After Puerto Rico declared a form of bankruptcy May 3, The New York Times used these words to describe the U.S. territory’s fiscal woes: “borrowing to pay operating expenses, year after year”; “unable to provide its citizens effective services”; and “rising pension costs, crumbling infrastructure, departing taxpayers and credit downgrades.”

This diagnosis should sound very familiar to anyone living in Illinois.

The striking similarities between insolvent Puerto Rico and the Land of Lincoln serve as a dire warning: Without real reforms, Illinois won’t be able to shake off an eventual junk bond rating or get off the path to financial ruin.

The Times says as much: “While many of Puerto Rico’s circumstances are unique, its case is also a warning sign for many American states and municipalities – such as Illinois and Philadelphia.”

The Times went further, saying that the island’s total financial collapse will only make things worse: “Government workers will forgo pension money, public health and infrastructure projects will go wanting, and the ‘brain drain’ the island has been suffering as professionals move to the mainland could intensify.”

Illinois is destined for a similar outcome if it doesn’t pass the structural spending reforms that Puerto Rico avoided for decades.

Of course, Illinois isn’t Puerto Rico. The island’s per capita debt, pension, budget, out-migration and economic crises are far more dire than Illinois’ own.

But it’s not just the crises themselves that invite comparison, but rather how Illinois and Puerto Rico have responded to them. Or rather, not responded.

Puerto Rico, Illinois leaders avoid reforms necessary to prevent fiscal collapse

Politicians in both Puerto Rico and Illinois have been unwilling to pass the structural reforms both places desperately need. The political class is beholden to public sector unions, trial lawyers and other politically connected insiders.

As a result, necessary pension and spending reforms have been ignored, massive borrowing continues, out-migration has picked up, and high taxes have gone even higher, all while finances have spiraled downward.

Puerto Rico, like Detroit before it, represents the endpoint of politicians maintaining a failed status quo: total financial collapse.

Previously, there were no laws that allowed Puerto Rico to declare any form of bankruptcy, but in 2016 Congress was pressured to pass special legislation that allowed the island to do so. With that precedent, it’s a possibility that Congress could treat Illinois similarly.

Illinois isn’t there yet, but the state’s worsening situation can easily be compared to what’s happened to Puerto Rico:

