Illinoisans struggling to make ends meet might be surprised to hear there’s another big tax hike in the works. This time they’ll be required to pay more at the pump.

There’s talk in Springfield of an increase in gas taxes to fund new roads, bridges and infrastructure projects. Unfortunately, the recently passed budget and its record $5 billion income tax hike didn’t cover new, major infrastructure spending. Instead, new infrastructure is typically funded by a capital bill, with its own set of debt and dedicated funds.

The state last passed a capital bill in 2009, when it appropriated $31 billion for infrastructure projects.

Lawmakers haven’t put out any numbers on the size of the tax to finance a new plan yet, though state Sen. Dave Syverson, R-Rockford, has said it may increase the cost of gas by 5 cents a gallon. That would imply a total tax hike of approximately $350 million.

Other groups have introduced far more expensive proposals. The Metropolitan Planning Council as recently as last year called for a 30-cents-per-gallon increase in state motor fuel taxes and a 50 percent increase in vehicle registration fees as part of a $43 billion capital plan. That would drain more than $2 billion from taxpayers annually.

The additional 5 to 30 cents a gallon in these proposals would come on top of the taxes Illinoisans already pay at the pump.

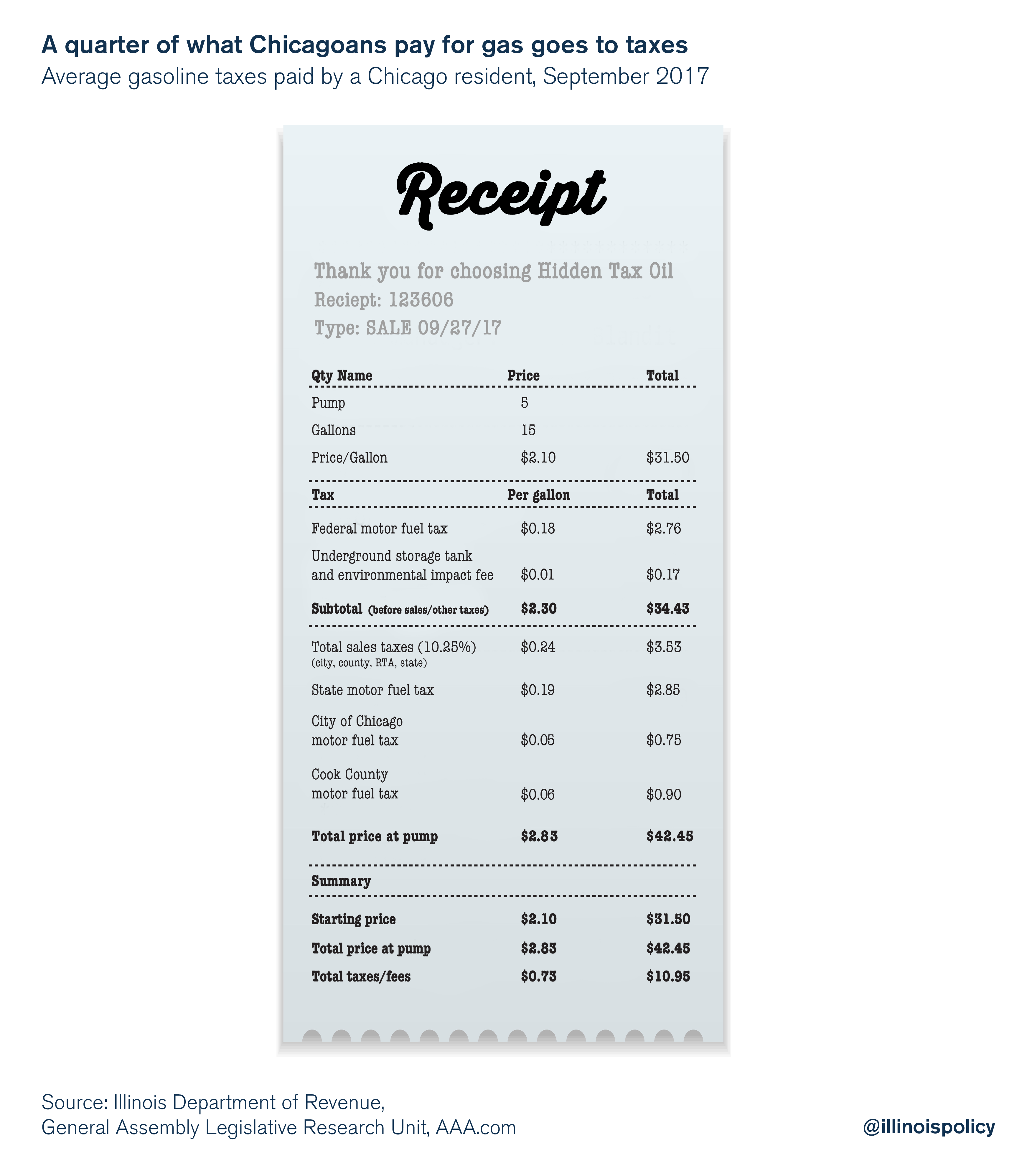

Take Chicagoans, for example. City drivers on average pay $2.83 at the pump, according to AAA, and a fourth of that price is due to taxes.

On average, Chicagoans pay more than $0.70 in federal, state and local taxes on every gallon of gas.

The typical Chicagoan’s gasoline bill includes the following taxes:

- A federal motor fuel (excise) tax of 18.4 cents

- State underground storage and environmental fees of a little over 1 cent

- A slew of sales taxes that total 10.25 percent, or roughly 24 cents per gallon based on today’s gas prices*:

- 6.25 percent state sales tax

- 1.25 percent Chicago sales tax

- 1.75 percent Cook County sales tax

- 1.00 percent Regional Transportation Authority sales tax

- And more state and local motor fuel (excise) taxes:

- 19 cent state motor fuel tax

