Democratic gubernatorial candidate J.B. Pritzker has promised a number of new spending programs as well as closing Illinois’ current structural deficit. To finance these promises, Pritzker has proposed a progressive income tax hike.

But how much would these promises cost? And how high would taxes need to be to finance them?

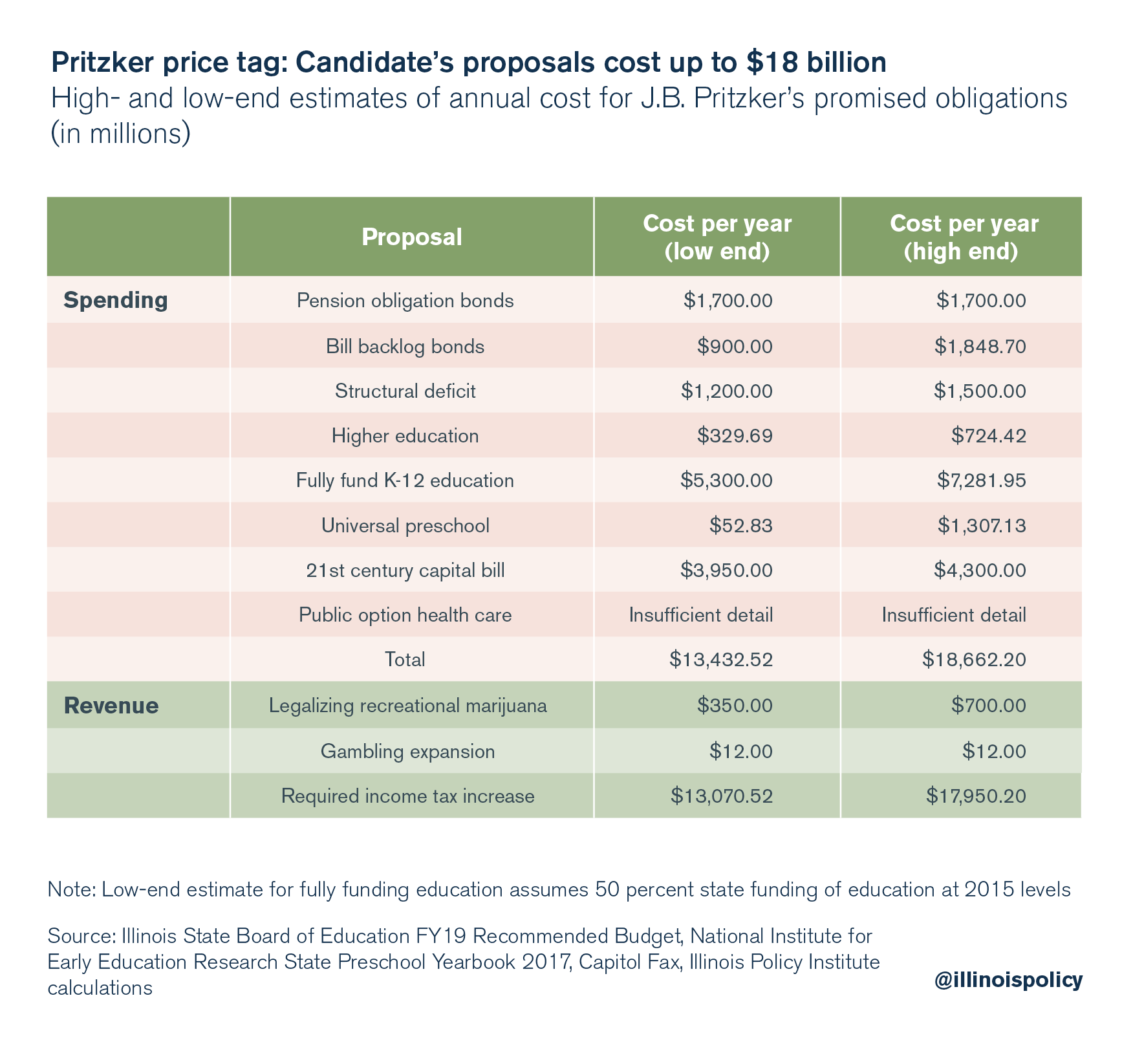