- A massive, growing pension crisis

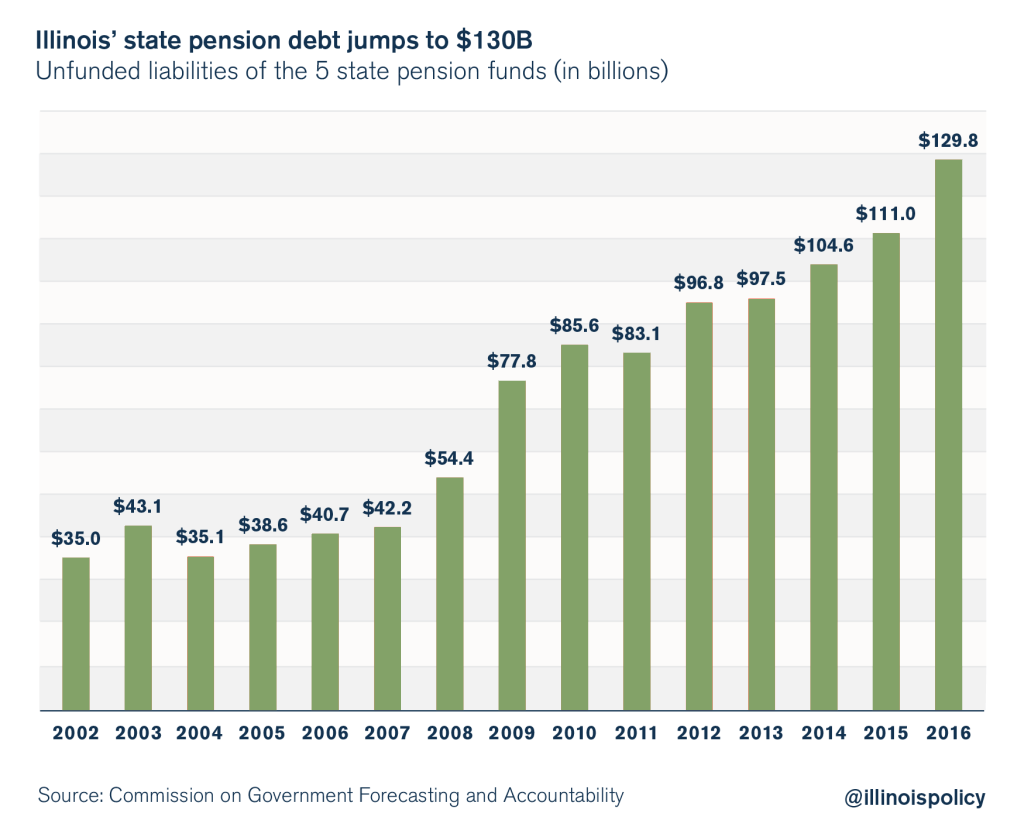

For decades, Puerto Rico did nothing to fix its pension crisis. Today, the commonwealth’s pension system is basically insolvent. Every penny that goes into the fund is immediately spent on current retiree benefits.That sounds awfully familiar to what Dick Ingram, the head of the Illinois Teachers’ Retirement System, or TRS, said in 2012 when he cited a forecast indicating TRS’ funds could run dry by 2029.Some Chicago pension funds are also on track to collapse soon.Illinois has been ignoring a pension crisis that piles a bigger burden on the backs of Illinoisans every day that reforms aren’t enacted.Total state pension debt has skyrocketed over the past 15 years to over $130 billion in 2016.

In 2002, the state pension debt burden per household was $7,600. Today, it is nearly four times higher, at $27,000 per household.

And that’s just state pension debt; that doesn’t include local government pensions or health care debt.

In fact, when it’s all added up, total unfunded pension and retiree health care debt across all levels of Illinois government has grown to $267 billion. That’s $56,000 in total government retirement debt per household.

What’s even more disturbing is the fact that this massive debt is based on official government numbers that use rosy assumptions. Under more realistic assumptions, the situation is much worse for Illinoisans.

