The wheels are in motion on Gov. J.B. Pritzker’s capital bill. But preliminary details shared with Springfield political blog CapitolFax show Illinoisans should brace for a wide range of heavy tax and fee hikes to fund it.

Pritzker is proposing a $41.5 billion capital plan over six years, funded by $2.4 billion in new tax and fee revenue. The proposed tax and fee hikes include the following, among other changes:

Gas tax hike ($1.2 billion)

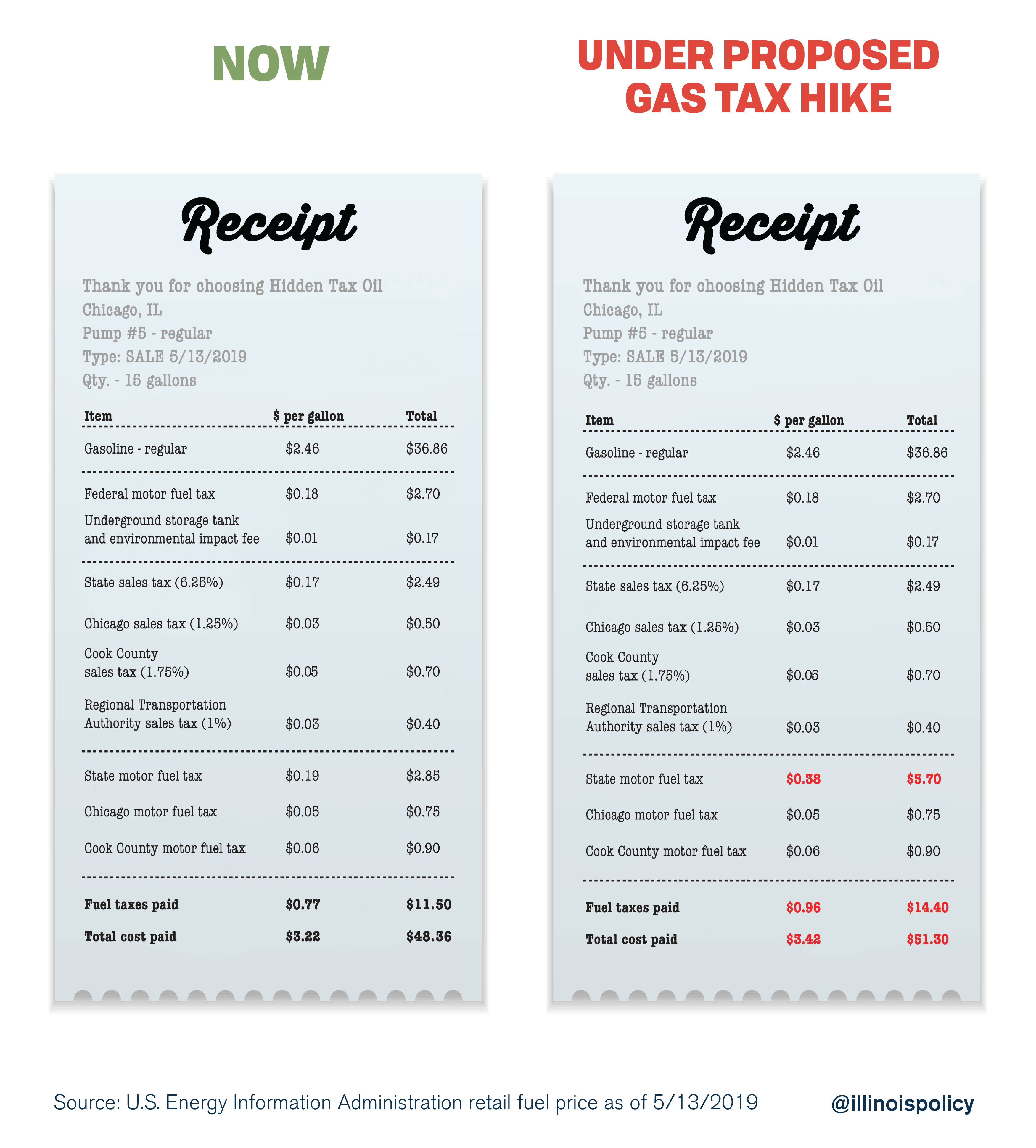

The preliminary capital plan relies on doubling Illinois’ motor fuel tax to 38 cents from 19 cents per gallon, effective July 1. This would make Illinois’ total gas tax burden the second highest in the nation.

