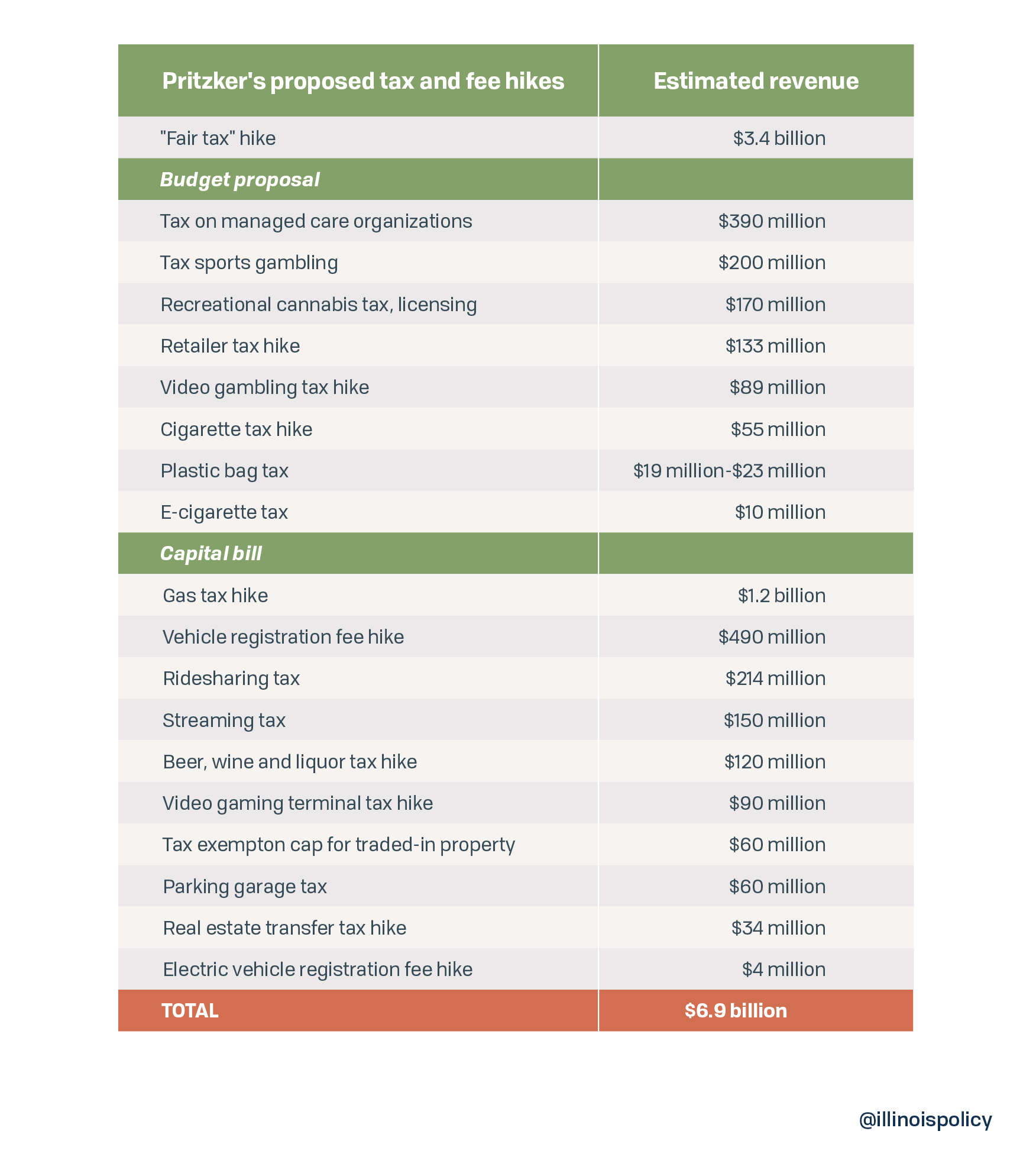

Gov. J.B. Pritzker’s push for a graduated income tax constitutional amendment gets the attention, but lurking nearby are 18 other proposed taxes and fees – all waiting to pull $6.9 billion away from Illinois taxpayers.

The governor previously proposed nine tax and fee hikes worth $4.5 billion as part of his budget address, including the graduated tax. His recently released capital plan adds another 10 that would ask Illinoisans to pay $2.4 billion more.

The graduated tax was the cornerstone of Pritzker’s campaign and now his legislative agenda. Illinois Policy Institute research found that in order to fully pay for his promised spending, his income tax hike proposal would lead to middle-income families paying as much as $3,500 more per year.

