Public university and college leaders in Illinois are quick to blame the state’s recent two-year budget impasse for their financial and enrollment troubles To be sure, Illinois’ budget impasse created difficulties for any group counting on money from the state.

But the budget debacle actually exposed a much deeper crisis in higher education.

For decades, Illinois colleges and universities have prioritized administrators over students, overspending on bloated bureaucracies and expensive compensation, all while hiking student tuition. A 2015 report by the Illinois Senate Democratic Caucus concluded: “Much of this [increase in tuition and fee] revenue growth has been used to support an increasingly larger bureaucracy and excessive administrative salaries.”

That’s made higher education in Illinois unaffordable for too many of Illinois’ students, especially those with limited means.

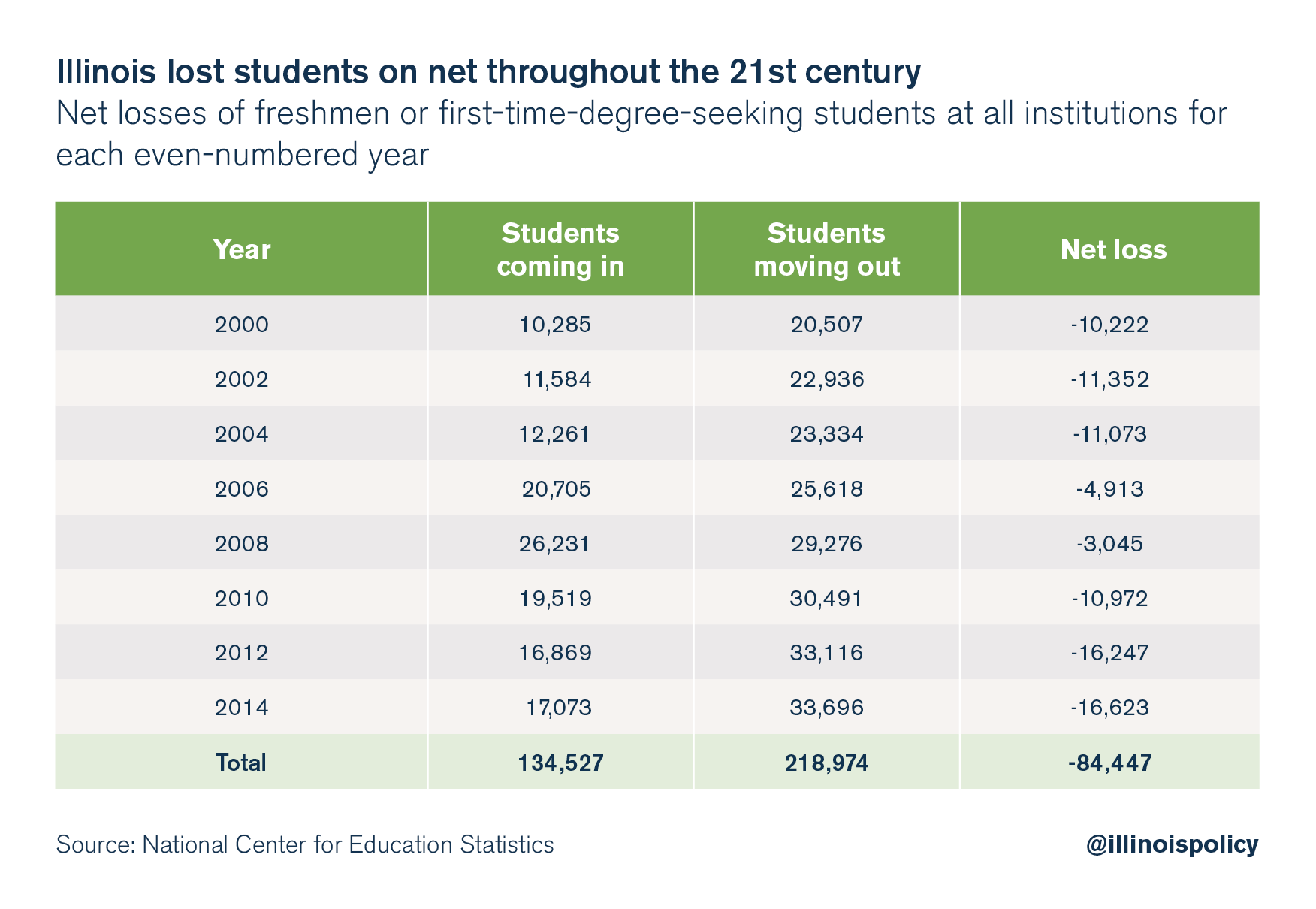

As a result, Illinois students have been forced to look for opportunities elsewhere. According to a National Center of Education Statistics survey run every two years, Illinois lost a net 84,000 students to other states from 2000 through 2014. Assuming the loss of students remained consistent during non-survey years, Illinois lost at least a net 150,000 students between 2000 and 2014.

More than 16,000 students left to attend college elsewhere in 2014 alone – before the two-year budget impasse even began.

The number of higher education administrators has grown even as students have left. The number of administrators in Illinois’ universities grew by more than 30 percentbetween 2004 and 2010. The student population, in contrast, grew by just 2.3 percent.

