On Tuesday (Sept. 10), the East St. Louis’ firefighter pension fund demanded that Illinois Comptroller Susana Mendoza intercept more than $2.2 million of East St. Louis city revenues so they could be diverted to the pension fund.

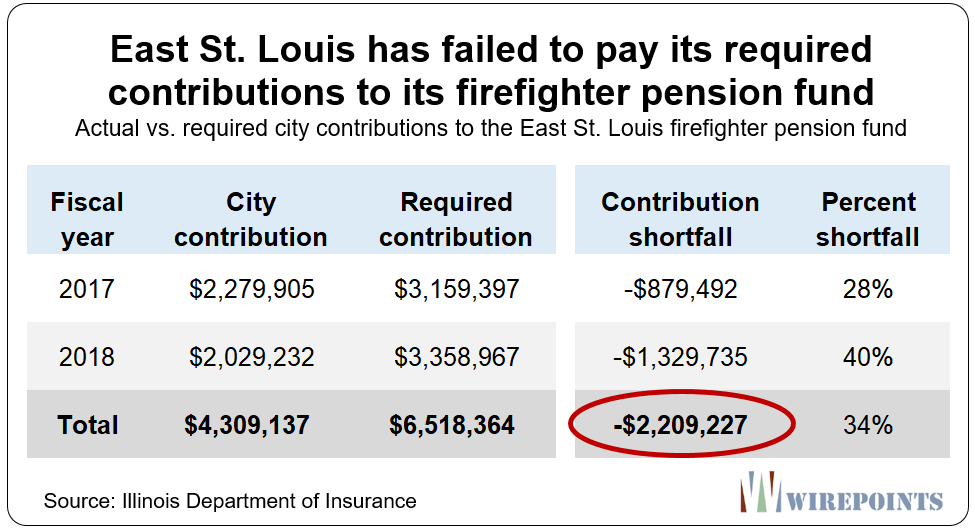

The fund trustees said the city shorted firefighter pensions by $880,000 in 2017 and another $1.3 million in 2018. Under a 2011 pension law, the state comptroller gained the powers to intercept city revenues on behalf of police and fire pension funds shorted by their municipalities.

Harvey was the first municipality to run afoul of the intercept law. North Chicago, a Chicago suburb of 30,000, was the second. Now it’s East St. Louis’ turn.

Back when Harvey was first intercepted last year, Wirepoints reported that comptroller confiscations could wreak havoc on hundreds of Illinois communities, potentially creating a domino effect. Hundreds of Illinois’ 650 pension funds have not received their statutorily required contributions from their respective cities in recent years, meaning the intercept law could go into wide usage under a broader crisis scenario. In the most recent analysis of Illinois Department of Revenue data, nearly half of the 650 funds were not properly funded in 2017 (see details below).

That domino effect could be exacerbated given that municipalities have virtually no control over their own pension funds. State law sets all the rules and pensions are protected by the Illinois Constitution, meaning that in a market downturn, the pension funds may have little choice but to demand more intercepts.

The East St. Louis firefighter fund has certified to the comptroller that the municipality didn’t fully pay its required contributions to the pension fund in 2017 and 2018. Now the Comptroller has 60 days to decide whether that’s correct. After that, it can begin confiscating East St. Louis revenues.

The intercept law was first utilized in 2018, when Harvey, Illinois, revenues were garnished to pay the city’s police and firefighter pension funds.

That intercept of nearly $3.3 million led to the layoff of 40 public safety workers so the city could avoid insolvency. The city found it couldn’t simultaneously pay for both current workers and pensioners. The city and the pension plans eventually reached a deal that relieved some of the pressure on the city.

The East St. Louis intercept

East St. Louis is no stranger to fiscal crises, but the intercept is bound to cause the city a new level of pain. The Comptroller can confiscate revenues that come from the state and an overwhelming share of the city’s general budget comes from the state.

If the full $2.2 million is intercepted, the city would end up losing the equivalent of 10 percent of its budget (the city’s 2018 general budget equaled $18 million). And what’s worse, the city’s 2019 budget is already facing millions in deficits.

East St. Louis’ fire and police pensions are some of the worst funded in the state, with funded ratios of just 31% and 9%, respectively. In total, the city has a shortfall of more than $104 million in its public safety pension plans, according to Illinois’ Department of Insurance. That’s more than $9,700 per household in a community where 43 percent of people live below the poverty line.

And with just $6.1 million in assets and annual payouts to beneficiaries totaling $3.7 million, the city’s fire fund has the equivalent of only two years of payouts in its accounts today.

Another day, another domino

Cities like Harvey, North Chicago and now East St. Louis are the vanguard of a much wider problem faced by municipalities across Illinois.

The most recent numbers show that 301 of Illinois’ 651 public safety pension funds, or 46 percent, were shorted their full payments in 2017, according to the actuarial standards published by the Illinois Department of Insurance.

Illinois cities – from Kankakee to Danville to Alton – need pension fixes before costs bankrupt them. And while state politicians have effectively quashed any chance for reforms now, that shouldn’t stop city officials from demanding real changes.

Municipal leaders across Illinois need to demand the following if they want their cities to survive Illinois’ collective crisis:

- An amendment to the constitution’s pension protection clause so pensions can be reformed and workers’ retirement security saved;

- The ability to convert pensions to defined contribution plans for workers going forward;

- A freeze on retirees’ cost-of-living adjustments (while protecting small pensioners) until pension plans return to health;

- Public sector collective bargaining reforms so officials can hold the line on new labor contracts, and;

- And the possibility of a fresh start through the ability to invoke municipal bankruptcy.

Without the above reforms, East St. Louis, North Chicago and Harvey might only be the first in a long list of collapsing cities.