Senate Democrats already passed their own different rate proposal for the progressive tax, but even if Pritzker’s rates are actually enacted any middle class tax relief would be more than wiped out by these other tax and fee hikes the governor has proposed. All Illinoisans – not just “the rich” – would end up paying more to Springfield.

Pritzker should drop all 19 plans to take more money from overtaxed Illinois residents. The Prairie State already has one of the highest state and local tax burdens in the nation. High taxes are the No. 1 reason people say they want to leave Illinois, and given the state’s five straight years of population loss, it cannot afford to alienate more residents.

Here are the details on all 19 proposals.

Capital bill tax and fee hikes ($2.4 billion total)

Pritzker recently proposed a $41.5-billion plan called “Rebuild Illinois” to increase spending on roads, bridges and other infrastructure. Unlike the Illinois Policy Institute’s recently released plan to increase infrastructure spending by $10 billion without tax hikes, Pritzker’s proposal includes no reforms and relies only on asking Illinoisans to pay more. These are the plan’s taxes and fees.

Double state’s motor fuel tax ($1.2 billion)

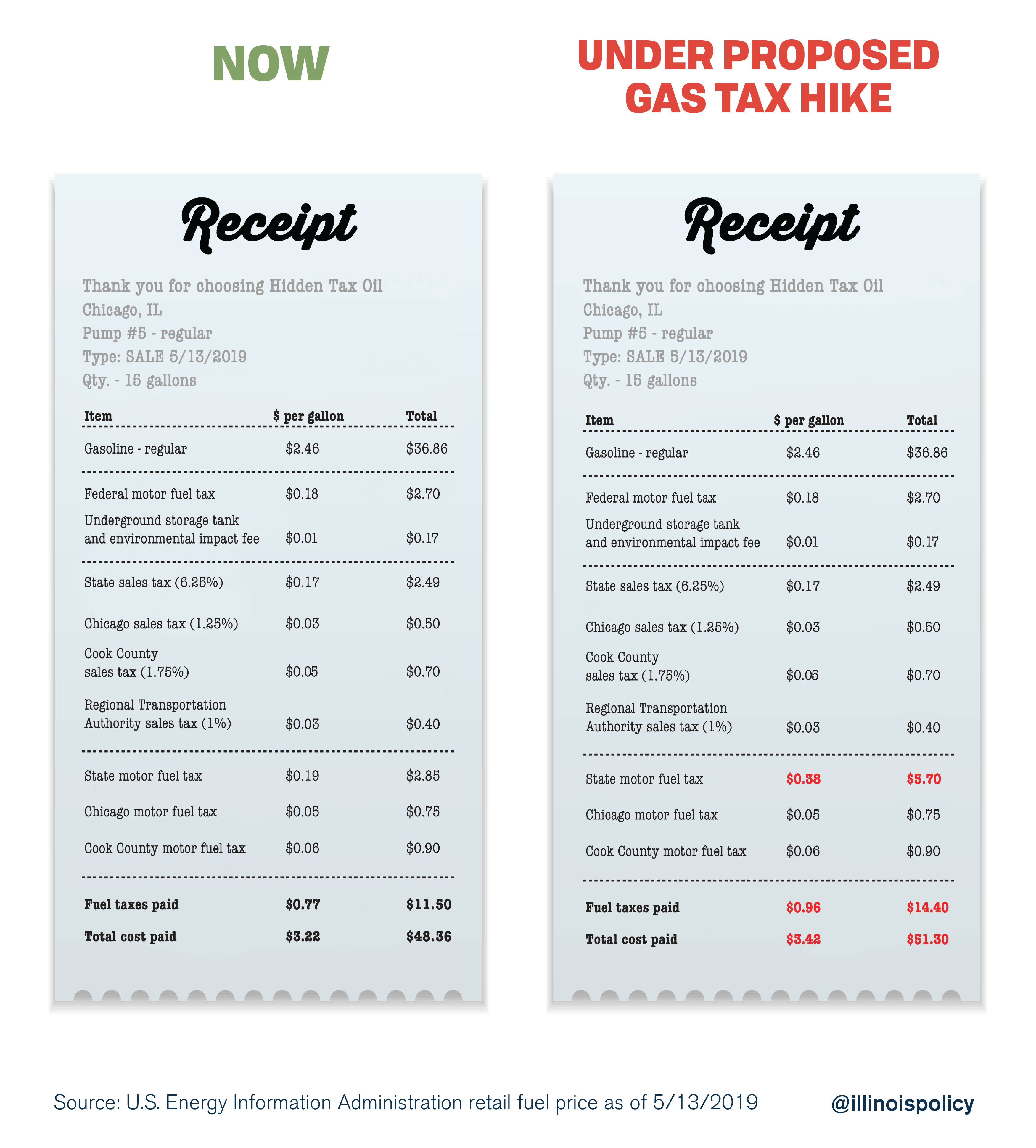

The preliminary capital plan relies on doubling Illinois’ motor fuel tax to 38 cents from 19 cents per gallon, effective July 1. This would make Illinois’ total gas tax burden the second-highest in the nation. Pritzker proposes dedicating $650 million of the new revenue to local government infrastructure spending while the state would keep the other $560 million.

Under the proposed gas tax hike, drivers filling up in Chicago would pay 96 cents in taxes and fees on a $2.46 gallon of gasoline – an effective tax burden of 39%.

A draft of Pritzker’s capital plan states, “Illinois currently has one of the lowest motor fuel taxes in the nation.” That is misleading.

When adding up all the layers of taxes and fees Illinoisans pay on gasoline, they currently pay the 10th-highest average total state and local gas tax burden in the nation, according to the Tax Foundation. The Prairie State is one of just seven states where drivers pay general state and local sales taxes on gas purchases. Illinois also adds state and local excise taxes after the sales taxes are applied, meaning drivers are taxed on the taxes.

Nearly double maximum vehicle registration fee ($490 million)

The preliminary capital plan would also hike vehicle registration fees, imposing a new cost structure based on the age of the car. The current annual fee of $101 would jump to $199 for vehicles 3 years old or newer, $169 for vehicles 4-6 years old, $139 for vehicles 7-11 years old, and $109 for vehicles 12 years and older.

The $199 registration fee for newer vehicles would be higher than any neighboring state and third-highest in the nation, according to Ballotpedia research. Illinois’ vehicle registration fee was just $79 as recently as 2009.

15-fold increase in electric vehicle registration fee ($4 million)

