Public pensions are already eating away Illinois government services, increasing by more than 500% during the past 20 years as spending on core services including child protection, state police and college money for poor students has dropped by nearly one-third since 2000.

At the same time the clock is running out on the state’s public pension funds, with the first potential insolvency looming as soon as 2039, according to an analysis commissioned by the Illinois Policy Institute.

Pension contributions accounted for less than 4% of Illinois’ general funds budget from 1990 through 1997. For fiscal year 2020, pension contributions and related costs will consume 25.5% of all general revenues at $10.2 billion. This figure includes:

- Direct contributions to the five state systems of $9.224 billion

- Debt service on pension obligation bonds worth $708 million

- The state’s contribution to Chicago Teachers’ Pension Fund normal costs (the employer share of pension costs created by an additional year of work) of $257.4 million

- $92 million in new debt service costs for pension buyout bonds

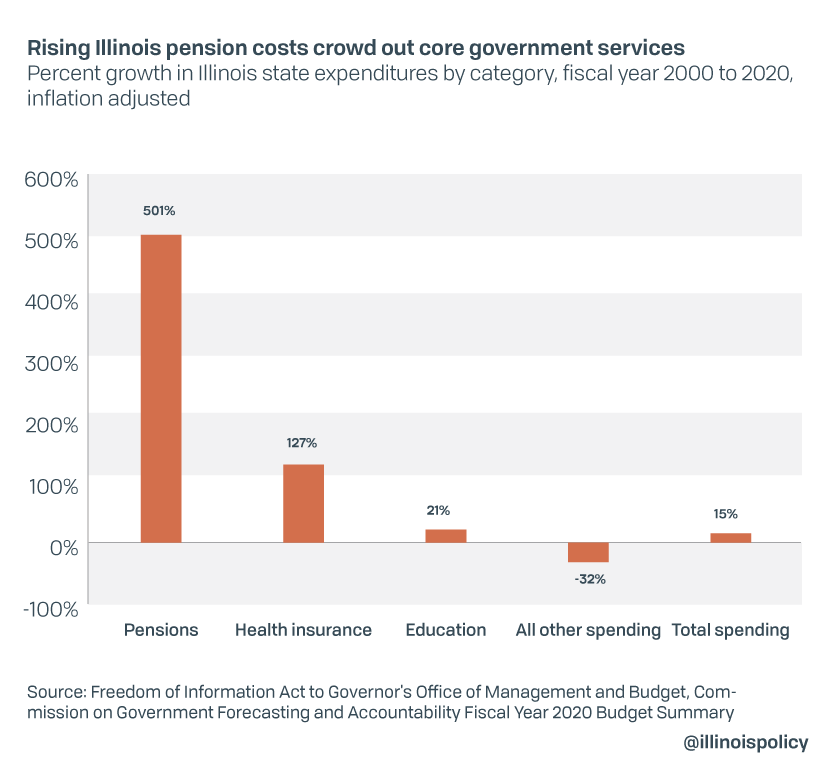

Since fiscal year 2000, after adjusting for inflation, state spending on pensions has grown more than 500%. Spending on government worker health insurance has grown 127% percent. Meanwhile, spending on K-12 education, often touted as a top priority by Illinois politicians, is up just 21%. All other spending, including social services for the disadvantaged, is actually down in real terms by 32%. Total spending has risen by 15% over that period.