- A collapsing credit rating

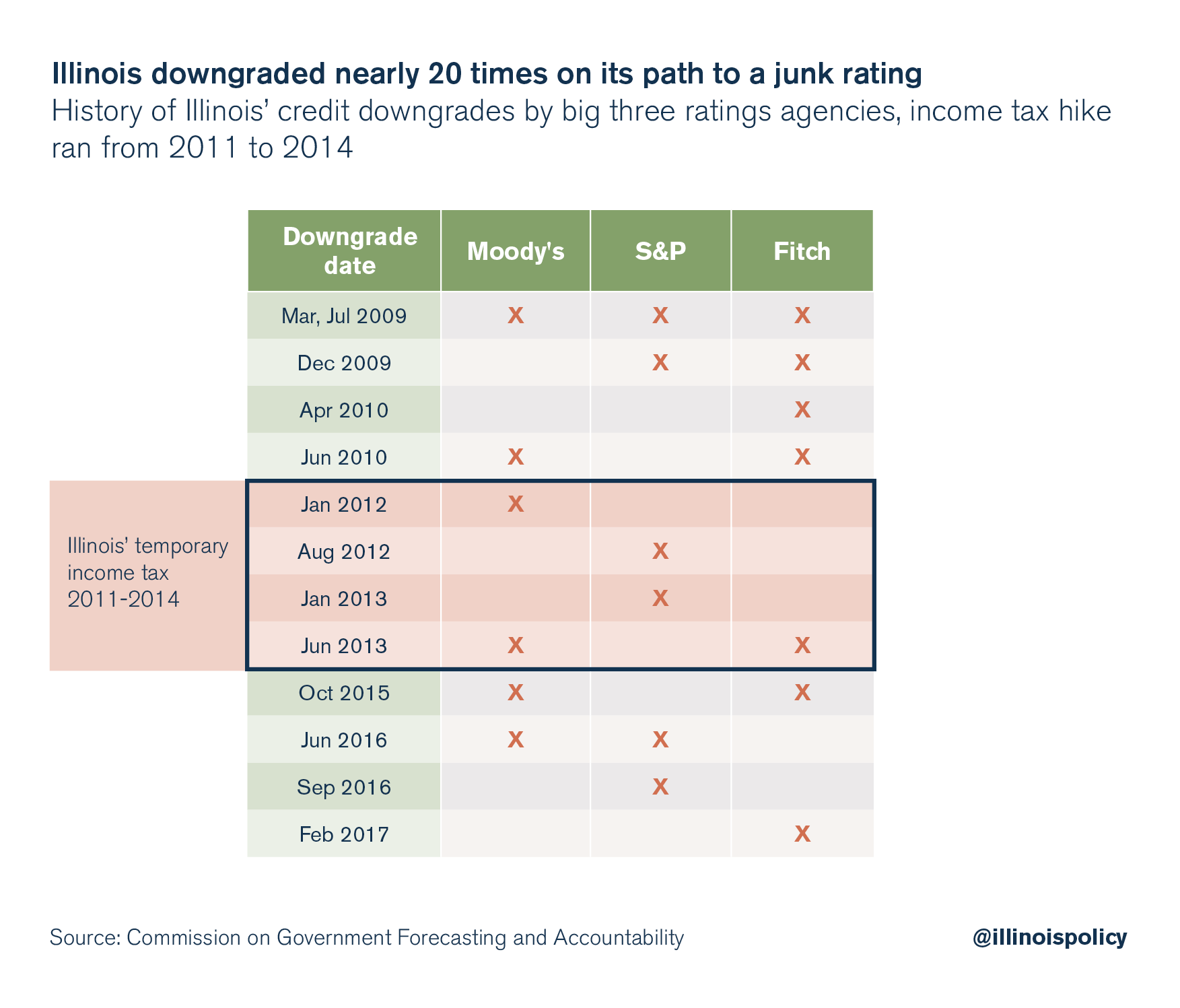

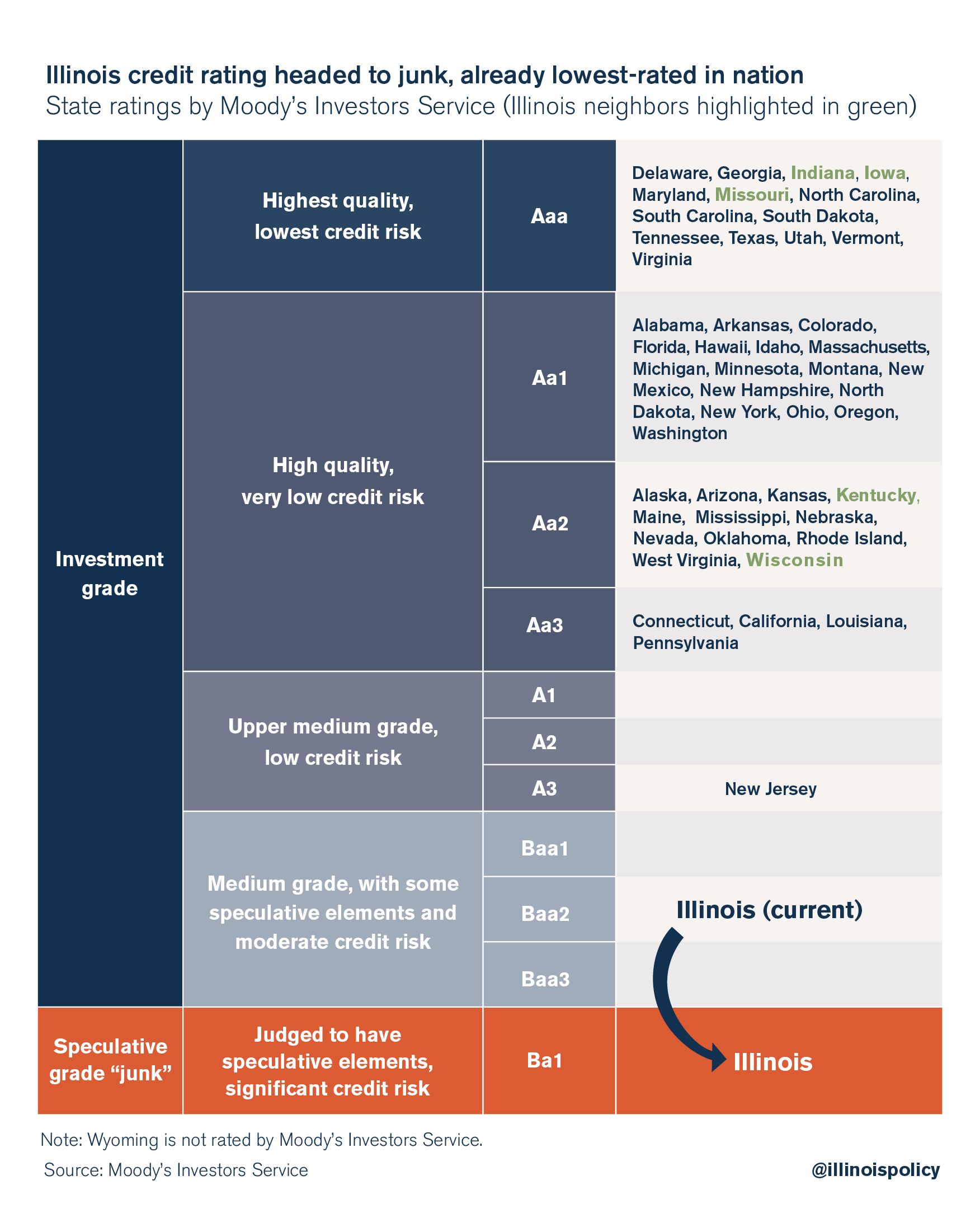

Puerto Rico’s bankruptcy reflects its failed pension system, as does the massive penalty it’s been paying to borrow money due to its junk rating.Similarly, Illinois’ credit rating has taken a dive as the state has failed to pass any significant spending reforms over the last several years. The state’s rating is now just two notches above junk status after experiencing nearly 20 downgrades from the big three ratings agencies.

The state’s borrowing cost is now far higher than that of any other state. And it may join Puerto Rico in junk status very soon. Both Moody’s Investors Service and Standard & Poor’s Global Ratings have warned that Illinois could be downgraded again, possibly by two notches, if the state’s financial crisis continues.If that happens, Illinois would be the first state in the nation to fall to junk status – delivering another blow to Illinois’ already low reputation.

The state’s borrowing cost is now far higher than that of any other state. And it may join Puerto Rico in junk status very soon. Both Moody’s Investors Service and Standard & Poor’s Global Ratings have warned that Illinois could be downgraded again, possibly by two notches, if the state’s financial crisis continues.If that happens, Illinois would be the first state in the nation to fall to junk status – delivering another blow to Illinois’ already low reputation.

A junk rating would further discourage investment, job creators and the in-migration of new residents. It would also hurt Illinois financially and push up borrowing costs, taking even more funds away from core government programs and social service providers.