The registration fee for electric vehicles would rise to $250 per year from $34 every other year.

New $1 per-ride tax on ridesharing ($214 million)

The plan would enact a statewide $1 per-ride tax on ridesharing services such as Uber and Lyft. Chicago already levies a 72 cents per-ride fee on ridesharing services.

New 7% tax on cable, satellite and streaming services ($150 million)

Chicago’s “Netflix tax” would expand statewide, with the state charging a 7% tax on users of streaming services, as well as cable and satellite customers. None of these services are currently taxed at the state level. Chicago currently stretches the definition of its 9% citywide “amusement tax” to include online streaming services such as Netflix and Spotify, as well as Playstation rentals.

Tax hikes on beer, wine and liquor ($120 million)

Taxes on booze would rise by up to 50%. The per-gallon tax on beer and cider would rise to 27.7 cents from 23.1 cents; the per-gallon tax on wine would rise to $2.05 from $1.39, and the per-gallon tax on distilled liquor would rise to $12.60 from $8.55.

Illinois’ alcohol excise taxes already stick out among Midwestern states, leaving businesses near state borders at a disadvantage. Bob Myers, president of the Associated Beer Distributors of Illinois, estimated Illinois loses out on a “bare minimum” of $8 million per year to cross-border alcohol purchases.

New statewide parking garage tax ($60 million)

Daily and hourly garage parking would be hit with a 6% tax while monthly and annual garage parking would come with a 9% tax. Chicagoans already pay among the highest parking rates in the country. The state does not currently tax garage parking.

Doubling the real estate transfer tax ($34 million)

The proposal doubles the real estate transfer tax on non-residential real estate to $1 from 50 cents per $500 in value.

Capping traded-in property sales tax exemption ($60 million)

While the state currently exempts sales tax on sales of new items up to the full value of traded-in property, that exemption would be capped at $10,000.

Increasing video gaming terminal tax ($90 million)

The state now imposes a tax of 30% on net terminal income, but this tax would increase under a structure that the administration did not reveal in its capital proposal.

“Fair tax” hike with no middle class protections ($3.4 billion)

Pritzker’s plan to scrap Illinois’ constitutionally protected flat tax and replace it with a graduated, or “progressive,” income tax system is the largest single tax hike he has proposed.

Pritzker’s progressive income tax plan would slightly lower the effective income tax rate on earnings under $250,000 and hike them significantly after that, topping out with a 7.95% tax on income over $1 million. But rather than a marginal rate on that income, Pritzker’s plan uses a rare tax tool known as “recapture,” where those who earn over $1 million would instead see a much higher flat tax on all of their income – effectively adding an $8,565 tax bill to the first dollar earned over $1 million.