Universities have been paying those administrators exorbitant salaries. According salary data from the Illinois Board of Higher Education, more than half of Illinois’ 2,500 university administrators received a base salary of $100,000 or more in 2015.

The top-compensated university administrator in 2014, University of Illinois Chancellor Paula Allen-Meares received nearly $890,000 that year. And Dale Chapman, the President of Lewis and Clark Community College, received more than $540,000 in total compensation.

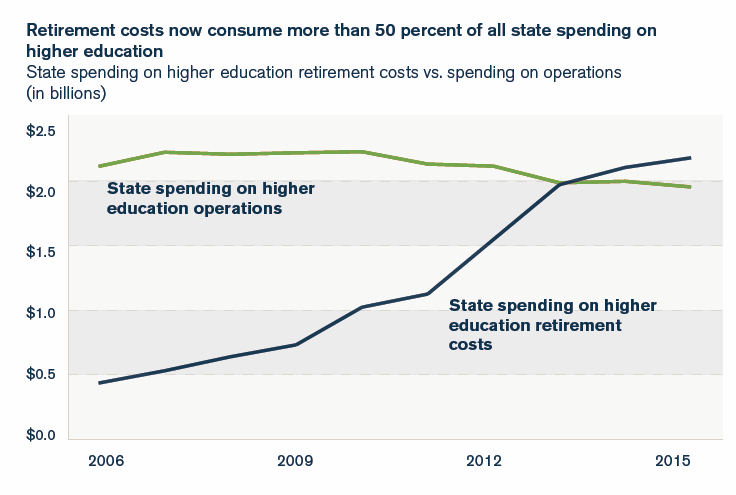

With those high salaries come high retirement costs. Because university retirees’ annual pension benefits are determined in part by their final average salaries, large salary increases coupled with generous pension rules, have boosted the retirement benefits of university employees far beyond what taxpayers can afford.

Of the more than 52,000 current State Universities Retirement System, or SURS, retirees, over 50 percent retired in their 50s, many with full pension benefits.

Almost half will see their annual pension benefits double over the course of their retirement, based on approximate life expectancies.

And over 40 percent will receive more than $1 million in total retirement benefits, and over 7,400 (14 percent) will receive more than $2 million in benefits.

With those numbers, it’s no surprise pension costs now consume half of all state contributions to higher education.

To pay for administrative excesses, student tuition and fees at public universities grew anywhere from 75 to 110 percent between 2006 and 2016.

At the University of Illinois at Urbana-Champaign, the public university with the highest tuition and fee costs in the state, average tuition now costs $15,626 annually, up 80 percent since 2006.