- Accelerating out-migration

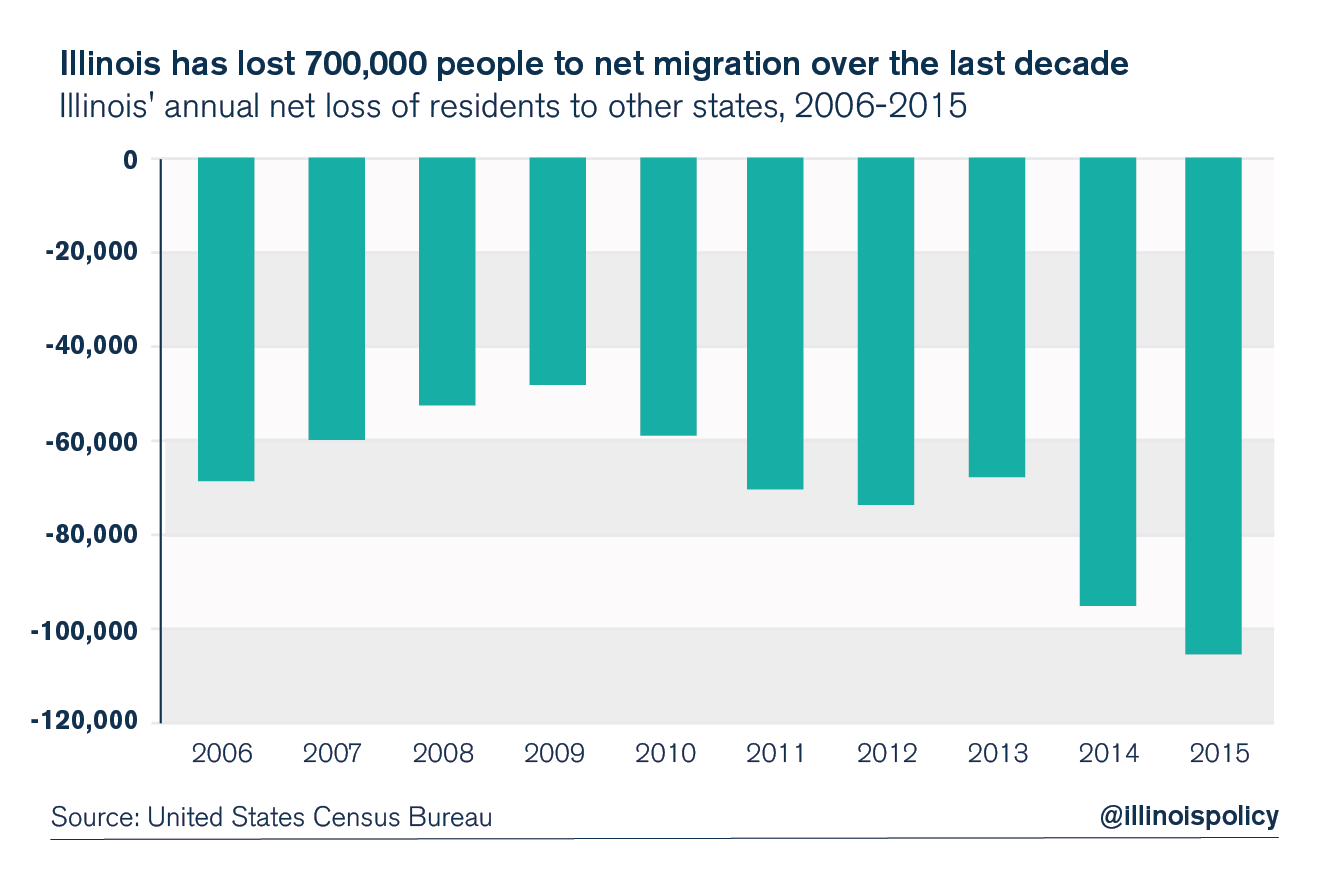

Puerto Rico has been bleeding residents at a rapid rate. Jobs are growing more and more scarce, and taxation is high. The island has lost 20 percent of its jobs and 10 percent of its population since 2007 alone, according to USA Today.Illinois has been suffering an exodus of its own. Illinois has lost a net of 700,000 people to other states over the last decade.

Thanks to international immigration, Illinois has avoided actually shrinking for a majority of those years. But things are changing.