Pritzker’s proposed rates would almost certainly be short-lived, as estimates using the most recently available IRS data reveal his proposal would actually raise just $1.4 billion to $2.4 billion, while his spending promises total $14 billion to $19 billion. Nevertheless, Pritzker is claiming his tax change would raise $3.4 billion – and rates could be increased to the level necessary to actually raise that amount.

The last state to implement a plan similar to Pritzker’s was Connecticut in 1996. State lawmakers made the same promises of middle-class tax cuts, property tax relief and increased spending on social services. Those promises were broken. In fact, the typical Connecticut family has seen a 13% hike in their income tax rates since the implementation of Connecticut’s progressive tax, property tax burdens increased 35%, and the poverty rate increased 47% during the 10 years following the passage of their progressive tax.

In order for the progressive tax to take effect, lawmakers would first need to approve an amendment to the Illinois Constitution removing the state’s flat income tax protection, and voters would then need to approve that change in November 2020 – either by a 60% majority of those voting on the ballot question or more than 50% of those voting in the election.

Tax and fee hikes from budget proposal ($1.1 billion total)

Beyond the “fair tax,” Pritzker proposed a litany of other new tax and fee hikes in his first budget proposal.

Tax on managed health care organizations ($390 million)

Pritzker’s proposed budget calls for a new tax levied on managed care organizations generating an estimated $390 million. While budget documents from the administration focus on organizations involved in Medicaid-related services, federal law requires the tax to apply uniformly to private sector managed care organizations. Taxing such organizations could increase premium costs for consumers.

Tax sports gambling ($200 million)

Pritzker proposes legalizing and taxing sports betting online and at select locations across the state. Between license fees and new taxes, the governor estimates this would raise $200 million in revenue for fiscal year 2020.

Recreational cannabis tax and licensing regime ($170 million)

The governor’s budget proposal calls for selling marijuana licenses at $100,000 each for an estimated $170 million in new revenue. In comparison, a liquor license costs $750.

Retailer tax hike ($133 million)

Pritzker’s proposed budget reduces a tax credit available to retailers for collecting sales tax on behalf of the state, generating an estimated $75 million for the state and $58 million for local governments.

Video gambling tax hike ($89 million)

Companies with video gaming terminals in Illinois would see marginal net income from those terminals above $2.5 million a year taxed at 50% rather than the current 30%, bringing in an estimated $89 million.

Increased cigarette tax ($55 million)

Illinois’ cigarette tax is already among the highest in the region, driving sales across state lines. Pritzker’s budget proposes hiking the cigarette tax rate by 32 cents per pack, generating an estimated $55 million.

Plastic bag tax ($19 million to $23 million)

A new 5-cent statewide tax on plastic bags would hit up Illinois shoppers for as much as $23 million in state revenue under Pritzker’s budget proposal. Two bills currently in the General Assembly would impose a per-bag tax of 7 cents or 10 cents, respectively. No U.S. state currently collects a statewide plastic bag tax.

New e-cigarette tax ($10 million)

Pritzker’s budget proposal calls for taxing e-cigarettes statewide at 36% of the wholesale price.

Add them all up, and Illinoisans’ total tax and fee bill is $6.9 billion

Illinois’ economy and taxpayers cannot withstand more tax hikes.

To balance Illinois’ budget and pay off debt, Pritzker should instead look to structurally reform the cost drivers of Illinois’ budget and debt problems: the rising costs of pensions and government worker health insurance. The Illinois Policy Institute recently released Budget Solutions 2020, a plan to balance Illinois’ budget immediately, pay off its debt and cut taxes in fewer than five years.

While it’s true Illinois should invest more in its infrastructure, there are credible concerns that Pritzker’s administration hopes to trade capital projects for votes on his plan to scrap Illinois’ constitutionally protected flat tax and make way for a state income tax hike. Not only is it wrong to hold infrastructure spending hostage to force through an economically harmful tax hike, but taxpayers will get far less value from a capital bill if projects are selected for political reasons rather than based on a neutral cost-benefit analysis.

The Illinois Policy Institute’s no tax hike capital plan offers an alternative. By adopting efficiency reforms, focusing on maintenance infrastructure rather than new projects and dedicating existing revenues to transportation, lawmakers can deliver on the promise of repairing roads and bridges while protecting taxpayers’ wallets.

Pritzker can give Illinoisans 19 more reasons to leave, or he can fix state finances and fix the roads without tax hikes. It shouldn’t be a difficult choice.