Under the proposed gas tax hike, drivers filling up in Chicago would pay 96 cents in taxes and fees on a $2.46 gallon of gasoline – an effective tax burden of 39%.

A draft of Pritzker’s capital plan states, “Illinois currently has one of the lowest motor fuel taxes in the nation.” This is misleading.

When adding up all the layers of taxes and fees Illinoisans pay on gasoline, they currently pay the 10th highest average total state and local gas tax burden in the nation, according to the Tax Foundation. The Prairie State is one of just seven states where drivers pay general state and local sales taxes on gas purchases. Drivers also pay underground storage and environmental fees of 1.1 cents per gallon, along with various local charges.

Vehicle registration fee hike ($490 million)

The preliminary capital plan would also hike vehicle registration fees, imposing a new cost structure based on the age of the car. The current annual fee of $101 would jump to $199 for vehicles 3 years old or newer, $169 for vehicles 4-6 years old, $139 for vehicles 7-11 years old, and $109 for vehicles 12 years and older.

The $199 registration fee for newer vehicles would be higher than any neighboring state and third-highest in the nation, according to Ballotpedia research. Illinois’ vehicle registration fee was just $79 as recently as 2009.

New $1 per ride tax on ridesharing ($214 million)

The plan would enact a statewide $1 per ride tax on ridesharing services such as Uber and Lyft. Chicago already levies a 72-cent per ride fee on ridesharing services.

New 7% tax on cable, satellite and streaming services ($150 million)

Chicago’s “Netflix tax” would expand statewide, with the state charging a 7% tax on users of streaming services, as well as cable and satellite customers. None of these services are currently taxed at the state level. Chicago currently stretches the definition of its 9 percent citywide “amusement tax” to include online streaming services such as Netflix and Spotify, as well as Playstation rentals.

Tax hikes on beer, wine and liquor ($120 million)

Taxes on booze would rise by up to 50%. The per-gallon tax on beer and cider would rise to 27.7 cents from 23.1 cents; the per-gallon tax on wine would rise to $2.05 from $1.39, and the per-gallon tax on distilled liquor would rise to $12.60 from $8.55.

Illinois’ alcohol excise taxes already stick out among Midwestern states, leaving border-state businesses at a disadvantage. Bob Myers, president of the Associated Beer Distributors of Illinois, estimated Illinois loses out on a “bare minimum” of $8 million per year to cross-border alcohol purchases.

New statewide parking garage tax ($60 million)

Daily and hourly garage parking would be hit with a 6% tax while monthly and annual garage parking would come with a 9% tax. Chicagoans already pay among the highest parking rates in the country. The state does not currently tax garage parking.

Doubling the real estate transfer tax ($34 million)

The proposaldoubles the real estate transfer tax on non-residential real estate to $1 from 50 cents per $500 in value.

Hiking registration fees for electric vehicles ($4 million)

The registration fee for electric vehicles would rise to $250 per year from $34 every other year.

Pork for progressive tax

Pritzker also released a list of new capital projects that would be funded with this new revenue. But the state’s most pressing infrastructure needs may not be top of mind.

According to Politico Illinois, “Democratic leaders are subtly offering a piece of the capital bill to get votes for the progressive income tax. Lawmakers get a sense that they could be treated well in the capital bill if they vote in favor of a graduated income tax, which Pritzker calls ‘the fair tax.’”

Using a capital bill as a political tool to pass the progressive income tax amendment – which is unpopular in Illinois House districts held by Democrats – is a recipe for poor spending choices.

Fortunately, the Illinois Policy Institute on May 16 published a smarter roadmap for lawmakers: an evidence-based, $10 billion capital plan without any tax or fee hikes.