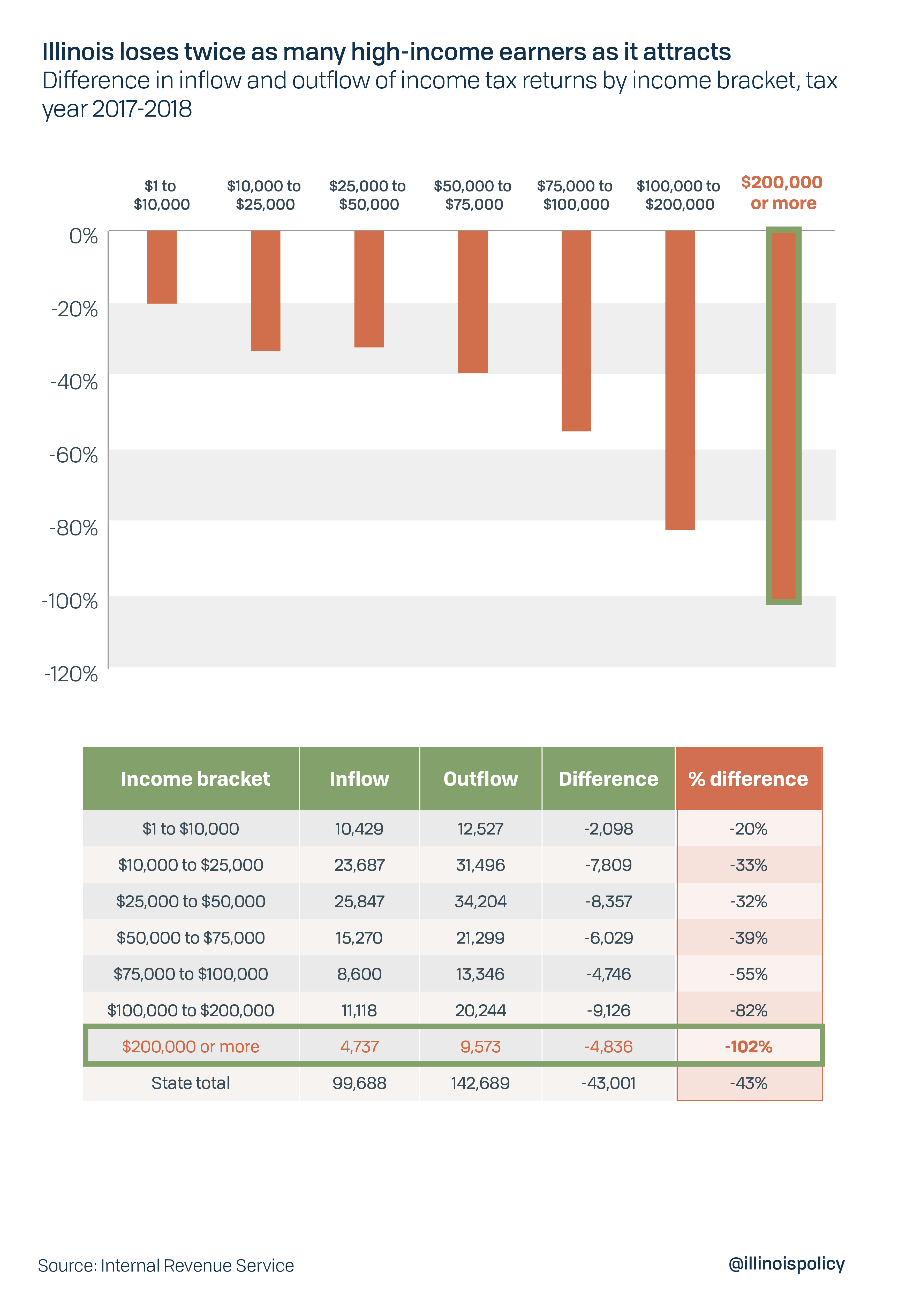

IRS data also shows that while Illinois is losing residents of all income brackets to other states, the Illinoisans departing at the fastest rate are higher income earners.

In fact, Illinois is losing people earning more than $200,000 a year at nearly twice the rate of average-income residents.

The only state to see a higher share of residents making more than $200,000 leave in tax year 2018 was New York. Gov. Andrew Cuomo put it this way: “‘Tax the rich! Tax the rich! Tax the rich!’ We did. Now, God forbid, the rich leave.”

These numbers become even more stark when you compare the size of the flows in and out of the state by income group. The data reveals Illinois is losing more than twice as many wealthy residents as the state is attracting. In fact, the higher the income level, the larger the gap between Illinoisans who leave and those who come in.

The highest income bracket reported by the IRS is $200,000 and up. Pritzker’s progressive income tax proposal would hike taxes on those earning $250,000 and up. But without spending reform, Illinois will be forced to hike income taxes beyond Pritzker’s introductory rates.