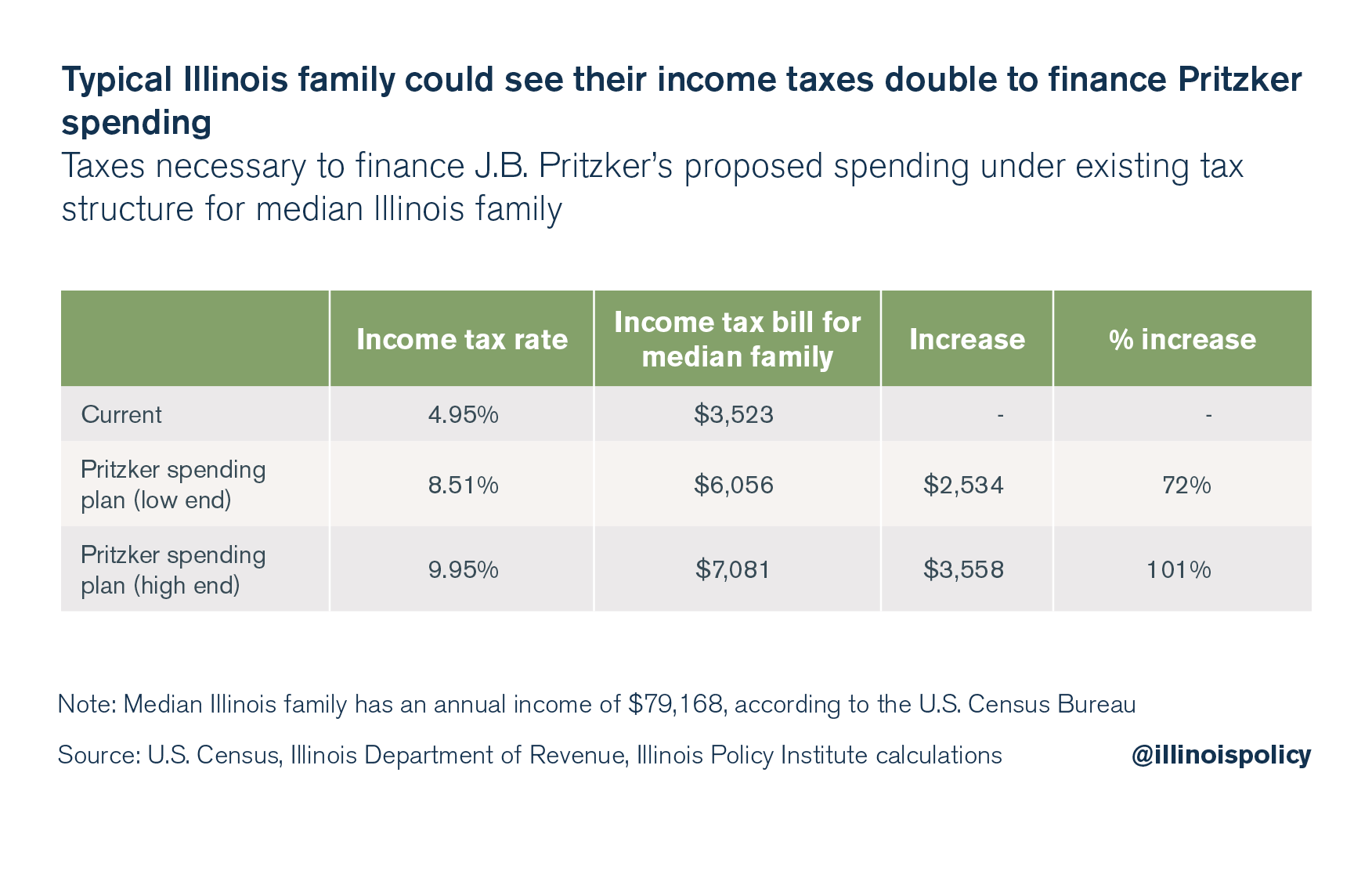

Reasonable estimates show the cost of Pritzker’s spending promises demand an income tax hike of $13 billion to $18 billion. This would require approximately doubling the state’s personal income tax to 9.95 percent on the high end and 8.51 percent on the low end from the current 4.95 percent income tax rate.