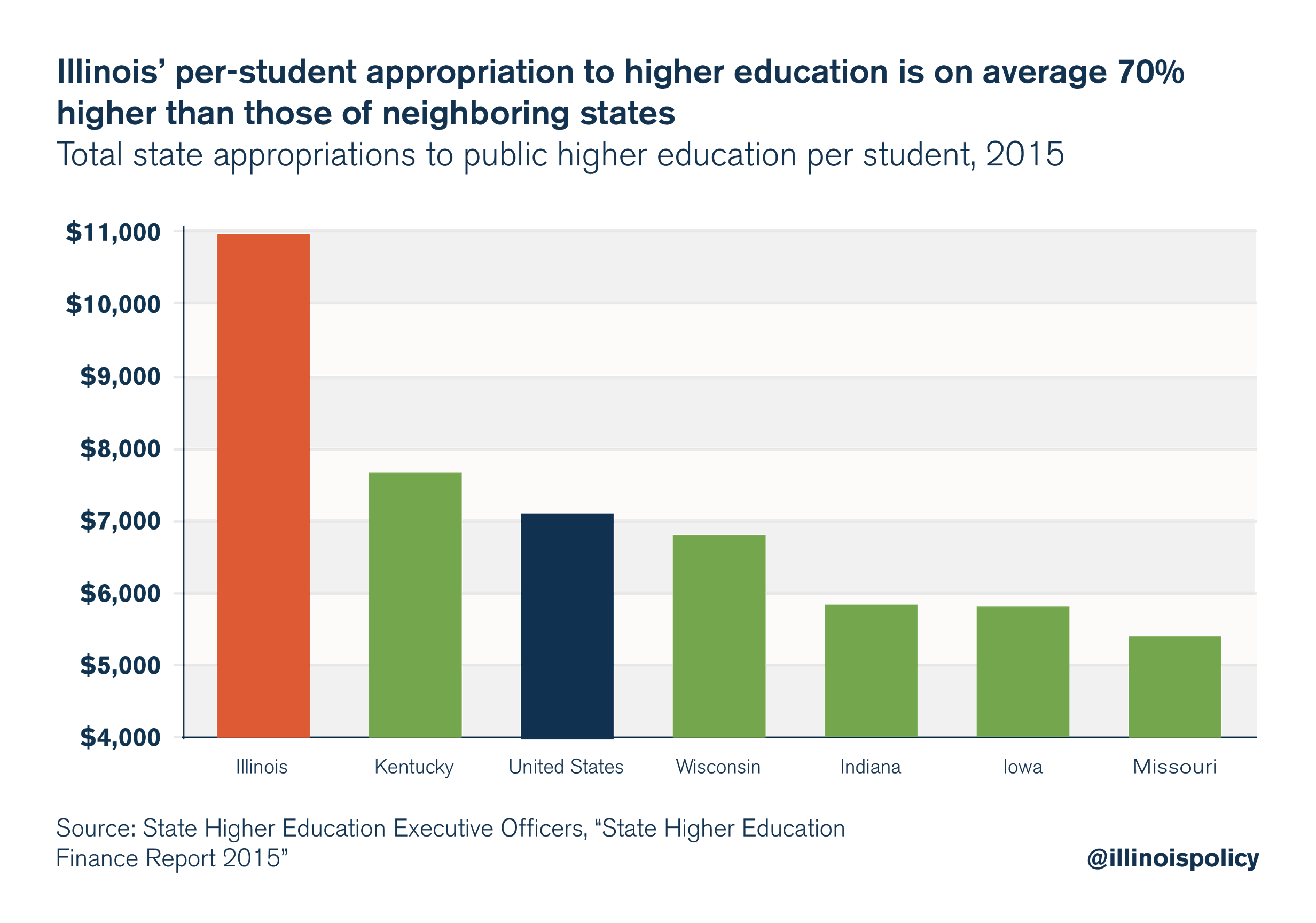

Today, Illinois’ average in-state tuition and fees for public universities is over $13,000. That’s about 50 percent higher than in neighboring states.

The budget impasse was harmful, but blaming it for all of the state’s higher education woes only distracts from the problems Illinois universities created themselves. Universities should bring their costs in line with what students can afford. If not, the student exodus will continue.