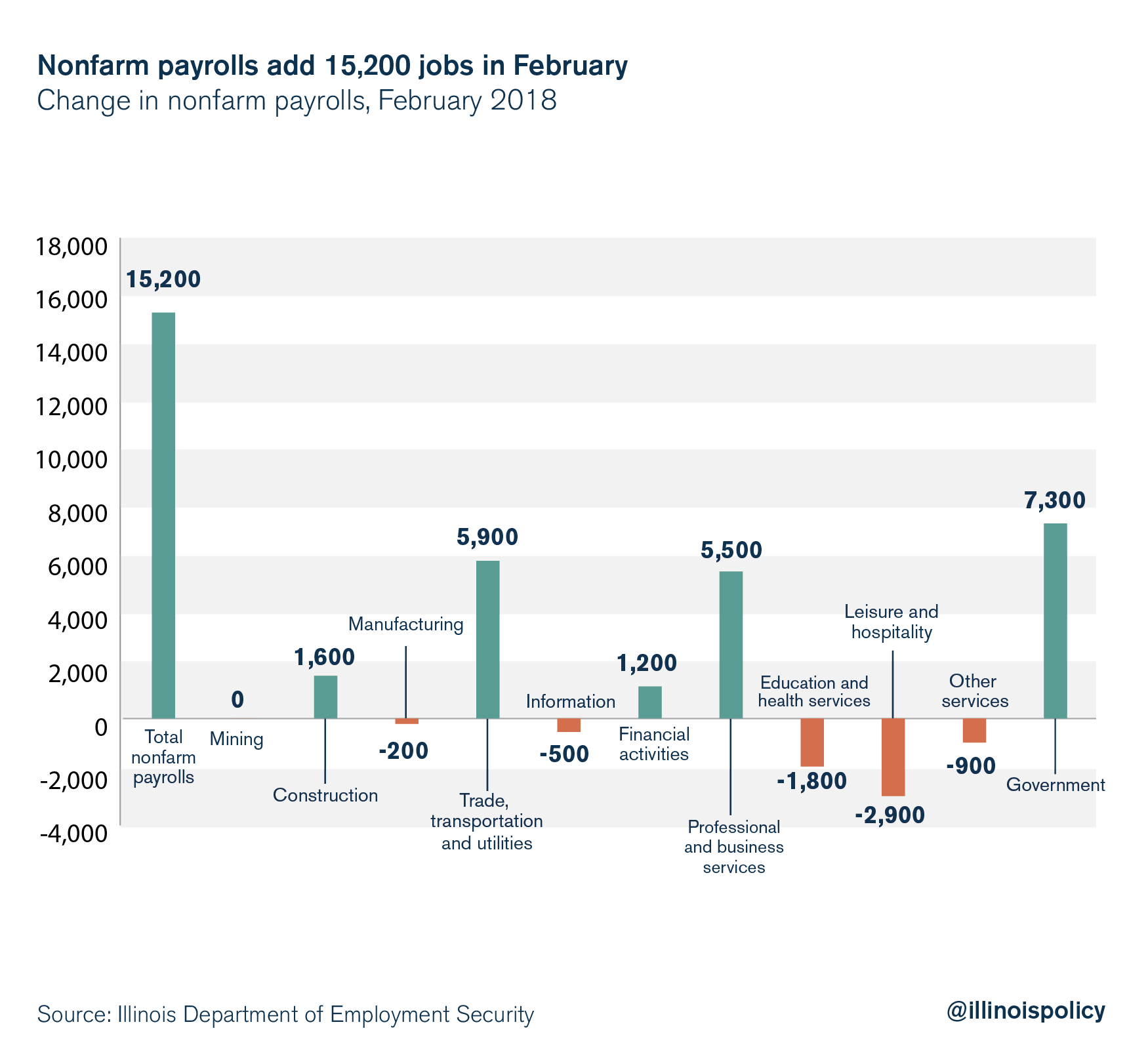

Nonfarm payrolls increased by more than 15,000 during February, according to data released March 22 by the Illinois Department of Employment Security, or IDES. This 0.25 percent growth in payrolls is better than the 0.21 percent growth seen in the rest of the U.S.

But rather than gains in Illinois’ private sector, growth in government payrolls made up more than half the state’s employment growth over the month. Specifically, growth in the government sector was driven by local government payroll expansions, which increased by 7,800, while state government payrolls added 100 jobs and federal government payrolls actually shed 600 jobs.

In February, the industry sectors with gains in employment were government (+7,300 jobs, +0.9 percent); trade, transportation, and utilities (+5,900, +0.5 percent); professional and business services (+5,500, +0.6 percent); construction (+1,600, +0.7 percent); and financial activities (+1,200, +0.3 percent).

In February, the industry sectors with gains in employment were government (+7,300 jobs, +0.9 percent); trade, transportation, and utilities (+5,900, +0.5 percent); professional and business services (+5,500, +0.6 percent); construction (+1,600, +0.7 percent); and financial activities (+1,200, +0.3 percent).

The industry sectors with payroll declines were leisure and hospitality (-2,900, -0.5 percent); education and health services (-1,800, -0.2 percent); other services (-900, -0.4 percent); information (-500, -0.5 percent); and manufacturing (-200, -0.03 percent). The mining sector saw no change in payrolls over the month.

This month’s IDES report also made revisions to January payroll estimates. These adjustments revealed January nonfarm payrolls actually decreased by 1,300 rather than the increase of 200 jobs originally reported.