- 5 cent Chicago motor fuel tax

- 6 cent Cook County motor fuel tax

So when Chicagoans fill their tanks with 15 gallons of gas, it costs them over $42 dollars, with nearly $11 going to taxes.

Illinois just 1 of 7 states with sales tax on gas

The gas taxes Illinoisans pay are far higher than in most other states because of a particular feature. Illinois, along with just six other states (California, Connecticut, Georgia, Indiana, Michigan and New York), applies sales taxes to gasoline. That means when gas prices go up, so do the taxes Illinoisans pay.

For example, when gasoline cost more than $4 a gallon in 2011, sales taxes jumped and American Petroleum Institute data showed Illinoisans paid the third-highest gas taxes in the country.

And when gas prices are relatively modest, as they are now, Illinois’ gas tax burden declines.

Nevertheless, Illinoisans today currently pay the 18th-highest gas taxes in the country.

Gas taxes add to Illinoisans’ burden

Illinoisans already face some of the highest combined state and local tax burdens in the nation, and the highest property tax burden of any state. And that burden is growing.

Residents just got hit with the largest permanent income tax increase in state history as part of the 2018 budget. And Chicagoans have had to deal with a spate of tax and fee increases, from record property tax hikes to new sugary drinks taxes.

But for politicians, all those taxes are not enough. They may hike gas taxes even though Illinoisans already pay some of the highest gas taxes in the nation.

It’s galling that lawmakers are considering imposing yet another burden on taxpayers. They have yet to fix the pension crisis, pass a truly balanced budget, reduce property tax burdens, or remove burdensome costs on job creators.

Politicians need to stop thinking of ways to tax struggling Illinoisans.

Yes, a capital plan is imperative to making Illinois more competitive and to addressing any urgent infrastructure needs, but any plan should balance the cost of improvements with the burdens Illinoisans already face. Lawmakers should focus more on enacting structural reforms, pursuing private investments, and crafting sensible public-private partnerships to fund any new plan.