Outmigration continues

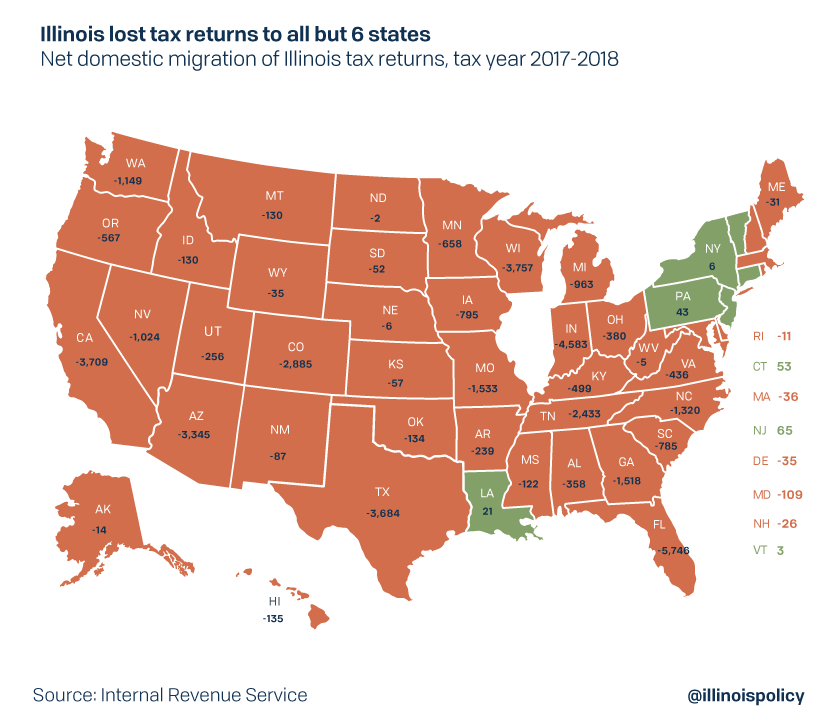

Illinois saw a net loss of 43,498 tax returns to other states in tax year 2018, representing a net loss of 87,882 residents, as measured in exemptions from the IRS data release. Illinois lost residents to 43 out of 49 states on net.

Illinois gained residents on net from Vermont, New York, Louisiana, Pennsylvania, Connecticut and New Jersey, but the gain was only 191 income tax returns.

When Illinoisans leave the state, they don’t go empty handed. They take with them jobs, opportunity, financial assets and talent that would otherwise have remained in Illinois. In 2018, while Illinois gained $6.6 billion from other states, $12.2 billion moved from Illinois to other states. 2018’s net loss of up to $5.6 billion in adjusted gross income, or AGI, is improved from the record loss of up to $6.9 billion in 2017, but greater than the loss in any other year on record.

Since 2010, Illinois has failed to register a single year in which the state gained AGI on net from other states. Instead, during the decade, it has lost up to a cumulative $32 billion in income to other states. That loss is the second largest loss of any state in the nation in both raw dollar terms and on a percentage basis. Only New York lost more income in absolute terms and only Alaska saw a larger percentage decline.

Illinois is home to one of the most skilled and productive workforces in the world. However, the IRS data reveals the state is shedding workers who earn more than those who come into the state. After adjusting AGI to reflect what those who left the state likely would have made had they remained during tax year 2018, those who left made nearly $18,000 more per income tax return than those who moved in.

This earnings gap makes “wealth flight” from Illinois even worse as the income earned by those who move in isn’t enough to offset the loss in income earned by those who left.

What this means for Illinois

Illinois’ people problem cannot be ignored. The state’s population decline has resulted in an economy nearly $80 billion smaller than it should be. It has also meant less tax money for the state as the tax burden has grown for the fewer taxpayers left behind.

Lawmakers have enacted major tax hikes on a regular basis for those fewer state taxpayers. Now, voters have been asked to approve Pritzker’s $3.4 billion progressive income tax hike at the Nov. 3 election, with proponents promising this is what Illinois needs to turn itself around.

However, taxes are already the No. 1 reason Illinoisans say they want to leave. And Pritzker is specifically proposing to raise taxes on those who are already most likely to leave. Despite data that consistently confirms this, and feedback from Illinoisans explicitly stating taxes are the main reason they want to leave, the governor claims his tax hike won’t push out more Illinoisans.

Illinoisans can see how this might play out: California already conducted a similar experiment with state tax policy. Instead of increasing funding for education and putting the state on a firm fiscal footing as promised, a major progressive income tax hike in California was diverted mostly to pensions, and funding for many services now makes up a smaller share of the budget than before. A new paper by Stanford University researchers shows wealthy residents were about 40% more likely to leave after Californians in 2012 passed a progressive income tax hike. Those departures and other responses to higher taxes eliminated 45.2% of the revenue the state expected to get from high earners. The “temporary” tax is still in place and the continuing budget pressures has hurt California’s middle class.

A real solution

Instead of again asking taxpayers for more, lawmakers need to pursue real reforms that would put the state on firm fiscal footing and give much needed certainty and tax relief to families and businesses.

First, Illinois must address its pension problem, which continues to grow despite two record income tax hikes within the past decade. Though pensions take up more than 25% of general fund expenditures, the pension funds’ debt is growing. But by amending the Illinois Constitution to allow for the adjustment of the growth rate of not-yet-accrued benefits, the state can reduce pension debt and ensure the plans can support retirees without overwhelming taxpayers. Such changes could include increasing the retirement age for younger workers, tying annual benefit increases to the actual cost of living and making retirement plans more closely resemble 401(k)s for new workers.

Second, a spending cap could help the state meet Illinois’ constitutional balanced budget requirement, which has been ignored for 18 years. One interesting proposal would be a smart spending cap that ties government spending growth to Illinois’ total growth in gross domestic product. Texas and Tennessee have implemented something similar to this, and both have budget surpluses, no state income tax and lower property tax rates than Illinois.

Responsible government spending growth that taxpayers can afford would provide more stability for families and businesses. But if the state substitutes tax hikes for necessary reforms, Illinois can expect continuing population decline and a loss of wealth and economic activity as residents seek better opportunities elsewhere.