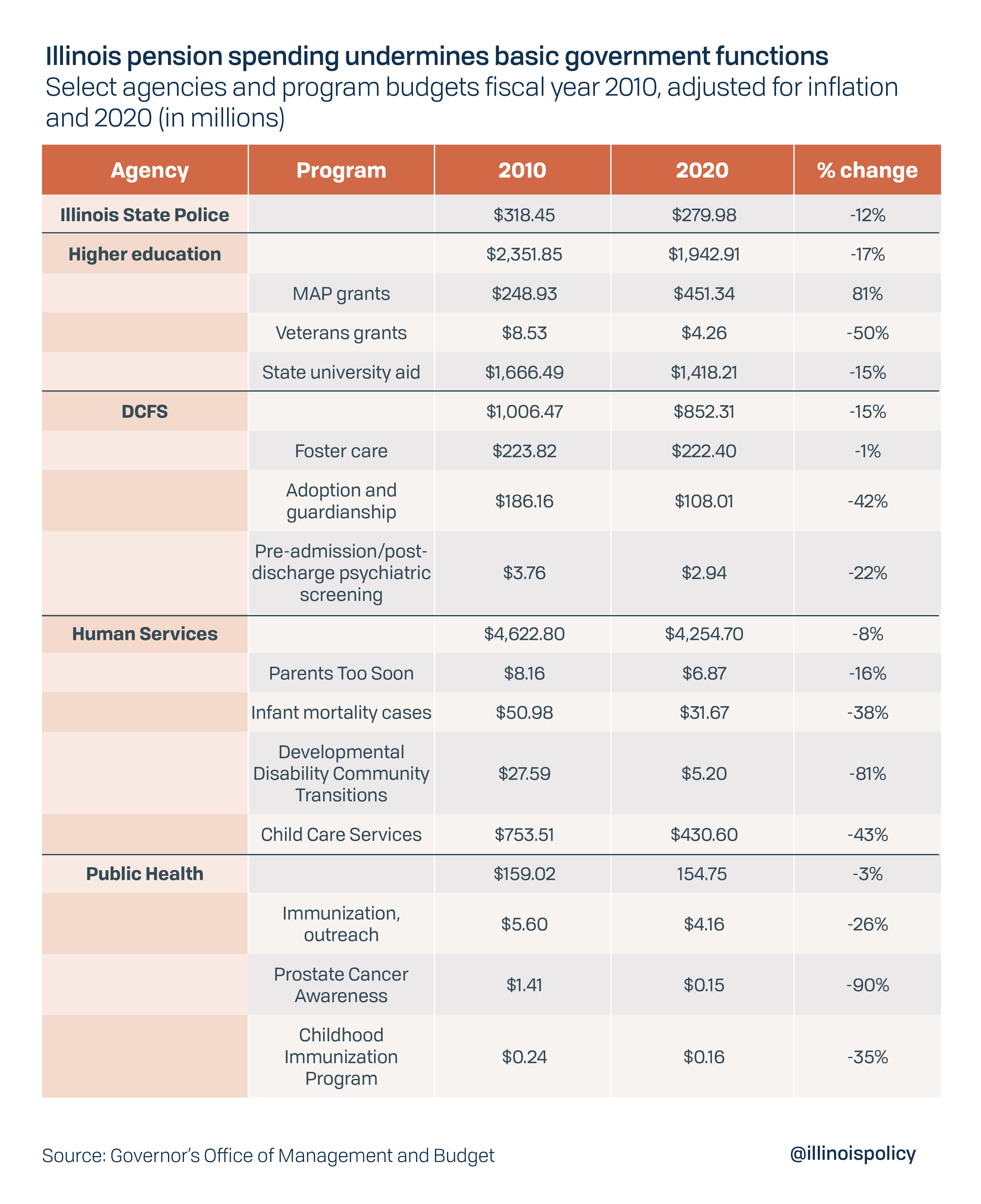

Consider the following list of programs and agency budgets, all of which are included in the “other spending” category. These programs include the state police, helping poor students pay for college, protecting children from child abuse, aiding the poor, and fighting disease and other public health issues.

Whenever media reports on a failure of state government services, including the ongoing crisis of a failing Department of Children and Family Services, the unsustainable cost of current pension benefits should be at the top of mind for residents and lawmakers.

Pensions are also a leading cause of Illinois’ high property taxes, causing them to skyrocket from around the national average in 1996 to the second highest in the nation today. Despite this, local governments are also cutting core services residents value today to pay for yesterday’s government in the form of pensions.

For example, in 2018 Peoria was forced to lay off 16 police officers, 22 firefighters and 27 municipal workers to be able to afford its pension payment. That same year the South Chicago suburb of Harvey laid off 18 firefighters and 13 police officers to make its own pension contributions.

Without pension reform, Illinois residents face a future in which they’re asked to pay more in taxes to receive ever less in valuable government services.

The status quo places retirees at risk, too!

The Illinois Constitution states that “membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”1

However, despite the widespread use of the term, this clause is not appropriately called a pension “protection” clause. By preventing even modest adjustments in future benefit earnings, the prevailing interpretation of the clause from the Illinois Supreme Court places government worker retirement security at risk, through potential insolvency of the funds.

