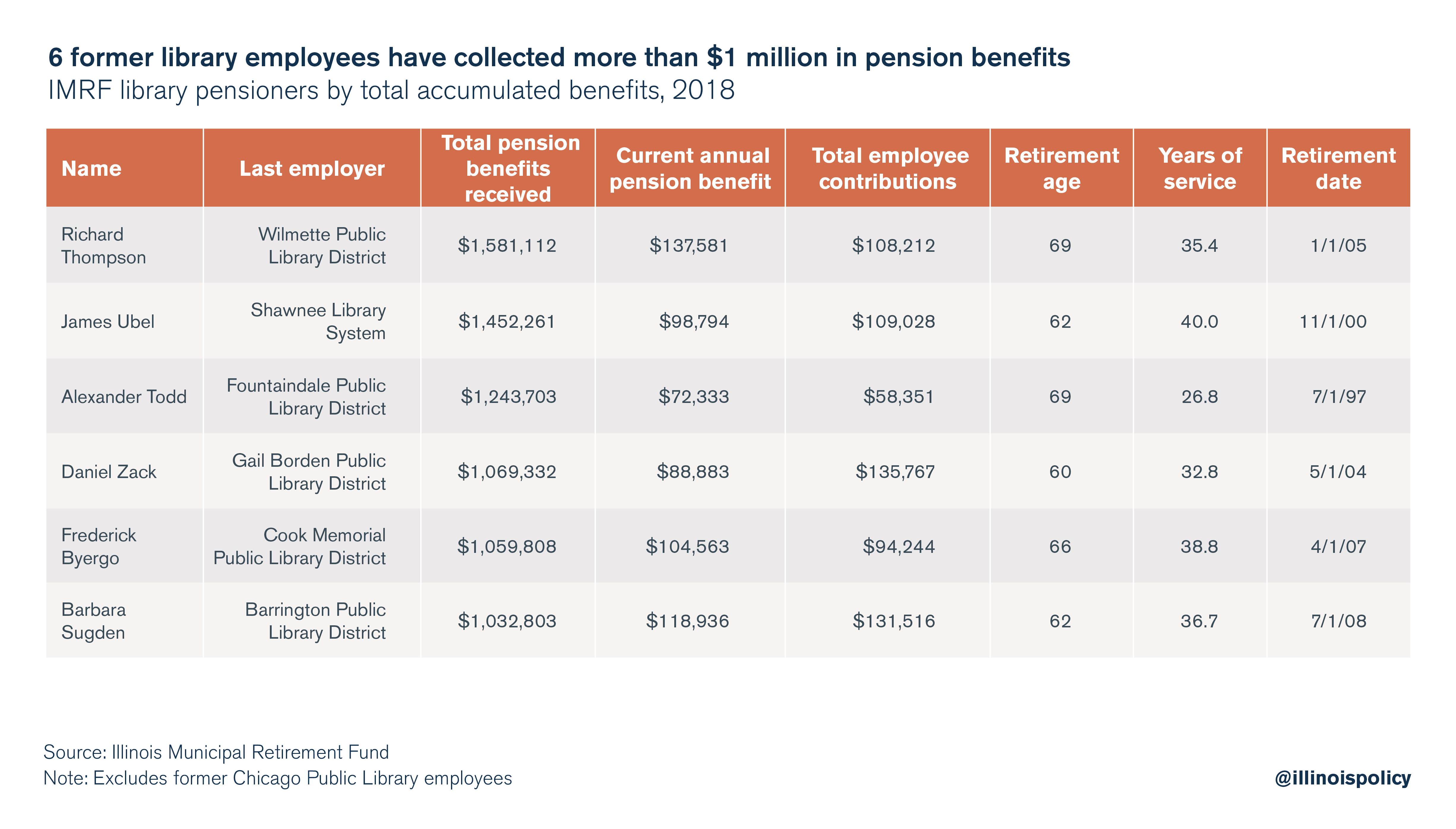

Public records from Illinois’ municipal retirement fund show especially high payouts for a select group of former library employees in Illinois.

Six current retirees from Illinois libraries have each taken home more than $1 million in benefits over the course of their retirements, according to data from the Illinois Municipal Retirement Fund. This data excludes Chicago Public Library retirees.

Taken alone, these extraordinarily high payouts are not the primary driver of Illinois’ pension crisis. And retirees themselves are not to blame for the growing costs to taxpayers. But these benefits do illustrate the unfairness inherent in Illinois’ defined-benefit pension scheme.

Nearly 20,000 retirees enrolled in Illinois’ six state pension systems currently receive six-figure pensions, according to data from the Taxpayer Education Foundation. And most of these former workers receive automatic, compounding 3 percent increases in their payout each year.

In a state where taxpayers are seeing among the weakest income growth in the nationand some of the highest property taxes as well, this system is unsustainable.

Pension reform is a moral imperative in Illinois – for the interests of government workers, taxpayers and those reliant on core government services alike. But the Illinois Supreme Court has repeatedly blocked commonsense reforms that would bring more stability to the pension funds and offer a path toward tax relief.

A constitutional amendment protecting already-earned benefits but permitting changes to future, not-yet-earned benefits would allow for the following reforms, most of which achieved bipartisan support in Illinois in 2013:

- Increasing the retirement age for younger workers

- A cap on the maximum pensionable salary that grows at a rate pegged to inflation

- Replacing Illinois’ 3 percent guaranteed annual benefit increases with a cost-of-living increase tied to inflation

- The ability to suspend cost-of-living increases during certain years, allowing inflation to catch up to past raises

Without action from state lawmakers on pension reform, government employees can expect their retirement funds to race toward insolvency, taxpayers can expect calls for further tax hikes, and Illinoisans who need access to government programs will continue to watch those services crowded out of state and local budgets.