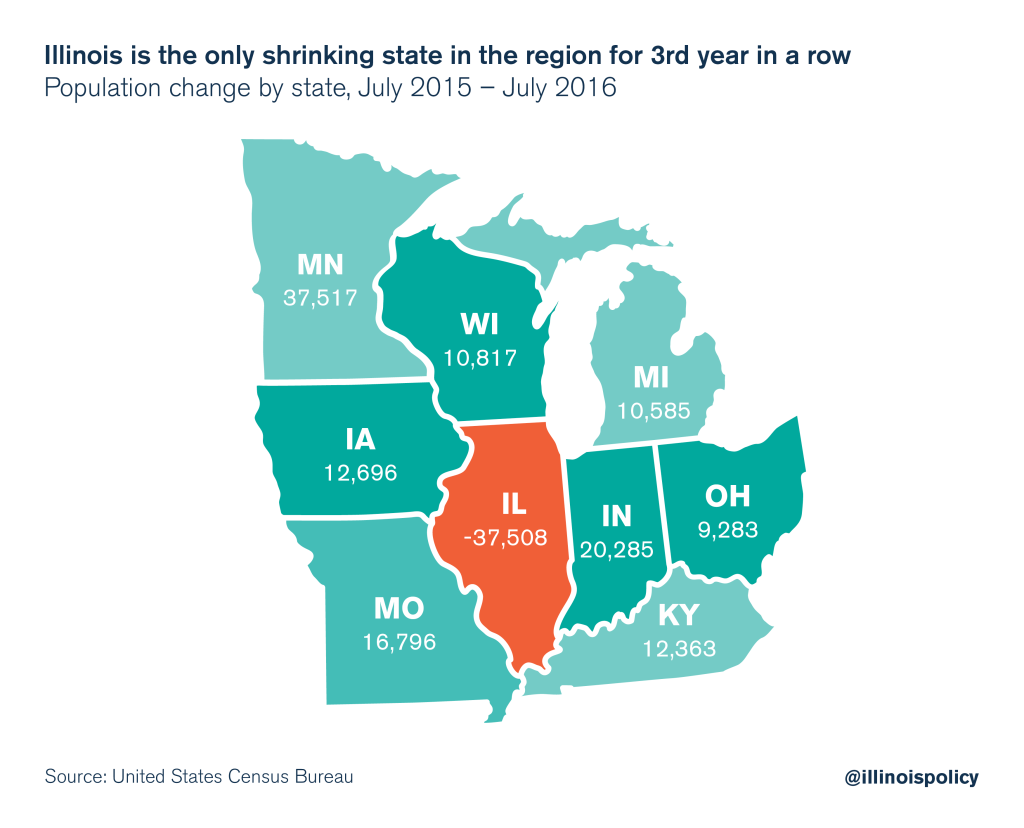

Thanks to international immigration, Illinois has avoided actually shrinking for a majority of those years. But things are changing.International migration has slowed, and Illinois has actually declined in total population over the past three years – the only state in the region to do so.