That means within the existing flat income tax structure, which would remain in place until at least 2020, the typical family in Illinois making just over $79,000 would pay an additional $2,500 to $3,500 in income taxes in order to finance Pritzker’s spending promises.

Economic modeling shows a tax hike of this magnitude could cost the state between 94,000 and 132,000 jobs and $22.4 billion to $31.3 billion in economic activity.

Illinois taxpayers deserve to know the effects of policy proposals by aspiring elected officials. Unfortunately, Pritzker has yet to release any details about his tax policy proposal, including the amount of revenue he wants to raise or the tax bracket schedule under his progressive income tax hike. As a result, it is necessary to approach his tax plan in reverse by estimating the following:

- The cost of Pritzker’s potential spending based on public statements

- The tax rates necessary to pay for that spending

- The economic impact of the resulting tax increase

Members of the Illinois media have been trying to get clear answers from Pritzker regarding how much revenue he would like to raise through tax increases and what his tax rates would be for each income level under a progressive income tax.

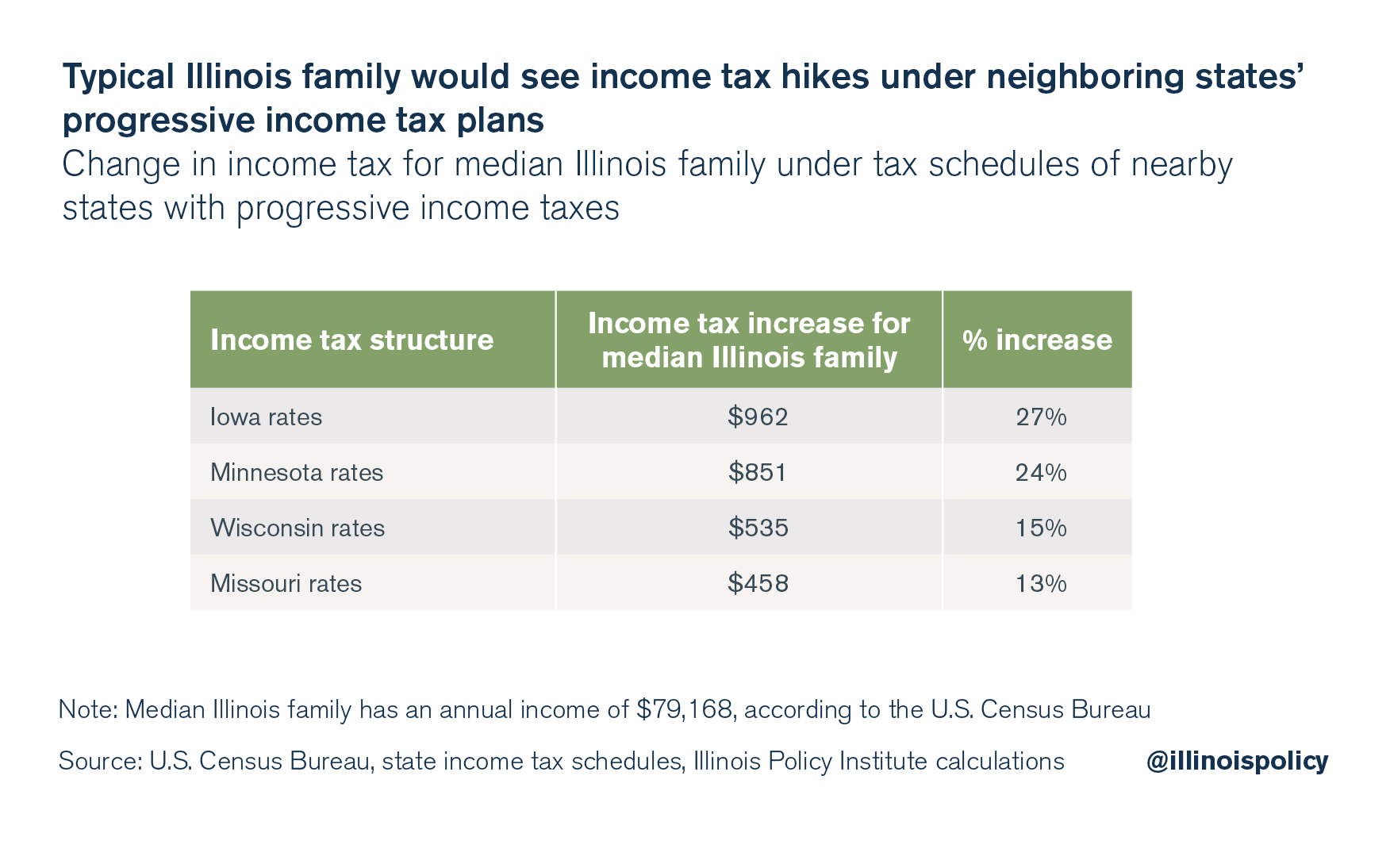

The closest the candidate has come so far to providing those answers was in a radio interview with WJBC-AM 1230 in April. In that interview, Pritzker pointed to Minnesota, Wisconsin, Iowa and Missouri as examples of what his tax plan could look like. The median income family in Illinois would pay higher income taxes under every one of those states’ plans.

But because Pritzker will not provide more detail, and because he also has stated he wants to cut taxes for the middle class, reporters have been left to speculate as to how much additional revenue he wants to raise. Rich Miller from the Springfield-based political blog Capitol Fax came up with one estimate, which he originally pegged at $5.6 billion. After Pritzker’s recent comments on education funding, Miller revised his estimate upward to $10.7 billion. These estimates, while useful, are too low.

This report uses public statements from Pritzker and various government data to develop estimates of the fiscal impact of his new spending proposals.

At the high end, the new spending promised by Pritzker could cost taxpayers more than $18 billion per year.

This cost estimate demonstrates that given the amount of revenue needed to fulfill his campaign promises, it would be virtually impossible for Pritzker to cut taxes on the middle class through a progressive tax. The reason is simple: middle-class Illinoisans far outnumber wealthy Illinoisans. According to data from the Internal Revenue Service, just 0.3 percent of Illinois tax returns reported income of over $1 million.