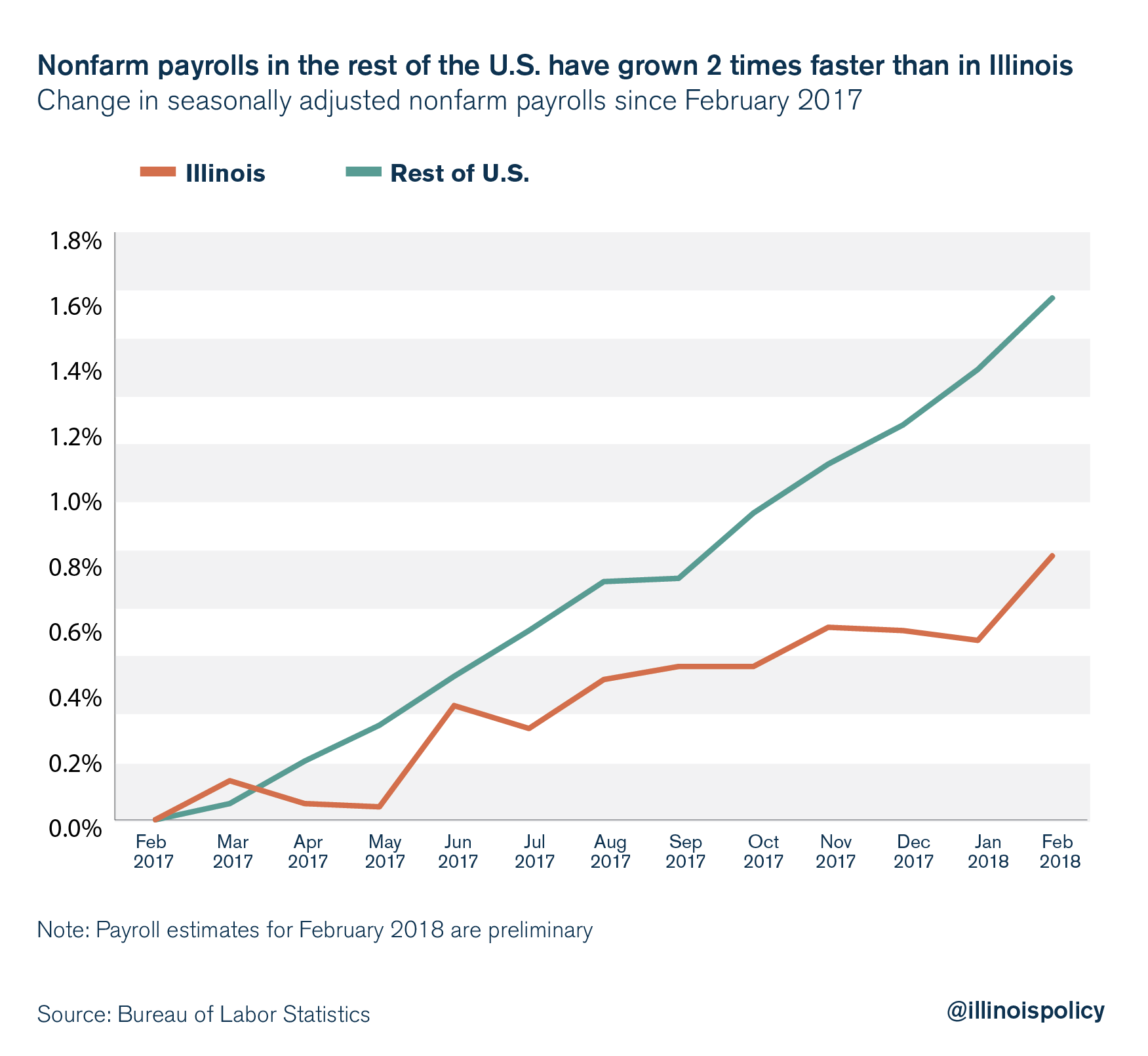

While it’s good to see Illinois outperformed the U.S. in terms of monthly employment growth for the first time since September 2017, payrolls have only increased half as fast as the rest of the nation in the past year.

The increase in local government payrolls is concerning as they are largely financed through property taxes, which make up over 80 percent of all local government tax revenue. Illinoisans already face one of the highest property tax burdens in the nation, and expanding the number of local government workers will only exacerbate this burden. Furthermore, increasing property taxes and weak private sector employment growth can be expected to have a negative effect on home values, which are still below their pre-recession level in Illinois.

Illinois would be better suited to limit the expansion of local government payrolls and provide families and businesses within Illinois relief from the highest tax burden in the nation. This would help to stimulate private investment, resulting in stronger employment growth.

If Illinois is to do this, the state needs policies that will incentivize investment and growth, and inspire confidence in job seekers to stay in the labor market – and Illinois in general.

This does not include considering yet another income tax hike. Elected officials and gubernatorial candidates alike have been touting their support for enacting a progressive income tax system in Illinois. Given what Illinoisans know about the rates put forth in House Bill 3522, a progressive income tax would constitute a tax hike of 21 percent, and increase tax bills for Illinoisans earning as little as $17,300.

Meanwhile, the 2017 income tax hike is still being felt throughout the state, and is expected to shrink the state’s economy. This progressive income tax proposal would likely drag the state’s economy down even further, resulting in declining investment and fewer opportunities available to families who are trying to make ends meet.

Instead of saddling taxpayers with a higher income tax burden, lawmakers need to rein in the growth of government spending with a spending cap. Fortunately for taxpayers, state Sen. Tom Cullerton, D-Villa Park, and state Rep. Allen Skillicorn, R-East Dundee, have both filed constitutional amendments tying growth in state spending to growth in the state’s economy: SJRCA 21 and HJRCA 38.

If other lawmakers were to follow their lead and support these efforts, Illinois could provide certainty for businesses while averting the need for future tax hikes, thus putting the state on a path toward healthier economic growth.