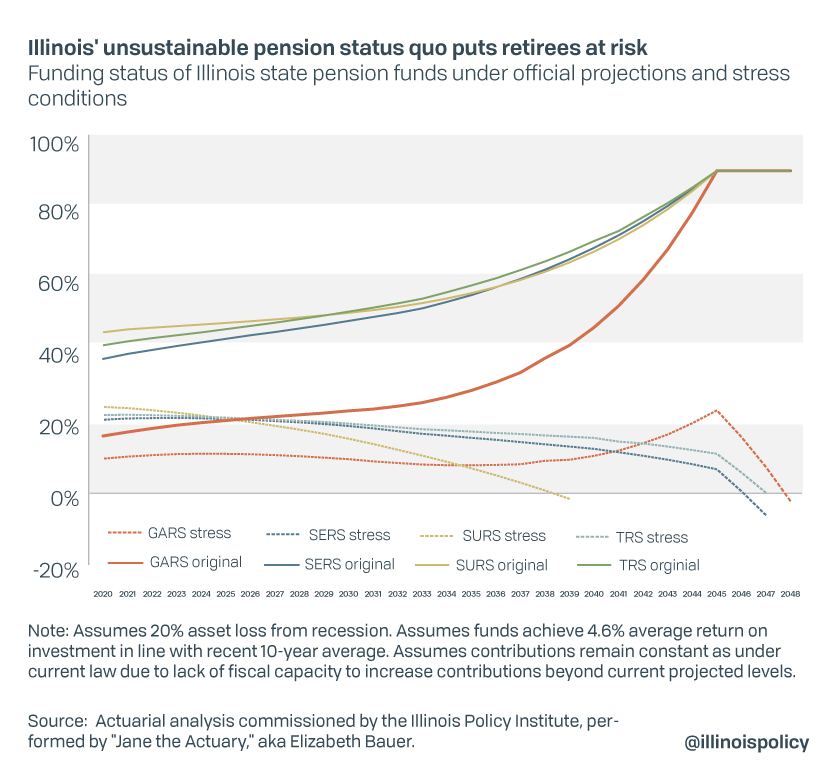

An actuarial stress test of the systems commissioned by the Illinois Policy Institute shows if state-run pension funds lose 20 percent of their asset value as a result of a recession – the same loss experienced in 2009 – and the average return on investment matches the roughly 4.6 percent the funds experienced in the 10 years after the last recession, the state’s major retirement systems will run out of money in fewer than 30 years.

This stress test helps to show how vulnerable pension math is to guesses about the future. While the state’s official projections show that each fund will reach 90% funding by 2045, this assumes the funds are able to obtain a consistent return on investment of between 6.75 and 7 percent, that the state always makes its full legally required contribution and that there is not another major national recession during that time period.

Under the stress test scenario, SURS would be the first to reach insolvency, and the fund would be unable to pay full benefits by 2039 with assets on hand. The other systems would see their funding ratios—the amount of money on hand to pay promised benefits – decline each year despite constantly increasing employer contributions. Retirement systems for teachers, state employees and elected officials would run out of money between 2046 and 2048.

Legal scholar and pensions expert Amy Monahan has argued even ironclad legal provisions preventing benefit cuts cannot be used to force states to pay full benefits from insolvent funds. Simply put, if there’s no money, benefits can’t be paid without impairing the state’s ability to exercise the basic functions of government and courts cannot force legislatures to spend money or incur debt.

In other words, the status quo is putting public workers and retirees at risk, not protecting them.

Constitutional pension reform can solve the crisis

Residents across the state deserve the opportunity to vote on an amendment to the state constitution that would enable common sense pension reform. Amending the pension clause does not mean striking it entirely. Lawmakers should adopt language in line with other states to recognize a distinction between earned benefits, which should be protected, and the future growth rate of benefits, which should be open to change to bring them in line with economic realities.

No retiree needs to see a dollar cut from the check they are currently receiving and no current worker should see their core annuity reduced. But state and local elected officials need the flexibility to make changes to parts of the benefit formula that are unsustainable, such as the 3% compounding post retirement raises, which are often mistakenly referred to as a cost of living adjustment, or COLA. A true COLA would be tied to inflation, so that retirement benefits keep pace with rising prices but do not exceed what’s fair and affordable.

The only fair way out of Illinois’ pension crisis – and to stop economically harmful tax hikes from driving more residents and businesses out of the state – is to reduce pension liabilities with benefit reforms. Thoughtful reforms can strike a balance between guaranteeing retirement security for workers while protecting taxpayers and the state economy from trying to pay down massive debt at unaffordable benefit levels. The biggest obstacle standing in the way of a brighter future for Illinois has been and remains lawmakers’ lack of political will to pursue transformative reform.