In looking at examples of detailed progressive tax plans in Illinois, this reality becomes more clear. A progressive tax proposal from the Center for Tax and Budget Accountability, or CTBA, would hike taxes on anyone earning more than $300,000 a year – about 2 percent of Illinois taxpayers according to CTBA’s calculations – but would have only raised $2 billion in a static estimate (assuming no negative economic effects of higher taxes).6

So what would tax rates have to look like in order to raise $13 billion to $18 billion in new revenue?

This analysis estimates the tax rates necessary to cover Pritzker’s promised spending based on the current flat tax structure in Illinois. While Pritzker has proposed instituting a progressive income tax, he has not released his own rate schedule, so there is no concrete plan that can be used for estimates. Additionally, a progressive income tax cannot be implemented in Illinois prior to fiscal year 2021.

Pritzker has previously floated the idea of an “artificial progressive income tax,” wherein lawmakers increase the flat tax rate but also increase deductions and exemptions for lower income earners to reduce their effective rate. However, the candidate has not released any details about the value of the increased deductions, so those cannot be credited in any estimate.

Under the existing tax structure, which a potential Gov. J.B. Pritzker would almost certainly have to work with for fiscal year 2020, the cost of the candidate’s spending promises could mean doubling the income taxes paid by a median income Illinois family making $79,168, according to the U.S. Census Bureau.

Raising $18 billion to finance Pritzker’s spending promises would require nearly doubling Illinois’ personal income tax rate to 9.95 percent from 4.95 percent. At the low end, Pritzker’s new spending would cost $13 billion. Raising $13 billion in additional revenue would mean increasing the personal income tax rate to 8.51 percent from 4.95 percent, a 72 percent hike.

After applying Illinois’ standard personal exemption of $2,000, the median income family would pay an additional $2,534 to $3,558 in taxes in order to finance Pritzker’s spending promises with the existing tax structure.

If Pritzker truly wants to fix Illinois finances and provide tax relief to hard-working residents, he should abandon his progressive tax plan and expensive new spending promises, focusing instead on meaningful spending reforms such as an amendment to the state constitution’s pension clause and a spending cap.

(Read the complete report here).