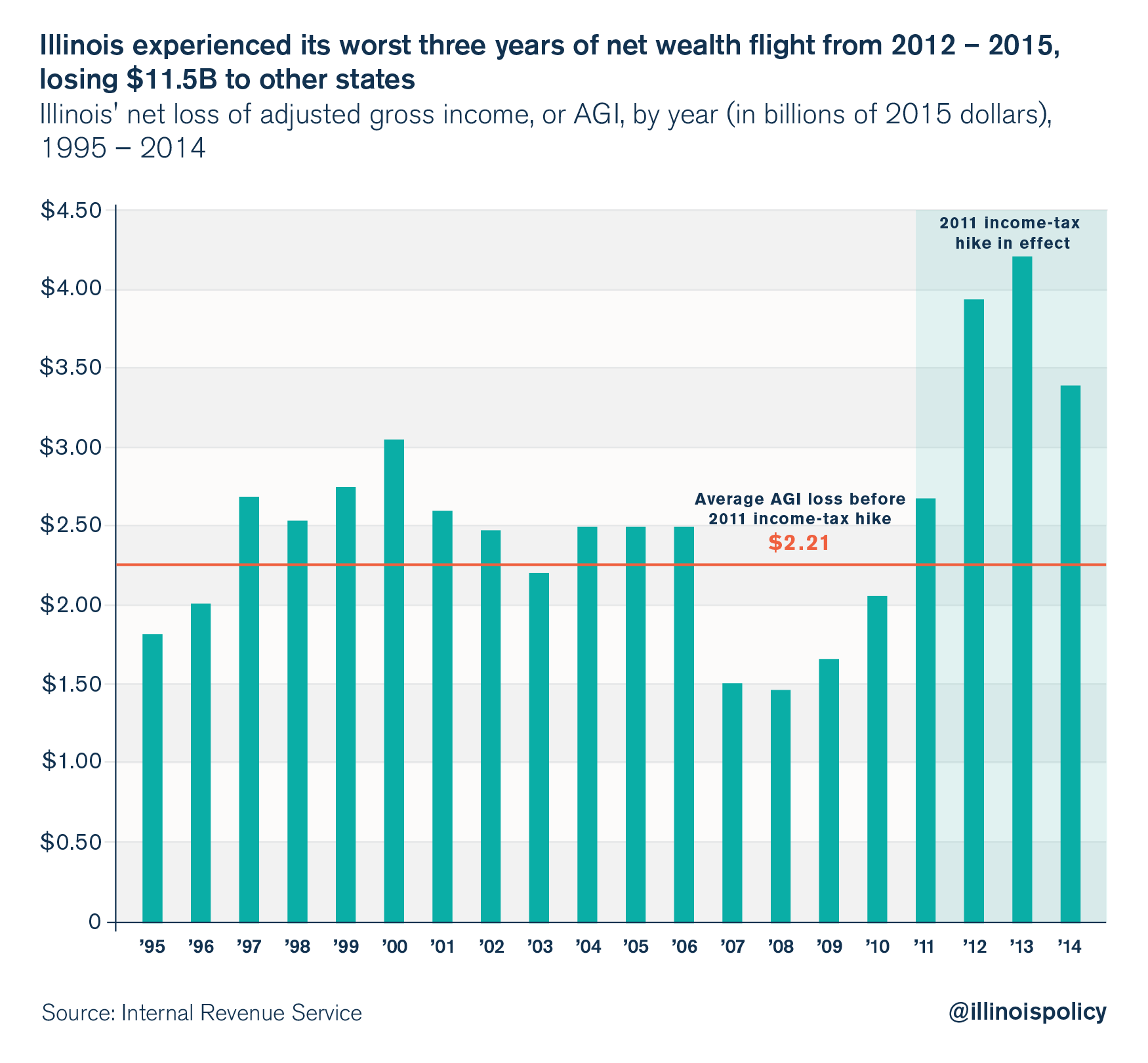

What’s worse, Illinois’ out-migration and population loss are having a profoundly negative effect on the state’s tax base.

-

Illinois has lost just under $50 billion in annual adjusted gross income over the past 20 years as residents have left Illinois to find opportunities in other states. That’s deprived the state of billions of dollars in tax revenue.

The fate of Puerto Rico should make lawmakers even more anxious about finding the right solutions to avoid a similar collapse in Illinois.

Illinois is far stronger economically than Puerto Rico, and its problems aren’t as far along. But that’s not an excuse to pretend Illinois isn’t in a deep crisis.

What it does mean is that Illinois’ path back to prosperity and financial stability can be easier – as long as lawmakers act now to fix the state’s deep structural problems.

That’s why Illinois cannot waste time on yet another bad deal like the Illinois Senate’s proposed “grand bargain.” That plan would hit Illinoisans with billions in higher taxes because it has no real reforms to address the state’s out-of-control spending drivers.

Illinois can’t afford to try another Band-Aid fix in hopes of staving off its day of reckoning. That path leads to Puerto Rico and Detroit.

Instead, Illinoisans need a real spending reform plan that fixes the state’s structural problems and balances the budget without tax hikes.

State Sens. Kyle McCarter, R-Lebanon, and Dan McConchie, R-Hawthorn Woods, have released such a plan.

The Illinois Policy Institute has also provided a reform road map. The plan provides tax relief to struggling homeowners through a comprehensive property tax reform package, and enacts major reforms to spending on health care and government worker compensation.

Most importantly, it implements a 401(k)-style retirement plan for government workers going forward, a solution that’s been under lawmakers’ noses for nearly 20 years.

Illinois can still be the economic powerhouse and beacon of opportunity it once was. It still has a strong economic base, a well-educated workforce, and a number of natural advantages.

But without reform, the state could end up suffering a fate similar to Puerto Rico’s.